Antique Mall 1099 Requirements Form

What is the Antique Mall 1099 Requirements

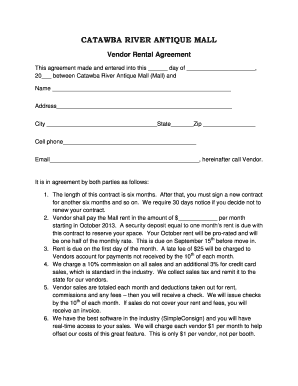

The Antique Mall 1099 requirements refer to the necessary documentation and information needed for vendors operating within antique malls to comply with IRS regulations. This form is essential for reporting income earned by vendors who sell goods in these settings. It helps ensure that all income is accurately reported for tax purposes, allowing both the antique mall owners and the vendors to maintain compliance with federal tax laws.

Key elements of the Antique Mall 1099 Requirements

Understanding the key elements of the Antique Mall 1099 requirements is essential for vendors. These elements typically include:

- Vendor Information: Details such as the vendor's name, address, and taxpayer identification number (TIN) must be included.

- Income Reporting: The total amount of income earned by the vendor during the tax year must be accurately reported.

- Filing Deadlines: Vendors must be aware of the deadlines for submitting the 1099 form to ensure compliance and avoid penalties.

- Signature Requirements: Certain signatures may be required to validate the form, ensuring it is legally binding.

Steps to complete the Antique Mall 1099 Requirements

Completing the Antique Mall 1099 requirements involves several straightforward steps:

- Gather all necessary vendor information, including names, addresses, and TINs.

- Calculate the total income earned by each vendor for the tax year.

- Fill out the 1099 form with the collected information, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline.

Legal use of the Antique Mall 1099 Requirements

The legal use of the Antique Mall 1099 requirements is governed by IRS regulations. It is crucial for antique mall owners and vendors to understand their obligations under federal tax law. Properly completing and filing the 1099 form ensures that income is reported accurately, which helps avoid potential legal issues related to tax evasion or misreporting. Compliance with these requirements also fosters trust and transparency between vendors and the antique mall management.

Filing Deadlines / Important Dates

Filing deadlines for the Antique Mall 1099 requirements are critical for vendors to observe. Typically, the IRS requires that 1099 forms be submitted by January thirty-first of the year following the tax year in which the income was earned. Additionally, copies of the forms must be provided to the vendors by the same date. Missing these deadlines can result in penalties, making it essential for antique mall owners and vendors to stay organized and informed about these important dates.

Who Issues the Form

The Antique Mall 1099 requirements form is generally issued by the antique mall owner or management. They are responsible for collecting the necessary information from vendors and ensuring that the form is completed accurately. Once the form is filled out, it must be distributed to the respective vendors and submitted to the IRS. Understanding the role of the antique mall owner in this process is vital for maintaining compliance and ensuring that all parties are informed of their responsibilities.

Quick guide on how to complete antique mall 1099 requirements

Complete Antique Mall 1099 Requirements effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Antique Mall 1099 Requirements on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based activity today.

How to modify and eSign Antique Mall 1099 Requirements with ease

- Locate Antique Mall 1099 Requirements and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, either via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Antique Mall 1099 Requirements and guarantee exceptional communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the antique mall 1099 requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the antique mall 1099 requirements for vendors?

Antique mall 1099 requirements typically state that vendors must provide a Form 1099-MISC to report payments made to independent contractors. If a vendor earns over $600 in a calendar year, they are required to issue this form. It's essential to keep accurate records of all transactions to comply with these requirements.

-

How can airSlate SignNow help with meeting antique mall 1099 requirements?

airSlate SignNow simplifies the process of generating and sending 1099 forms, ensuring compliance with antique mall 1099 requirements. Our platform allows users to quickly gather signatures and share documents electronically, making the year-end reporting process efficient and stress-free.

-

Are there any additional fees associated with meeting antique mall 1099 requirements using airSlate SignNow?

Using airSlate SignNow to manage your antique mall 1099 requirements involves a subscription cost, but there are no hidden fees for sending and signing documents. Our pricing plans are transparent, allowing you to budget effectively while ensuring compliance with required documentation.

-

What features does airSlate SignNow offer that assist with antique mall 1099 requirements?

Our platform includes features like customizable templates for 1099 forms, automated reminders for signatures, and secure document storage. These tools assist in adhering to antique mall 1099 requirements efficiently, empowering users to focus on their business instead of paperwork.

-

How does airSlate SignNow integrate with accounting software to handle antique mall 1099 requirements?

airSlate SignNow offers integrations with popular accounting software, making it easier to manage and track financial transactions. These integrations help align with antique mall 1099 requirements by streamlining how you generate and submit necessary tax forms, ensuring accuracy and compliance.

-

Can I collaborate with my team on antique mall 1099 requirements using airSlate SignNow?

Yes, airSlate SignNow provides collaborative features that allow team members to work together on documents related to antique mall 1099 requirements. You can easily share forms, gather inputs, and ensure all necessary parties are involved in the process, enhancing teamwork and efficiency.

-

Is airSlate SignNow suitable for small antique mall businesses in managing 1099 requirements?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it a great choice for small antique mall businesses. Its features can help simplify the management of antique mall 1099 requirements, allowing small businesses to handle tax documents with ease.

Get more for Antique Mall 1099 Requirements

Find out other Antique Mall 1099 Requirements

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document