Form it 201 Resident Income Tax Return Tax Year 2024

What is the Form IT 201 Resident Income Tax Return Tax Year

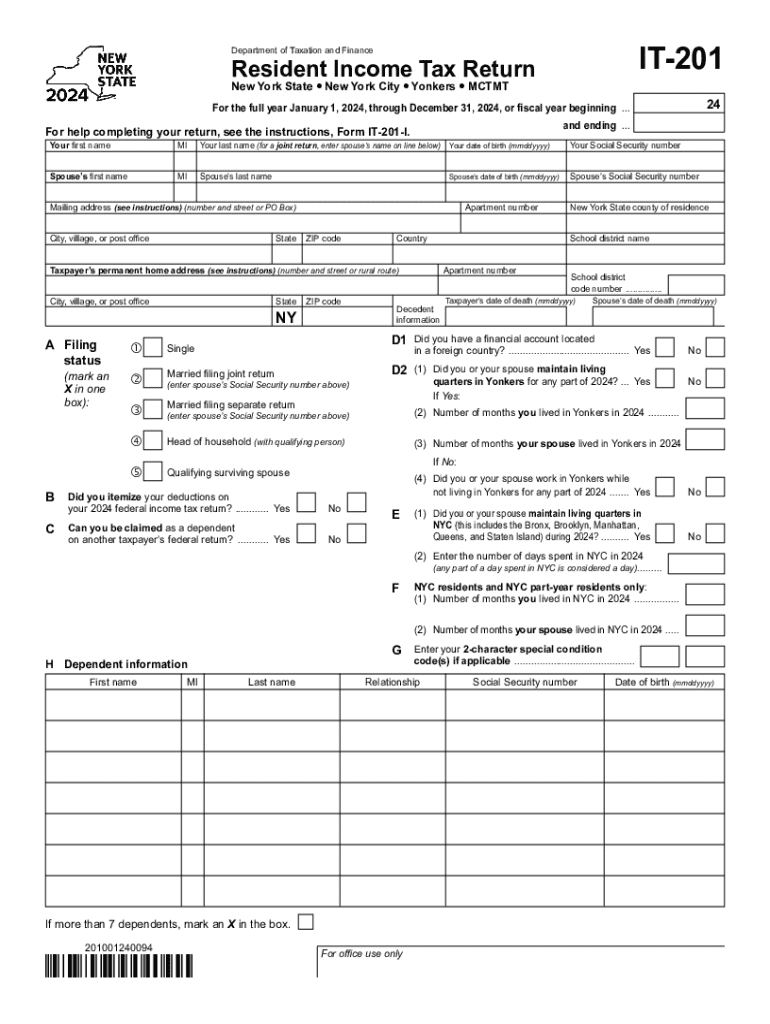

The Form IT 201 is the official New York State Resident Income Tax Return used by individuals to report their income and calculate their tax liability for the tax year. This form is essential for residents who earn income within New York State, as it helps determine the amount of state tax owed or the refund due. The IT 201 is specifically designed for residents, including those who may have part-time or full-time employment, self-employed individuals, and those receiving various forms of income such as dividends or rental income.

Steps to complete the Form IT 201 Resident Income Tax Return Tax Year

Completing the Form IT 201 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, and records of other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Complete the income section by listing all sources of income, including wages, interest, and dividends.

- Calculate deductions: Identify and apply any eligible deductions, such as standard or itemized deductions, to reduce taxable income.

- Determine tax liability: Use the tax tables provided to calculate the amount of tax owed based on your taxable income.

- Claim credits: Apply any tax credits you qualify for, which can further reduce your tax liability.

- Sign and date the form: Ensure that you sign and date the form before submitting it.

How to obtain the Form IT 201 Resident Income Tax Return Tax Year

The Form IT 201 can be obtained through several methods. It is available for download as a PDF from the New York State Department of Taxation and Finance website. Additionally, paper copies can often be found at local tax offices, public libraries, and some post offices. For those who prefer digital access, the form can also be filled out using various tax preparation software that is compatible with New York State tax forms.

Key elements of the Form IT 201 Resident Income Tax Return Tax Year

The Form IT 201 consists of several critical sections that taxpayers must complete:

- Personal Information: This section requires basic details about the taxpayer, including name, address, and filing status.

- Income Section: Taxpayers must report all sources of income, including wages, interest, and business income.

- Deductions: This area allows taxpayers to claim standard or itemized deductions to lower their taxable income.

- Tax Calculation: This section includes tax tables and formulas to determine the total tax liability based on reported income.

- Credits: Taxpayers can apply for various credits to reduce their overall tax owed.

- Signature: A signature is required to validate the form and confirm that the information provided is accurate.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form IT 201. Typically, the deadline for filing the form is April fifteenth of the following year after the tax year ends. For example, for the tax year 2023, the form must be filed by April 15, 2024. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 201 can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved tax software that supports the IT 201 form.

- By Mail: Completed forms can be mailed to the appropriate address provided in the form instructions, depending on whether a payment is included.

- In-Person: Some taxpayers may choose to file in person at designated tax offices or during tax preparation events.

Handy tips for filling out Form IT 201 Resident Income Tax Return Tax Year online

Quick steps to complete and e-sign Form IT 201 Resident Income Tax Return Tax Year online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant platform for maximum simpleness. Use signNow to electronically sign and share Form IT 201 Resident Income Tax Return Tax Year for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form it 201 resident income tax return tax year 771988307

Create this form in 5 minutes!

How to create an eSignature for the form it 201 resident income tax return tax year 771988307

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new york state tax form it 201?

The new york state tax form it 201 is a personal income tax return form used by residents of New York State. It is essential for reporting income, calculating taxes owed, and claiming any applicable credits. Understanding this form is crucial for ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the new york state tax form it 201?

airSlate SignNow simplifies the process of completing and submitting the new york state tax form it 201 by allowing users to eSign documents securely. Our platform streamlines document management, making it easy to gather signatures and share forms electronically. This saves time and reduces the hassle of traditional paper filing.

-

What are the pricing options for using airSlate SignNow for the new york state tax form it 201?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Our plans are designed to be cost-effective, ensuring that you can manage the new york state tax form it 201 and other documents without breaking the bank. Check our website for detailed pricing information.

-

Are there any features specifically designed for the new york state tax form it 201?

Yes, airSlate SignNow includes features that cater specifically to the new york state tax form it 201, such as customizable templates and automated workflows. These features help users fill out the form accurately and efficiently, ensuring that all necessary information is included. Additionally, our platform supports secure storage and easy retrieval of completed forms.

-

Can I integrate airSlate SignNow with other software for the new york state tax form it 201?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage the new york state tax form it 201 alongside your other financial documents. This integration helps streamline your workflow and ensures that all your data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for tax forms like the new york state tax form it 201?

Using airSlate SignNow for the new york state tax form it 201 provides numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our platform allows for easy tracking of document status and ensures compliance with state regulations. This leads to a more efficient tax filing experience.

-

Is airSlate SignNow user-friendly for completing the new york state tax form it 201?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the new york state tax form it 201. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effortlessly. Support resources are also available for additional assistance.

Get more for Form IT 201 Resident Income Tax Return Tax Year

Find out other Form IT 201 Resident Income Tax Return Tax Year

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template