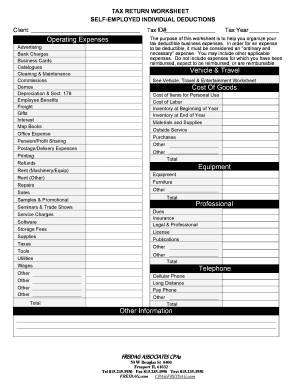

TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS Form

Understanding the tax return self employed individual deductions

The tax return self employed individual deductions refer to specific expenses that self-employed individuals can deduct from their taxable income. These deductions can significantly reduce the amount of tax owed, making it crucial for self-employed taxpayers to understand what qualifies. Common deductions include costs related to business operations, such as home office expenses, vehicle expenses, supplies, and professional services. Knowing which deductions apply can help maximize tax savings and ensure compliance with IRS regulations.

Steps to complete the tax return self employed individual deductions

Completing the tax return self employed individual deductions involves several key steps. First, gather all relevant financial documents, including income statements and receipts for business-related expenses. Next, fill out the IRS Schedule C form, which details income and expenses from self-employment. Accurately categorize each expense to ensure that all eligible deductions are claimed. After completing the Schedule C, transfer the net profit or loss to the IRS Form 1040. Finally, review the entire return for accuracy before submitting it to the IRS.

IRS guidelines for tax return self employed individual deductions

The IRS provides specific guidelines for what constitutes allowable deductions for self-employed individuals. It is essential to differentiate between personal and business expenses, as only the latter can be deducted. The IRS requires that expenses be both ordinary and necessary for the business. Ordinary expenses are common in the industry, while necessary expenses are helpful and appropriate for the business. Familiarizing oneself with IRS publications, such as Publication 535, can provide further clarity on eligible deductions and compliance requirements.

Required documents for tax return self employed individual deductions

To accurately complete the tax return self employed individual deductions, certain documents are necessary. These include:

- Income statements from all business activities

- Receipts for all deductible expenses

- Bank and credit card statements

- Any relevant contracts or agreements

- Previous tax returns for reference

Having these documents organized and readily available can streamline the filing process and ensure that all eligible deductions are claimed.

Legal use of the tax return self employed individual deductions

The legal use of the tax return self employed individual deductions is governed by IRS regulations. It is important for self-employed individuals to maintain accurate records of all income and expenses to substantiate their claims. In the event of an audit, having thorough documentation can protect against potential penalties. Additionally, understanding the legal definitions of ordinary and necessary expenses can help ensure compliance and avoid issues with the IRS.

Examples of using the tax return self employed individual deductions

Examples of common deductions include:

- Home office deduction for a portion of the home used exclusively for business

- Vehicle expenses for business-related travel, calculated using either the standard mileage rate or actual expenses

- Costs for business supplies, such as office materials and equipment

- Professional services, including fees paid to accountants or consultants

These examples illustrate how various expenses can be utilized to reduce taxable income, highlighting the importance of understanding what qualifies for deduction.

Quick guide on how to complete tax return worksheet self employed individual deductions

Complete TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS with ease on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents promptly without any hold-ups. Manage TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS on any platform using airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

How to modify and eSign TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS effortlessly

- Find TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you prefer. Modify and eSign TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return worksheet self employed individual deductions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self employed tax deductions worksheet?

A self employed tax deductions worksheet is a tool designed to help self-employed individuals identify and track their eligible business expenses. By properly utilizing this worksheet, you can ensure that you maximize your deductions during tax season, ultimately reducing your taxable income and saving money.

-

How can airSlate SignNow help with the self employed tax deductions worksheet?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to your self employed tax deductions worksheet. You can easily send your worksheet for signatures and share it with your accountant or tax preparer, simplifying the process and ensuring all necessary paperwork is completed and filed on time.

-

Is there a cost associated with using the self employed tax deductions worksheet on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing your self employed tax deductions worksheet, with various pricing plans to suit different needs. You can choose a plan that offers the features you require, ensuring you get the best value while maintaining easy access to your tax documents.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you can eSign documents, collaborate with team members, and keep track of your self employed tax deductions worksheet securely. Features like customizable templates and cloud storage streamline the process and ensure that all your important tax documents are easily accessible.

-

Can I integrate airSlate SignNow with accounting software for my self employed tax deductions worksheet?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easy to utilize your self employed tax deductions worksheet alongside your financial management tools. This integration ensures that all your tax information is consolidated, providing you with an organized overview of your financial standing.

-

Does airSlate SignNow provide support for users with questions about their self employed tax deductions worksheet?

Absolutely! airSlate SignNow offers comprehensive customer support for users who have questions about their self employed tax deductions worksheet. Our dedicated support team is ready to assist you with any inquiries, ensuring you have the guidance needed to make the most of your tax-deduction process.

-

What benefits can I expect from using a self employed tax deductions worksheet?

Using a self employed tax deductions worksheet can signNowly enhance your tax filing experience. It helps you categorize and document your expenses accurately, enabling you to claim all eligible deductions, minimize tax liability, and ultimately keep more of your hard-earned money.

Get more for TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS

- Northeast ohio communicable disease reporting form

- 470 3826 request for fip beyond 60 months iowa department of dhs iowa form

- Smouldering charcoal book pdf no no download needed needed form

- Fire safety analysis form

- Special event parking lot permit application city of arlington arlingtontx form

- Title objection letter example form

- Verification of contact information form 550584827

- St theresa catholic school viking athletic handbook 6623 rodrigo sttheresaschool form

Find out other TAX RETURN WORKSHEET SELF EMPLOYED INDIVIDUAL DEDUCTIONS

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now