Canada Revenue Tax Forms

What are the Canada Revenue Tax Forms?

The Canada Revenue Tax Forms are official documents required by the Canada Revenue Agency (CRA) for tax filing purposes. These forms facilitate the reporting of income, deductions, and credits, allowing taxpayers to accurately calculate their tax liabilities. Various forms cater to different taxpayer situations, including individuals, businesses, and specific income types. Understanding these forms is essential for compliance with Canadian tax laws.

How to Obtain the Canada Revenue Tax Forms

Taxpayers can obtain Canada Revenue Tax Forms through several channels. The most straightforward method is to visit the official CRA website, where forms are available for download in PDF format. Additionally, taxpayers can request paper copies to be mailed to their address. Local tax offices may also provide physical copies of the necessary forms. It is important to ensure that you are using the correct version for the relevant tax year.

Steps to Complete the Canada Revenue Tax Forms

Completing the Canada Revenue Tax Forms involves several key steps:

- Gather all necessary documents, including income statements, receipts, and previous tax returns.

- Download or obtain the appropriate form for your tax situation.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review your completed form for any errors before submission.

Legal Use of the Canada Revenue Tax Forms

The legal use of Canada Revenue Tax Forms is governed by tax laws established by the Canadian government. These forms must be filled out truthfully and accurately to comply with legal obligations. Submitting incorrect or misleading information can lead to penalties or legal repercussions. It is advisable to retain copies of submitted forms and any supporting documents for future reference and potential audits.

Required Documents

When filling out the Canada Revenue Tax Forms, certain documents are typically required to support the information provided. Commonly needed documents include:

- Income statements such as T4 slips from employers.

- Receipts for deductible expenses, including medical and educational costs.

- Previous year’s tax return for reference.

- Any relevant documents related to investments or other income sources.

Form Submission Methods

Taxpayers can submit their completed Canada Revenue Tax Forms through various methods, ensuring flexibility and convenience. The primary submission methods include:

- Online submission via the CRA's secure portal, which allows for quick processing.

- Mailing the completed forms to the designated CRA address.

- In-person submission at local CRA offices, if preferred.

Quick guide on how to complete canada revenue tax forms

Effortlessly prepare Canada Revenue Tax Forms on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassles. Manage Canada Revenue Tax Forms on any device using the airSlate SignNow applications for Android or iOS and enhance your document-related tasks today.

How to modify and electronically sign Canada Revenue Tax Forms effortlessly

- Obtain Canada Revenue Tax Forms and hit Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Canada Revenue Tax Forms and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada revenue tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

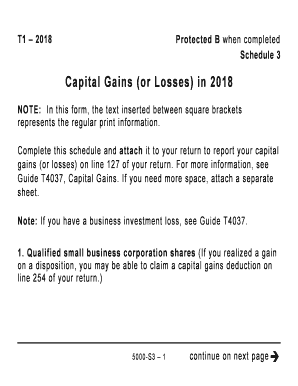

What is Revenue Canada Schedule 3?

Revenue Canada Schedule 3 is a tax form used for reporting capital gains and losses on your income tax return. This form helps individuals and businesses calculate their net income after accounting for these capital transactions. Understanding how to fill out Schedule 3 accurately can ensure compliance and potentially maximize your tax refund.

-

How can airSlate SignNow assist with submitting Revenue Canada Schedule 3?

airSlate SignNow offers a streamlined digital process for signing and submitting documents like Revenue Canada Schedule 3. With its intuitive interface, you can easily eSign the schedule and share it securely with your tax professional or submit it to the Canada Revenue Agency. This not only saves time but also minimizes the risk of errors.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow provides various pricing plans to fit different business needs, starting from basic features to advanced integrations. Each plan offers flexibility, ensuring you get the best value for managing documents like Revenue Canada Schedule 3. Check our website for details on specific features included in each pricing tier.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features for effective document management, including templates, custom fields, and automated workflows. These tools are especially helpful when preparing documents like Revenue Canada Schedule 3, ensuring that you can gather essential information efficiently. Additionally, real-time tracking ensures that you know where your documents are at all times.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports various integrations with popular business applications such as CRM systems, accounting software, and cloud storage services. This makes it easier to manage your documents, including Revenue Canada Schedule 3, alongside your existing tools. Integration enhances workflow efficiency and keeps all your processes streamlined.

-

What benefits does airSlate SignNow provide for businesses preparing taxes?

By using airSlate SignNow, businesses can simplify their tax preparation processes, including the submission of Revenue Canada Schedule 3. The platform's ease of use enhances collaboration with your team and advisors, ultimately saving time and reducing the likelihood of errors. Adopting this solution can lead to a more organized and less stressful tax season.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive documents such as Revenue Canada Schedule 3. Compliance with industry standards ensures that your data is safe throughout the signing and storage process. You can trust airSlate SignNow to keep your tax information confidential and secure.

Get more for Canada Revenue Tax Forms

Find out other Canada Revenue Tax Forms

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization