Return of Earnings Form

What is the Return of Earnings

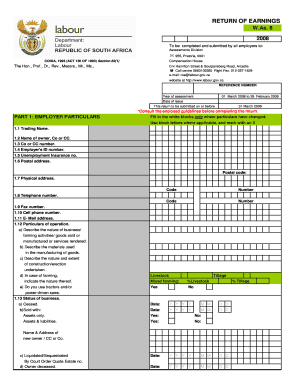

The return of earnings is a crucial document used in various business and tax contexts, primarily to report the income earned by a business or individual over a specific period. This form is often required by governmental agencies to ensure compliance with tax regulations and to assess the financial health of an entity. It typically includes details about revenue, expenses, and net income, providing a comprehensive overview of financial performance.

Steps to Complete the Return of Earnings

Completing the return of earnings involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, accurately input your earnings and expenses into the designated sections of the form. Review the completed form for any errors or omissions, as accuracy is critical. Finally, sign and date the form before submitting it to the appropriate authority.

Legal Use of the Return of Earnings

The return of earnings must adhere to specific legal standards to be considered valid. It is essential to ensure that the form is filled out truthfully and accurately, as providing false information can lead to penalties. Compliance with relevant laws, such as the Internal Revenue Code, is crucial. Additionally, using a reliable electronic signature tool can enhance the legal validity of the document, as it provides a secure method for signing and submitting forms online.

Filing Deadlines / Important Dates

Timely filing of the return of earnings is vital to avoid penalties. Deadlines may vary based on the type of entity and the specific tax year. Generally, businesses should be aware of annual filing dates and any extensions that may apply. Keeping a calendar of important dates can help ensure that submissions are made on time, maintaining compliance with federal and state regulations.

Required Documents

To successfully complete the return of earnings, certain documents are typically required. These may include financial statements, tax identification numbers, and any previous tax returns. Having these documents readily available can streamline the process and reduce the likelihood of errors. Additionally, if the business has multiple income streams, detailed records for each source should be included.

Form Submission Methods (Online / Mail / In-Person)

The return of earnings can often be submitted through various methods, including online, by mail, or in person. Online submission is increasingly popular due to its convenience and speed. However, businesses should ensure they are using secure platforms that comply with eSignature laws. For those opting to submit by mail or in person, it is important to verify the correct address and any specific submission guidelines provided by the relevant authority.

Penalties for Non-Compliance

Failing to file the return of earnings on time or submitting inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for businesses to avoid unnecessary costs and maintain good standing with tax authorities.

Quick guide on how to complete return of earnings

Complete Return Of Earnings effortlessly on any device

Online document management has gained popularity with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Return Of Earnings on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to edit and electronically sign Return Of Earnings with ease

- Obtain Return Of Earnings and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Edit and electronically sign Return Of Earnings and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the return of earnings

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the COIDA return of earnings form?

The COIDA return of earnings form is a mandatory document that employers in South Africa must submit to report their earnings and claim for benefits. This form is crucial for compliance with the Compensation for Occupational Injuries and Diseases Act. By using the airSlate SignNow platform, you can easily fill out and eSign the COIDA return of earnings form, streamlining your submission process.

-

How can airSlate SignNow help with the COIDA return of earnings form?

airSlate SignNow provides a user-friendly interface that simplifies the completion and submission of the COIDA return of earnings form. With features like document templates and eSignature capabilities, you can prepare your returns quickly and ensure they comply with legal requirements. This efficiency saves time and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the COIDA return of earnings form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including affordable options for small businesses. The cost of using the platform for your COIDA return of earnings form is competitive, especially considering the time saved in preparing and submitting documents. You can choose a plan that best fits your organization's size and requirements.

-

What features does airSlate SignNow offer for handling the COIDA return of earnings form?

AirSlate SignNow offers a range of features tailored for managing the COIDA return of earnings form effectively. These include customizable templates, secure eSignature options, and automated reminders to ensure timely submissions. All these features work together to enhance the user experience and ensure compliance.

-

Can airSlate SignNow integrate with other business software for COIDA return of earnings form processing?

Absolutely! airSlate SignNow supports integrations with various business software, allowing for seamless workflow management when handling the COIDA return of earnings form. Whether you need to link it with accounting software or HR management tools, these integrations help consolidate your processes into a single solution.

-

What are the benefits of using airSlate SignNow for the COIDA return of earnings form?

The primary benefits of using airSlate SignNow for the COIDA return of earnings form include enhanced efficiency, reduced paperwork, and digital security. It ensures that your forms are completed accurately and submitted on time. Additionally, the ease of collaboration with team members improves overall productivity.

-

How secure is airSlate SignNow for submitting the COIDA return of earnings form?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance standards to protect your data when submitting the COIDA return of earnings form. You can have confidence that sensitive information remains confidential during the entire signing process. Additionally, audit trails help track all document activities for your peace of mind.

Get more for Return Of Earnings

Find out other Return Of Earnings

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later