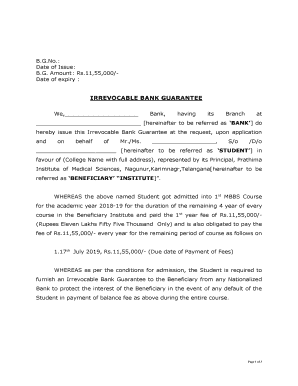

Irrevocable Bank Guarantee Prathima Institute of Medical Sciences Form

Understanding the Irrevocable Bank Guarantee

An irrevocable bank guarantee is a financial instrument provided by a bank, assuring that a specific obligation will be fulfilled. This guarantee is often used in various transactions, such as real estate deals or international trade, where one party requires assurance that the other will meet their obligations. Unlike a revocable guarantee, once issued, it cannot be canceled or altered without mutual consent. This feature provides a higher level of security and trust for the parties involved.

Key Elements of the Irrevocable Bank Guarantee

Several critical components define an irrevocable bank guarantee:

- Beneficiary: The party that benefits from the guarantee, typically the one requiring assurance.

- Obligor: The party whose obligations are being guaranteed.

- Amount: The maximum financial liability of the bank under the guarantee.

- Expiration Date: The date until which the guarantee is valid, after which it becomes void.

- Terms and Conditions: Specific stipulations under which the guarantee can be claimed, including documentation required to make a claim.

Steps to Complete the Irrevocable Bank Guarantee

Completing an irrevocable bank guarantee involves several steps to ensure accuracy and compliance:

- Gather Required Information: Collect details about the parties involved, the amount, and the purpose of the guarantee.

- Draft the Guarantee: Prepare the document, including all necessary elements such as terms, conditions, and signatures.

- Submit to the Bank: Present the draft to the bank for review and approval, ensuring all information is accurate.

- Review and Sign: Once approved, both parties should review the final document and sign it in the presence of a bank official.

- Receive the Guarantee: After processing, obtain the final irrevocable bank guarantee document from the bank.

Legal Use of the Irrevocable Bank Guarantee

The legal enforceability of an irrevocable bank guarantee is significant in various transactions. It serves as a binding commitment that can be enforced in a court of law if the obligations are not met. To ensure its legal standing, the guarantee must comply with relevant laws and regulations, including those related to contract law and financial transactions. Proper documentation and adherence to the terms outlined in the guarantee are essential for its enforceability.

Application Process for Obtaining the Irrevocable Bank Guarantee

Obtaining an irrevocable bank guarantee involves a structured application process:

- Identify the Need: Determine the specific requirements and purpose for the guarantee.

- Choose a Bank: Select a financial institution that offers bank guarantees and has a good reputation.

- Complete the Application: Fill out the bank's application form, providing all necessary details and supporting documents.

- Submit Financial Statements: Provide the bank with relevant financial information to assess creditworthiness.

- Await Approval: The bank will review the application, which may take several days to weeks, depending on their policies.

- Receive the Guarantee: Upon approval, the bank will issue the irrevocable bank guarantee.

Examples of Using the Irrevocable Bank Guarantee

Irrevocable bank guarantees are commonly used in various scenarios, including:

- Real Estate Transactions: Buyers may require a guarantee to ensure that the seller fulfills their obligations.

- International Trade: Exporters often use guarantees to assure payment from foreign buyers.

- Construction Contracts: Contractors may need guarantees to secure payment for completed work.

Quick guide on how to complete irrevocable bank guarantee prathima institute of medical sciences

Effortlessly Prepare Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to obtain the correct format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences on any device with airSlate SignNow apps for Android or iOS, and enhance any document-related procedure today.

The Easiest Way to Modify and Electronically Sign Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences with Ease

- Locate Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text (SMS), or invite link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable bank guarantee prathima institute of medical sciences

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank guarantee and how does it work?

A bank guarantee is a financial promise made by a bank on behalf of a customer, ensuring payment to a third party if the customer fails to fulfill a contract. It serves as a security measure that instills confidence in transactions, particularly in business agreements. Using airSlate SignNow for your documentation needs, including bank guarantees, simplifies signing and storage.

-

How can airSlate SignNow help with bank guarantees?

airSlate SignNow streamlines the process of creating, sending, and signing bank guarantees, making it easy for businesses to handle their agreements. With its user-friendly interface, you can quickly generate customized documents that meet your specific needs. This enables faster processing times and reduced administrative overhead.

-

What are the benefits of using airSlate SignNow for bank guarantees?

Using airSlate SignNow for your bank guarantees offers several benefits including electronic signatures, document tracking, and secure cloud storage. This not only enhances collaboration but also improves compliance and reduces the risk of errors. Furthermore, it provides a more efficient workflow, allowing you to focus on your business operations.

-

Is airSlate SignNow cost-effective for managing bank guarantees?

Yes, airSlate SignNow offers a cost-effective solution for managing bank guarantees by eliminating the need for paper-based processes. With flexible pricing plans, businesses of all sizes can find an option that fits their budget. The savings from reduced printing and mailing costs add to the overall value of the service.

-

What integrations does airSlate SignNow offer for bank guarantees?

airSlate SignNow integrates seamlessly with various applications, making it easy to manage bank guarantees alongside your existing tools. Popular integrations include CRM platforms, cloud storage solutions, and productivity apps. This connectivity ensures that your workflows remain uninterrupted and efficient.

-

Are bank guarantees legally binding when signed with airSlate SignNow?

Yes, bank guarantees signed through airSlate SignNow are legally binding and comply with electronic signature laws. The platform adheres to all industry standards to ensure the validity of your documents. This allows businesses to have confidence in their online agreements and transactions.

-

Can I customize my bank guarantee templates in airSlate SignNow?

Absolutely! airSlate SignNow provides users with the ability to customize their bank guarantee templates to fit specific requirements. You can include logos, specific terms, and other unique details, ensuring your bank guarantees align with your branding and business needs.

Get more for Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences

- Gauteng shared service centre vendor registration form

- Marriage certificate format

- Maap form

- Business permit application form

- Royal mail claim form

- Ohio residential property disclosure form

- Non availability of birth certificate form 10 pdf

- Official csusm transcript request california state csusm form

Find out other Irrevocable Bank Guarantee Prathima Institute Of Medical Sciences

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe