Foreign Earned Income Tax Worksheet Form

What is the Foreign Earned Income Tax Worksheet

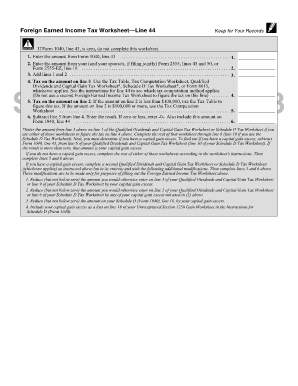

The Foreign Earned Income Tax Worksheet is a crucial document for U.S. citizens and resident aliens who earn income abroad. This worksheet assists taxpayers in calculating the foreign earned income exclusion, which allows eligible individuals to exclude a portion of their foreign earnings from U.S. taxation. By using this worksheet, taxpayers can determine their eligibility for the exclusion and ensure compliance with IRS regulations. It is particularly beneficial for those living and working in foreign countries, as it helps to avoid double taxation on their income.

How to use the Foreign Earned Income Tax Worksheet

Using the Foreign Earned Income Tax Worksheet involves several steps. First, taxpayers must gather all relevant income information, including wages, salaries, and self-employment income earned while living abroad. Next, they should complete the worksheet by following the instructions provided by the IRS, ensuring that all figures are accurately reported. The worksheet will guide users through the calculation of the exclusion amount, which can significantly reduce their taxable income. It is essential to retain a copy of the completed worksheet for personal records and future reference.

Steps to complete the Foreign Earned Income Tax Worksheet

Completing the Foreign Earned Income Tax Worksheet requires careful attention to detail. Here are the key steps:

- Gather all income documentation, including W-2 forms and self-employment records.

- Determine your tax home and the period of foreign residency.

- Fill out the worksheet, starting with your total foreign earned income.

- Calculate the foreign earned income exclusion based on your eligibility.

- Review the completed worksheet for accuracy before submitting it with your tax return.

Eligibility Criteria

To qualify for the foreign earned income exclusion, taxpayers must meet specific eligibility criteria. These include:

- Being a U.S. citizen or resident alien.

- Having foreign earned income, which must be income earned from services performed in a foreign country.

- Establishing a tax home in a foreign country.

- Meeting either the bona fide residence test or the physical presence test.

Understanding these criteria is essential for taxpayers to determine their eligibility for the exclusion and to correctly complete the Foreign Earned Income Tax Worksheet.

IRS Guidelines

The IRS provides specific guidelines for completing the Foreign Earned Income Tax Worksheet. Taxpayers should refer to IRS Publication 54, which details the foreign earned income exclusion and the requirements for claiming it. This publication outlines the necessary documentation, the definition of foreign earned income, and the tests for establishing residency. Adhering to these guidelines ensures that taxpayers can accurately report their foreign income and take advantage of the exclusion, minimizing their tax liability.

Required Documents

When filling out the Foreign Earned Income Tax Worksheet, several documents are necessary to support the information provided. These documents typically include:

- W-2 forms from foreign employers.

- Self-employment income statements.

- Proof of residency in the foreign country, such as a lease agreement or utility bills.

- Any other relevant income documentation.

Having these documents readily available will facilitate the completion of the worksheet and ensure accurate reporting of foreign income.

Quick guide on how to complete foreign earned income tax worksheet

Easily Prepare Foreign Earned Income Tax Worksheet on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Foreign Earned Income Tax Worksheet on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Foreign Earned Income Tax Worksheet Effortlessly

- Locate Foreign Earned Income Tax Worksheet and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would prefer to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from your chosen device. Edit and eSign Foreign Earned Income Tax Worksheet and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the foreign earned income tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the foreign earned income tax worksheet?

The foreign earned income tax worksheet is a document used to calculate the exclusion of income from foreign earnings when filing taxes. It helps expatriates determine their eligibility for tax benefits under IRS regulations, simplifying the filing process and maximizing deductions.

-

How can I access the foreign earned income tax worksheet using airSlate SignNow?

You can easily access the foreign earned income tax worksheet through airSlate SignNow's user-friendly platform. Simply log in, navigate to the document section, and you can upload, fill out, and eSign your worksheet with just a few clicks.

-

What are the benefits of using airSlate SignNow for the foreign earned income tax worksheet?

Using airSlate SignNow for your foreign earned income tax worksheet offers many benefits, such as convenience, time-saving features, and secure eSignature capabilities. This allows expatriates to sign and manage their tax documents from anywhere, ensuring compliance and peace of mind.

-

Is there a cost associated with using airSlate SignNow for the foreign earned income tax worksheet?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs. Review our pricing page to find the plan that best fits your budget and discover how you can efficiently manage your foreign earned income tax worksheet at a competitive rate.

-

Does airSlate SignNow offer integration with accounting software for the foreign earned income tax worksheet?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to link your foreign earned income tax worksheet with other financial tools. This integration streamlines your workflow, making it easy to track and report your foreign income accurately.

-

Can I collaborate with others on the foreign earned income tax worksheet using airSlate SignNow?

Yes, airSlate SignNow enables collaboration on documents like the foreign earned income tax worksheet. You can invite team members or tax professionals to review and sign the worksheet, ensuring that all relevant parties are involved in the process.

-

How secure is the foreign earned income tax worksheet when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The foreign earned income tax worksheet is protected with advanced encryption, ensuring your sensitive information remains confidential and secure throughout the eSigning process.

Get more for Foreign Earned Income Tax Worksheet

- Qaqi form

- Multiple intelligences survey results bar graph rough draft form

- Helfo s1 form 516723453

- Form prqa 01 teachingcouncil ie

- The muscular system haspi answer key form

- When nasa form is filled

- Disability retirement initial information certification persi idaho persi idaho

- Gwinnett county admin variance application form

Find out other Foreign Earned Income Tax Worksheet

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement