Texas Arkansas Exemption Form

What is the Texas Arkansas Exemption Form

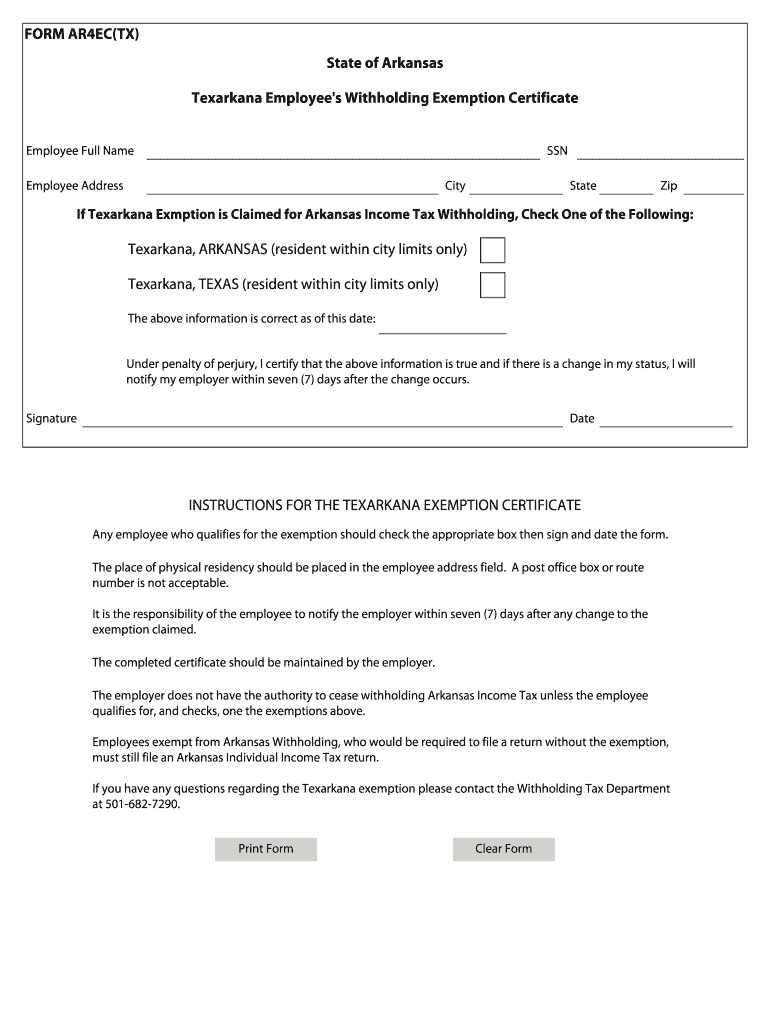

The Texas Arkansas Exemption Form is a legal document used primarily for tax purposes. It allows certain individuals or entities to claim exemptions from specific taxes in Texas and Arkansas. This form is essential for ensuring compliance with state tax regulations and can significantly affect the financial responsibilities of the filer. Understanding the purpose and implications of this form is crucial for individuals and businesses seeking to optimize their tax obligations.

How to use the Texas Arkansas Exemption Form

Using the Texas Arkansas Exemption Form involves several steps to ensure proper completion and submission. First, gather all necessary documentation that supports your claim for exemption. This may include identification, proof of residency, and any relevant financial records. Next, accurately fill out the form with the required information, ensuring that all sections are completed to avoid delays. Once completed, the form can be submitted electronically or via mail, depending on state guidelines.

Steps to complete the Texas Arkansas Exemption Form

Completing the Texas Arkansas Exemption Form requires attention to detail. Begin by downloading the latest version of the form from an official source. Carefully read the instructions provided with the form. Fill in your personal information, including your name, address, and tax identification number. Specify the type of exemption you are claiming and provide any supporting documentation as needed. Review the form for accuracy and completeness before submitting it to the appropriate tax authority.

Legal use of the Texas Arkansas Exemption Form

The legal use of the Texas Arkansas Exemption Form is governed by state tax laws. It is important to ensure that the form is used appropriately to avoid penalties or legal issues. The form must be filled out truthfully and submitted within the designated time frames. Misrepresentation or failure to comply with state guidelines can result in fines or other legal repercussions. Familiarizing oneself with the relevant laws and regulations is essential for lawful use.

Required Documents

When submitting the Texas Arkansas Exemption Form, certain documents may be required to support your claim. These typically include proof of identity, such as a driver's license or Social Security card, along with documentation that verifies your eligibility for the exemption. This could be tax returns, financial statements, or other relevant records. Ensuring that all required documents are included with your submission can help prevent processing delays.

Form Submission Methods

The Texas Arkansas Exemption Form can be submitted through various methods, depending on the preferences of the filer and the requirements of the state. Options typically include online submission through state tax websites, mailing a physical copy to the appropriate tax office, or delivering the form in person. Each method has its own set of guidelines and timelines, so it is important to choose the one that best fits your needs and ensures timely processing.

Quick guide on how to complete texas arkansas exemption form

Complete Texas Arkansas Exemption Form with ease on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Texas Arkansas Exemption Form on any device through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Texas Arkansas Exemption Form effortlessly

- Locate Texas Arkansas Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Texas Arkansas Exemption Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas arkansas exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas Arkansas Exemption Form?

The Texas Arkansas Exemption Form is a document that allows residents of Texas and Arkansas to apply for tax exemptions. It is essential for individuals and businesses looking to reduce their tax liabilities in these states. Understanding and completing this form correctly can lead to signNow savings.

-

How can I access the Texas Arkansas Exemption Form through airSlate SignNow?

You can easily access the Texas Arkansas Exemption Form through the airSlate SignNow platform. Simply log in, navigate to the document templates, and search for the form. This streamlines the process of obtaining and eSigning your exemption form.

-

Is there a cost associated with using airSlate SignNow for the Texas Arkansas Exemption Form?

airSlate SignNow offers a variety of pricing plans, with costs depending on the features you choose. Basic plans may include access to the Texas Arkansas Exemption Form at no extra charge, while more advanced features come with higher-tier subscriptions. It's important to review the pricing details to find the best fit for your needs.

-

What features does airSlate SignNow provide for the Texas Arkansas Exemption Form?

airSlate SignNow provides several features for the Texas Arkansas Exemption Form, including eSignature functionality, document tracking, and cloud storage. These features ensure that your form is securely signed and easily manageable, making the process seamless and efficient.

-

Are there any benefits to using airSlate SignNow for the Texas Arkansas Exemption Form?

Using airSlate SignNow for the Texas Arkansas Exemption Form offers numerous benefits, including increased efficiency and reduced paper use. The platform enables quick and secure eSignatures, allowing you to submit your exemption form faster than traditional methods. Additionally, automated reminders help ensure that you meet submission deadlines.

-

Can the Texas Arkansas Exemption Form be filled out on mobile devices?

Yes, airSlate SignNow allows you to fill out the Texas Arkansas Exemption Form on mobile devices. This mobile accessibility ensures that you can complete and sign your forms on the go, giving you the flexibility needed to manage your documents effectively from anywhere.

-

Does airSlate SignNow integrate with other software for the Texas Arkansas Exemption Form?

Absolutely! airSlate SignNow supports integrations with numerous software platforms, enhancing the ease of using the Texas Arkansas Exemption Form. Whether it's CRM systems, cloud storage, or project management tools, these integrations help streamline your workflow and improve overall productivity.

Get more for Texas Arkansas Exemption Form

- Petition to establish paternity tennessee form

- Phoenix life change of address form

- Vendor profile form

- Da 1569 form

- Financial declaration utah form

- Open records request form city of oak ridge

- After school meal program sponsor facility monitoring form schools utah

- Application for noise variance permit alexandriava form

Find out other Texas Arkansas Exemption Form

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now