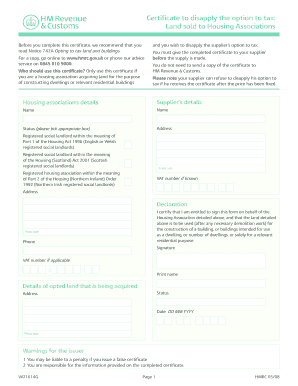

Vat5l Form

What is the Vat5l Form

The Vat5l form is a specific document used primarily for tax purposes in the United States. It serves as a vehicle for taxpayers to report various financial details to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. Understanding its purpose and requirements is crucial for accurate tax reporting and avoiding potential penalties.

How to Obtain the Vat5l Form

To obtain the Vat5l form, individuals can visit the official IRS website where the form is available for download in PDF format. It is important to ensure that you are accessing the most current version of the form to comply with the latest tax regulations. Additionally, the form may be available through tax preparation software or at local tax offices, providing multiple avenues for access.

Steps to Complete the Vat5l Form

Completing the Vat5l form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements and expense records. Next, carefully fill out each section of the form, ensuring that all information is accurate and up to date. After completing the form, review it for any errors or omissions before submitting it to the IRS. It is advisable to keep a copy for your records.

Legal Use of the Vat5l Form

The Vat5l form is legally binding when completed and submitted according to IRS guidelines. It is important to understand that any inaccuracies or fraudulent information can lead to legal repercussions, including fines or audits. Therefore, using the form correctly and ensuring that all data provided is truthful is essential for maintaining compliance with tax laws.

Key Elements of the Vat5l Form

Key elements of the Vat5l form include personal identification information, income details, deductions, and credits applicable to the taxpayer. Each section is designed to capture specific financial information, which is crucial for determining tax liability. Understanding these elements can help taxpayers accurately report their financial situation and optimize their tax outcomes.

Form Submission Methods

The Vat5l form can be submitted to the IRS through various methods, including online filing, mail, or in-person submission at designated IRS offices. Online filing is often the most efficient method, allowing for quicker processing times. When submitting by mail, it is important to send the form to the correct address as specified by the IRS to avoid delays.

Filing Deadlines / Important Dates

Filing deadlines for the Vat5l form are critical to avoid penalties. Typically, the form must be submitted by the tax deadline, which is usually April fifteenth for most taxpayers. However, it is advisable to check for any specific deadlines that may apply to your situation, such as extensions or special circumstances that could affect your filing date.

Quick guide on how to complete vat5l form

Complete Vat5l Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Vat5l Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

The easiest way to modify and electronically sign Vat5l Form seamlessly

- Find Vat5l Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Vat5l Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat5l form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the VAT5L form?

The VAT5L form is used for making VAT exemptions on certain goods and services. By allowing users to download VAT5L form easily, businesses can ensure compliance and proper management of their VAT obligations.

-

How can I download the VAT5L form through airSlate SignNow?

To download the VAT5L form through airSlate SignNow, simply visit our website and navigate to the forms section. You will find a quick link that allows you to download VAT5L form directly, making it convenient and efficient.

-

Is there a cost associated with downloading the VAT5L form?

No, downloading the VAT5L form via airSlate SignNow is completely free of charge. Our goal is to provide businesses with the necessary tools and forms without any added costs, so you can effectively manage your VAT needs.

-

What features does airSlate SignNow offer for managing documents?

AirSlate SignNow offers a range of features including eSignature capabilities, document sharing, and secure storage. These features streamline the process of downloading the VAT5L form and enhance document management overall.

-

Can I integrate airSlate SignNow with other applications for better workflow?

Absolutely! airSlate SignNow allows for integration with various applications, enhancing your workflow. This means you can easily manage your documents and download VAT5L form within the tools you already use.

-

What are the benefits of using airSlate SignNow for eSigning forms?

Using airSlate SignNow for eSigning forms offers numerous benefits, including speed, security, and ease of use. Plus, you can easily download VAT5L form and get it signed in minutes, improving efficiency for your business.

-

Is airSlate SignNow secure for handling sensitive forms like VAT5L?

Yes, airSlate SignNow employs top-notch security measures to ensure the safety of your sensitive forms, including the VAT5L form. We prioritize data protection, so you can download VAT5L form with peace of mind.

Get more for Vat5l Form

- Human remains release form 402864991

- Sc dhec form 2351

- Form interrogatories economic litigation

- Baseball player information sheet 81317060

- Ts student bus pass print application form

- Application for apec business travel card immd gov hk form

- Hire purchase agreement template form

- Hire agreement template form

Find out other Vat5l Form

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document