PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12 2013-2026

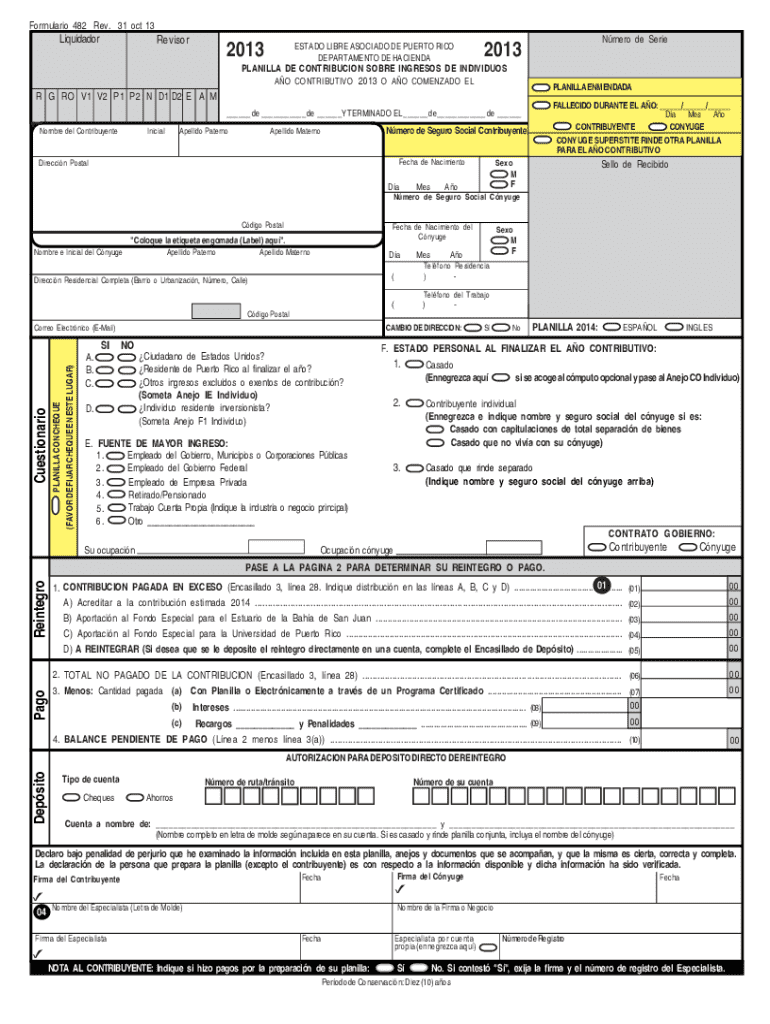

Understanding the Puerto Rico 482 Form

The Puerto Rico 482 form, also known as the Planilla Contribución sobre Ingresos, is essential for individuals filing their income tax returns in Puerto Rico. This form is specifically designed for residents who need to report their income and calculate their tax liabilities. It encompasses various income types, including wages, self-employment income, and investment earnings. Understanding the components of this form is crucial for accurate tax reporting and compliance with local tax laws.

Steps to Complete the Puerto Rico 482 Form

Completing the Puerto Rico 482 form involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring accuracy in amounts reported.

- Calculate deductions and credits applicable to your situation, which can reduce your overall tax liability.

- Review the completed form for any errors or omissions before submission.

Required Documents for Filing the Puerto Rico 482 Form

To successfully file the Puerto Rico 482 form, certain documents are necessary:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contract work completed throughout the year.

- Records of any other income, such as rental income or interest earned.

- Documentation for deductions, including receipts for medical expenses, education costs, and mortgage interest.

Filing Deadlines for the Puerto Rico 482 Form

It is important to be aware of the filing deadlines for the Puerto Rico 482 form. Typically, the deadline for submission is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Filing on time helps avoid penalties and interest on any taxes owed.

Form Submission Methods for the Puerto Rico 482

The Puerto Rico 482 form can be submitted through various methods:

- Online: Many taxpayers opt to file electronically through approved tax software or platforms.

- Mail: The form can be printed and mailed to the appropriate tax authority address.

- In-Person: Taxpayers may also choose to file in person at designated tax office locations.

Penalties for Non-Compliance with the Puerto Rico 482 Form

Failing to file the Puerto Rico 482 form on time or inaccurately reporting income can lead to penalties. Common consequences include:

- Late filing penalties, which may accrue daily until the form is submitted.

- Interest on unpaid taxes, which can increase the total amount owed over time.

- Potential audits or additional scrutiny from tax authorities if discrepancies are found.

Quick guide on how to complete planilla larga 23 oct 12 planilla larga 23 oct 12

Effortlessly Prepare PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12 on Any Device

The management of online documents has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to swiftly create, alter, and electronically sign your documents without delays. Handle PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12 on any platform using airSlate SignNow's Android or iOS applications and enhance any process that involves documents today.

The Easiest Way to Modify and eSign PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12 with Ease

- Obtain PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important parts of your documents or conceal sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct planilla larga 23 oct 12 planilla larga 23 oct 12

Create this form in 5 minutes!

How to create an eSignature for the planilla larga 23 oct 12 planilla larga 23 oct 12

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to puerto rico 482?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The term 'puerto rico 482' refers to a specific regulatory framework that businesses in Puerto Rico may need to comply with when using eSignature solutions. By utilizing airSlate SignNow, companies can ensure they meet these requirements efficiently.

-

How much does airSlate SignNow cost for users in puerto rico 482?

Pricing for airSlate SignNow varies based on the plan selected, but it remains a cost-effective solution for businesses in puerto rico 482. We offer different tiers to accommodate various needs, ensuring that all users can find a plan that fits their budget while benefiting from our robust features.

-

What features does airSlate SignNow offer for businesses in puerto rico 482?

airSlate SignNow provides a range of features tailored for businesses in puerto rico 482, including customizable templates, real-time tracking, and secure cloud storage. These features streamline the document signing process, making it easier for companies to manage their paperwork efficiently.

-

How can airSlate SignNow benefit my business in puerto rico 482?

By using airSlate SignNow, businesses in puerto rico 482 can enhance their operational efficiency and reduce turnaround times for document signing. This not only saves time but also improves customer satisfaction by providing a seamless signing experience.

-

Does airSlate SignNow integrate with other software for puerto rico 482 users?

Yes, airSlate SignNow offers integrations with various software applications commonly used by businesses in puerto rico 482. This allows users to connect their existing tools and streamline workflows, making document management even more efficient.

-

Is airSlate SignNow compliant with regulations in puerto rico 482?

Absolutely! airSlate SignNow is designed to comply with the legal requirements for electronic signatures in puerto rico 482. This ensures that all signed documents are legally binding and recognized by local authorities.

-

Can I use airSlate SignNow for mobile signing in puerto rico 482?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users in puerto rico 482 to sign documents on the go. This flexibility ensures that you can manage your signing needs from anywhere, enhancing productivity.

Get more for PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12

- Work permit form

- Memorandum of judgement form

- User registration form busy accounting software busyaccountingsoftware

- Interchange and order off form afl barwon

- Maryland form wh ar 540052232

- Patients global impression of change pgic health mil form

- Informed consent for radiology procedures or intravenous contrast

- Syndication agreement template form

Find out other PLANILLA LARGA 23 Oct 12 PLANILLA LARGA 23 Oct 12

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile