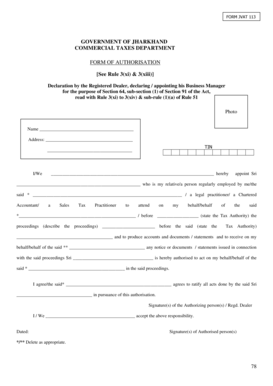

FORM JVAT 113

What is the FORM JVAT 113

The FORM JVAT 113 is a tax-related document used primarily for reporting specific transactions and activities to the appropriate state authorities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It typically involves reporting sales and use tax information, which is crucial for maintaining accurate financial records and fulfilling tax obligations.

How to use the FORM JVAT 113

Using the FORM JVAT 113 involves several steps to ensure accurate completion and submission. First, gather all necessary financial records related to the transactions you need to report. This may include invoices, receipts, and any other documentation relevant to sales and use taxes. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once completed, submit the form according to the specified methods, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the FORM JVAT 113

Completing the FORM JVAT 113 involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant documents, such as sales records and receipts.

- Review the form for required sections, including taxpayer information and transaction details.

- Carefully input data, ensuring all figures are correct and match your records.

- Double-check for any errors or omissions before finalizing the form.

- Submit the completed form through the designated method.

Legal use of the FORM JVAT 113

The FORM JVAT 113 is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. Compliance with the instructions outlined by state tax authorities is essential for the legal validity of this form.

Key elements of the FORM JVAT 113

Several key elements must be included when filling out the FORM JVAT 113 to ensure its validity:

- Taxpayer Information: This includes the name, address, and taxpayer identification number.

- Transaction Details: Accurate reporting of sales and use tax transactions.

- Signature: The form must be signed by the taxpayer or an authorized representative.

- Date of Submission: The date when the form is completed and submitted.

Filing Deadlines / Important Dates

Filing deadlines for the FORM JVAT 113 may vary based on state regulations. It is crucial to be aware of these dates to avoid penalties. Generally, forms should be submitted by the end of the reporting period, which could be monthly, quarterly, or annually, depending on the taxpayer's circumstances. Checking with state tax authorities for specific deadlines is recommended to ensure compliance.

Quick guide on how to complete form jvat 113

Effortlessly Prepare FORM JVAT 113 on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage FORM JVAT 113 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

Efficiently Modify and Electronically Sign FORM JVAT 113 Without Hassle

- Find FORM JVAT 113 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign FORM JVAT 113 while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form jvat 113

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM JVAT 113 and how is it used?

FORM JVAT 113 is a document used for tax purposes in various jurisdictions. It facilitates the declaration of tax liabilities and ensures compliance with local tax regulations. Using airSlate SignNow, businesses can eSign and send FORM JVAT 113 quickly and securely.

-

How does airSlate SignNow support the completion of FORM JVAT 113?

airSlate SignNow provides an intuitive platform for users to fill out and eSign FORM JVAT 113. The platform allows for easy collaboration among multiple parties, streamlining the process of document completion. Additionally, with customizable workflows, users can ensure that they meet all requirements effectively.

-

What are the pricing options for using airSlate SignNow for FORM JVAT 113?

airSlate SignNow offers various pricing tiers to accommodate different business needs. Users can choose from monthly or yearly plans that include features tailored for handling documents like FORM JVAT 113. Check the official website for detailed pricing information and any current promotions.

-

Can FORM JVAT 113 be integrated with other systems using airSlate SignNow?

Yes, airSlate SignNow allows seamless integrations with various third-party applications. This feature enhances the usability of FORM JVAT 113 by connecting with CRM, accounting software, and other necessary tools. Integration helps in automating data transfer and ensuring the accuracy of tax filings.

-

What benefits does eSigning FORM JVAT 113 provide?

eSigning FORM JVAT 113 with airSlate SignNow offers several advantages, including speed, security, and convenience. The digital signature process eliminates the need for printing, scanning, and mailing physical documents. Moreover, it provides a secure trail of approvals and signatures, ensuring compliance.

-

Is airSlate SignNow secure for handling FORM JVAT 113?

Absolutely! airSlate SignNow prioritizes the security of all documents, including FORM JVAT 113. The platform uses advanced encryption and authentication protocols to safeguard sensitive information, ensuring that your tax documents are protected against unauthorized access.

-

How can I access support for questions related to FORM JVAT 113 on airSlate SignNow?

If you have questions regarding FORM JVAT 113 while using airSlate SignNow, you can access a dedicated support team through multiple channels. The platform offers extensive resource guides, live chat, and email support to assist users with any inquiries they may have.

Get more for FORM JVAT 113

- Injection consent form template 263047688

- Taser certification online 252345229 form

- Safety kleen model 250 manual form

- Sf3107 1 form

- Maine seat belt law form

- Miami dade county direct deposit form

- 3 day notice to pay rent or vacate forms for utah landlords

- Replacement of a canadian citizesnhip certificate or cardreplacement of a canadian citizesnhip certificate or cardreplacement form

Find out other FORM JVAT 113

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself