Formulario 2012

What is the Formulario

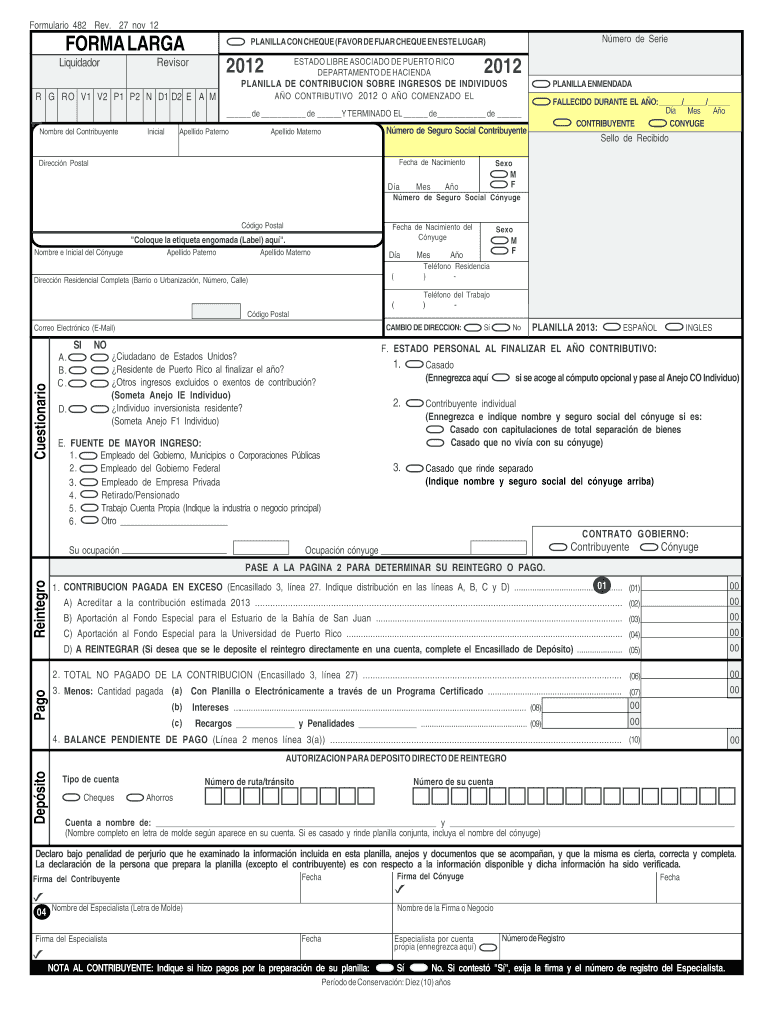

The state tax form 482, also known as the Puerto Rico tax return form 482, is a crucial document for individuals and businesses in Puerto Rico who are required to report their income and calculate their tax obligations. This form is specifically designed for taxpayers residing in Puerto Rico, allowing them to detail their earnings, deductions, and credits for the tax year. Understanding the purpose and requirements of this form is essential for accurate tax reporting and compliance with local tax laws.

How to use the Formulario

Using the state tax form 482 involves several key steps. First, gather all necessary financial documents, including income statements, proof of deductions, and any relevant tax credits. Next, download the form in PDF format, ensuring you have the most recent version. Carefully fill out the form, providing accurate information as required. Once completed, review the form for any errors before submitting it to the appropriate tax authority. Utilizing electronic tools, such as signNow, can streamline the signing and submission process, ensuring that your form is submitted securely and efficiently.

Steps to complete the Formulario

Completing the state tax form 482 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documentation, including W-2s, 1099s, and records of deductible expenses.

- Download the most current version of the form from a reliable source.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income, detailing each source of income.

- List any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form, ensuring all information is accurate before submission.

Legal use of the Formulario

The state tax form 482 must be used in accordance with local tax laws to ensure its legal validity. This includes adhering to submission deadlines and maintaining compliance with all reporting requirements. Electronic signatures provided through secure platforms like signNow can enhance the legal standing of the form, as they comply with regulations set forth by the ESIGN Act and UETA. It is important to keep copies of submitted forms and any supporting documents for your records, as they may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the state tax form 482 are typically set by the Puerto Rico Department of Treasury. Generally, the deadline for submitting the form coincides with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any specific extensions or changes that may apply to Puerto Rico taxpayers. Being aware of these dates is crucial to avoid penalties and ensure timely compliance with tax obligations.

Required Documents

To complete the state tax form 482 accurately, you will need several key documents, including:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Receipts and records for deductible expenses, such as medical costs or charitable donations.

- Proof of tax credits, if applicable.

- Any previous year’s tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The state tax form 482 can be submitted through various methods, offering flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically using secure platforms, which can expedite processing times.

- Mail: Completed forms can be mailed to the designated tax office. Ensure that you use the correct address and allow adequate time for delivery.

- In-Person Submission: Taxpayers may also choose to submit the form in person at local tax offices, providing an opportunity to ask questions or clarify any uncertainties.

Quick guide on how to complete pdf formulario 482 2015

Easily Prepare Formulario on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Formulario on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and eSign Formulario

- Find Formulario and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Formulario while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf formulario 482 2015

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

How can I fill out an ITR for year 2015-16?

Try ClearTax, the easiest e-filing platform in India

Create this form in 5 minutes!

How to create an eSignature for the pdf formulario 482 2015

How to generate an eSignature for the Pdf Formulario 482 2015 online

How to create an electronic signature for your Pdf Formulario 482 2015 in Google Chrome

How to generate an electronic signature for signing the Pdf Formulario 482 2015 in Gmail

How to make an eSignature for the Pdf Formulario 482 2015 straight from your mobile device

How to make an eSignature for the Pdf Formulario 482 2015 on iOS

How to make an electronic signature for the Pdf Formulario 482 2015 on Android

People also ask

-

What is a Formulario in airSlate SignNow?

A Formulario in airSlate SignNow refers to a customizable document form that allows users to collect signatures and other information electronically. This feature streamlines the signing process, making it easy to manage documents securely and efficiently. With Formulario, businesses can enhance their workflow by automating repetitive tasks.

-

How much does it cost to use Formulario in airSlate SignNow?

airSlate SignNow offers several pricing plans that include access to the Formulario feature. Pricing varies based on the number of users and the features you need, making it a cost-effective solution for businesses of all sizes. You can check our pricing page to find a plan that suits your requirements.

-

Can I customize my Formulario in airSlate SignNow?

Yes, you can fully customize your Formulario in airSlate SignNow to meet your specific needs. The platform allows you to add fields, logos, and branding elements to create a professional-looking document that reflects your company’s identity. This customization helps to enhance user experience and engagement.

-

What are the benefits of using Formulario for document signing?

Using Formulario in airSlate SignNow provides numerous benefits, including increased efficiency and reduced turnaround times for document signing. It eliminates the need for printing, scanning, or mailing documents, which can save your business time and resources. Additionally, Formulario ensures secure and legally binding signatures, giving you peace of mind.

-

Is Formulario compatible with other software and applications?

Absolutely! airSlate SignNow’s Formulario can be integrated with various third-party applications, including CRM systems, cloud storage, and productivity tools. These integrations help streamline your workflow by connecting all your essential tools in one place, enhancing overall productivity.

-

How secure is the Formulario feature in airSlate SignNow?

The Formulario feature in airSlate SignNow prioritizes security, employing encryption and compliance with industry standards to protect your data. Each document is securely stored, and the signing process is designed to ensure that only authorized individuals can access and sign the Formulario. This level of security helps protect sensitive information.

-

Can I track the status of my Formulario after sending it?

Yes, airSlate SignNow allows you to track the status of your Formulario in real-time. You can see when the document has been viewed, signed, or completed, providing you with complete visibility over the signing process. This feature helps you manage your documents more effectively and ensures timely follow-ups.

Get more for Formulario

Find out other Formulario

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe