Idaho K 1 Form

What is the Idaho K-1?

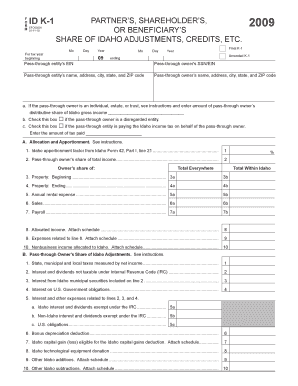

The Idaho K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and limited liability companies (LLCs) to the state of Idaho. This form is essential for individuals who receive income from these entities, as it helps ensure that all income is accurately reported to the Idaho State Tax Commission. The Idaho K-1 provides detailed information about each partner's share of income, which is necessary for personal income tax filings.

How to use the Idaho K-1

Using the Idaho K-1 involves several steps to ensure proper reporting of income. First, recipients must receive their K-1 from the partnership or entity that generated the income. Once received, individuals should carefully review the form for accuracy. The information on the K-1 must be reported on the recipient's Idaho individual income tax return. It is crucial to include all relevant income and deductions listed on the K-1 to comply with state tax regulations.

Steps to complete the Idaho K-1

Completing the Idaho K-1 requires attention to detail. Follow these steps:

- Gather all necessary information, including your personal details and the partnership or entity's information.

- Fill out the form accurately, ensuring that all income, deductions, and credits are correctly reported.

- Double-check the calculations to confirm that totals are accurate.

- Submit the completed form to the Idaho State Tax Commission along with your individual tax return.

Key elements of the Idaho K-1

The Idaho K-1 includes several key elements that are vital for accurate reporting. These elements typically consist of:

- Entity information: Name, address, and tax identification number of the partnership or corporation.

- Recipient information: Name, address, and taxpayer identification number of the individual receiving the K-1.

- Income details: Breakdown of the recipient's share of income, losses, and deductions.

- Credits: Any tax credits that the recipient is eligible to claim based on their share of the entity's activities.

Legal use of the Idaho K-1

The Idaho K-1 must be used in accordance with state tax laws to ensure compliance. This includes accurately reporting all income and deductions as outlined in the form. Failure to report K-1 income can lead to penalties and interest on unpaid taxes. It is important for taxpayers to retain a copy of the K-1 for their records and to consult with a tax professional if there are any uncertainties regarding its use.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance. Generally, the Idaho K-1 must be submitted along with the individual income tax return by the state’s tax deadline, which is typically April 15. However, if the partnership or entity has a different fiscal year, the deadline may vary. Taxpayers should keep track of any changes to deadlines announced by the Idaho State Tax Commission to avoid late filing penalties.

Quick guide on how to complete idaho k 1

Effortlessly Prepare Idaho K 1 on Any Device

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage Idaho K 1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The Easiest Way to Edit and Electronically Sign Idaho K 1 Seamlessly

- Obtain Idaho K 1 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Idaho K 1 and guarantee excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Idaho K 1 and how does it work with airSlate SignNow?

Idaho K 1 refers to the tax document used in the state of Idaho for reporting income from partnerships or S corporations. With airSlate SignNow, you can easily prepare and eSign your Idaho K 1 forms online, ensuring a streamlined and efficient process that saves you time.

-

How much does airSlate SignNow cost for handling Idaho K 1 documents?

airSlate SignNow offers various pricing plans to cater to different needs. You can find a plan that suits your budget while efficiently managing your Idaho K 1 documents without incurring high costs on paper and postage.

-

What features does airSlate SignNow offer for Idaho K 1 document signing?

airSlate SignNow provides a range of features for Idaho K 1 document signing, including customizable templates, secure eSignature, and real-time tracking. These features help simplify the signing process, making it both efficient and user-friendly.

-

Can airSlate SignNow integrate with other applications for Idaho K 1 management?

Yes, airSlate SignNow seamlessly integrates with various applications to improve efficiency in managing Idaho K 1 forms. Whether you use CRM systems or accounting software, these integrations help you sync data and streamline workflows.

-

What are the benefits of using airSlate SignNow for Idaho K 1 forms?

Using airSlate SignNow for managing Idaho K 1 forms offers several benefits, such as reduced turnaround time, increased security, and improved accuracy. These advantages make it a preferred choice for businesses looking to optimize their document workflows.

-

Is it easy to eSign my Idaho K 1 documents with airSlate SignNow?

Absolutely! airSlate SignNow is designed for ease of use, allowing you to eSign your Idaho K 1 documents quickly and effortlessly. The platform’s intuitive interface ensures that even those unfamiliar with digital signing can navigate it with ease.

-

Can I access my Idaho K 1 documents on mobile devices using airSlate SignNow?

Yes, with airSlate SignNow, you can access and manage your Idaho K 1 documents from any mobile device. The mobile-friendly design ensures you can work on the go, making eSigning straightforward and accessible.

Get more for Idaho K 1

Find out other Idaho K 1

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now