W4v Form

What is the W-4V Form

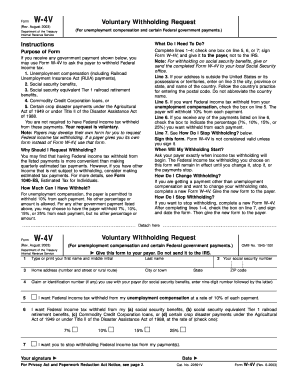

The W-4V form, officially known as the "Voluntary Withholding Request," is a document used by individuals to request voluntary federal income tax withholding from certain types of payments. This form is particularly relevant for those receiving unemployment compensation, pension payments, or other types of non-wage income. By submitting the W-4V, individuals can specify the amount of tax they would like withheld from these payments, ensuring they meet their tax obligations without facing a large tax bill at the end of the year.

How to Obtain the W-4V Form

To obtain the W-4V form, individuals can visit the official IRS website, where the form is available for download in PDF format. It can also be requested through the organizations making the payments, such as unemployment offices or pension plans. For convenience, the form can be printed and filled out manually or completed digitally before submission.

Steps to Complete the W-4V Form

Completing the W-4V form involves a few straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Select the type of payment you are receiving, such as unemployment compensation or pension payments.

- Indicate the amount you wish to have withheld from your payments. This can be a specific dollar amount or a percentage of the payment.

- Sign and date the form to certify the accuracy of the information provided.

Once completed, the form should be submitted to the appropriate payer of the income, such as your employer or the unemployment office.

Legal Use of the W-4V Form

The W-4V form is legally recognized by the IRS and must be used in accordance with federal tax laws. Submitting this form allows individuals to manage their tax withholding proactively, which can help avoid underpayment penalties. It is important to keep a copy of the submitted form for personal records, as it serves as proof of the withholding request.

Form Submission Methods

The W-4V form can be submitted using various methods, depending on the payer's requirements:

- Online Submission: Some organizations may allow for electronic submission of the W-4V form through their websites or portals.

- Mail: The completed form can be printed and mailed directly to the payer's address.

- In-Person: Individuals may also choose to deliver the form in person at the relevant office, such as an unemployment office or a pension plan administrator.

IRS Guidelines

The IRS provides specific guidelines for using the W-4V form. It is essential to ensure that the form is filled out accurately and submitted to the correct payer. The IRS recommends reviewing the withholding amounts periodically, especially if there are changes in income or tax circumstances. Keeping informed about any updates to tax laws can also help ensure compliance and proper withholding.

Quick guide on how to complete w4v form

Effortlessly prepare W4v Form on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage W4v Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign W4v Form with ease

- Find W4v Form and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign W4v Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w4v and how does it work with airSlate SignNow?

W4V is a key feature in airSlate SignNow that allows users to generate and manage W-4 forms efficiently. With a user-friendly interface, you can quickly fill out, eSign, and send W-4 documents to your employees, streamlining your payroll processes.

-

How much does airSlate SignNow cost for using the w4v feature?

The pricing for airSlate SignNow varies based on the plan you choose, which includes access to the w4v feature. Our plans are designed to be cost-effective, making it affordable for businesses of all sizes to manage and eSign W-4 documents seamlessly.

-

What features does the airSlate SignNow w4v offer for businesses?

The w4v feature in airSlate SignNow offers comprehensive capabilities such as document templates, collaborative editing, and real-time tracking of eSignatures. These features are designed to enhance productivity and ensure compliance with taxation requirements.

-

How can airSlate SignNow's w4v benefit my business?

Implementing the w4v feature in airSlate SignNow can signNowly reduce the time spent on paperwork and improve the accuracy of W-4 submissions. This not only helps in saving resources but also ensures that your employees are set up correctly for withholding, ensuring smooth payroll operations.

-

Can I integrate airSlate SignNow w4v with other software applications?

Yes, airSlate SignNow provides robust integrations with various software applications such as CRMs and HR systems. This flexibility allows you to seamlessly incorporate the w4v functionality into your existing workflows, enhancing efficiency further.

-

Is the airSlate SignNow w4v feature secure?

Absolutely! The airSlate SignNow w4v feature adheres to the highest security standards, ensuring that all document transactions are encrypted and compliant with regulatory requirements. This guarantees that your employees’ information is protected during eSigning.

-

How do I get started with using w4v in airSlate SignNow?

Getting started with w4v in airSlate SignNow is simple. You just need to sign up for an account, choose a plan that suits your needs, and then access the w4v feature from the dashboard to begin creating and managing your W-4 forms.

Get more for W4v Form

- Form rew 5 maine gov maine

- Kasneb exemptions form

- Form imm 5406

- Spn 3659 fmi 5 form

- What is the simple 12 form 21

- Field training checklist texas school district police chiefsamp39 association form

- Vitality trust forms

- Imperial solar energy center west eirea imperial solar energy center west eirea blm form

Find out other W4v Form

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself