It 201 V Form

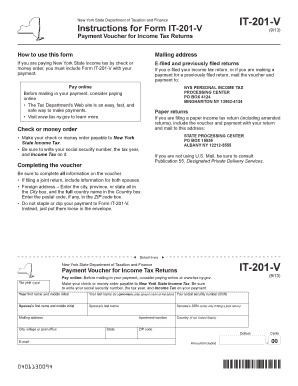

What is the IT 201 V?

The IT 201 V is a tax form used in the state of New York for individuals who are filing their personal income tax returns. This form is specifically designed for taxpayers who have a valid New York State tax identification number and need to report their income, deductions, and credits for the tax year. It is essential for ensuring compliance with state tax laws and for calculating the amount of tax owed or the refund due.

How to Use the IT 201 V

Using the IT 201 V involves several steps that ensure accurate reporting of your financial information. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid mistakes that could lead to delays or penalties. Once completed, review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to Complete the IT 201 V

Completing the IT 201 V requires attention to detail. Here are the steps to follow:

- Collect all relevant tax documents, including income statements and records of deductions.

- Begin filling out the form with your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable benefits.

- Calculate your deductions and credits according to the guidelines provided in the form instructions.

- Determine your total tax liability and any amount owed or refund due.

- Sign and date the form, confirming that the information provided is accurate.

Legal Use of the IT 201 V

The IT 201 V is legally binding when completed and submitted in accordance with New York State tax laws. It is crucial to ensure that all information is truthful and accurate, as providing false information can lead to penalties, including fines or legal repercussions. The form must be submitted by the designated filing deadline to avoid additional charges or interest on any taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the IT 201 V are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as any changes to deadlines announced by the New York State Department of Taxation and Finance.

Required Documents

To complete the IT 201 V accurately, certain documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of payment for any estimated taxes made during the year

Having these documents on hand will facilitate a smoother filing process and help ensure that all income and deductions are reported correctly.

Quick guide on how to complete it 201 v 1153329

Prepare It 201 V effortlessly on any device

The management of documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents quickly without interruptions. Manage It 201 V on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign It 201 V with ease

- Obtain It 201 V and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to store your changes.

- Decide how you want to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign It 201 V and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 201 v 1153329

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 201 v?

airSlate SignNow is an electronic signature solution that helps businesses streamline document workflows. With its easy-to-use interface, it 201 v empowers users to send and eSign documents effortlessly, making it an ideal choice for organizations looking to enhance their productivity.

-

What pricing options are available for it 201 v users?

airSlate SignNow offers several pricing plans tailored to meet the needs of different businesses. For it 201 v users, these plans are cost-effective and provide great value, allowing companies to choose the right level of functionality and features that suit their budget.

-

What key features does airSlate SignNow provide for it 201 v?

airSlate SignNow includes features such as secure eSigning, document templates, and real-time tracking. For it 201 v requirements, these features enhance collaboration and ensure compliance throughout the document management process.

-

How can airSlate SignNow benefit my business using it 201 v?

By using airSlate SignNow's it 201 v, businesses can save time and reduce costs associated with manual document handling. This solution streamlines the signing process, reduces turnaround times, and improves overall efficiency, allowing your team to focus on what truly matters.

-

Does airSlate SignNow integrate with other software for it 201 v?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing its functionality for it 201 v. This allows users to connect with tools like CRM systems and cloud storage solutions, creating a unified digital workspace.

-

Is airSlate SignNow secure for conducting it 201 v transactions?

Absolutely! airSlate SignNow is designed with security in mind, ensuring that all it 201 v transactions are protected through encryption and compliance with industry standards. This guarantees that your sensitive documents remain confidential and secure.

-

Can I customize document templates in airSlate SignNow for it 201 v?

Yes, airSlate SignNow allows users to create and customize document templates specifically for it 201 v. This feature enables you to standardize processes and ensure that your documents maintain a professional appearance while saving you time.

Get more for It 201 V

- Living strong fitness training systems body fat measurements livingstrong form

- Outpatientnontraditional facility based tb risk assessment facility risk assessment for tb transmission among clients and form

- Guarantee form rotary

- De26 102602 form

- Vusd sports physical form 12111 version doc

- Activity one american independence answer key form

- Boat charter agreement template form

- Boat purchase agreement template form

Find out other It 201 V

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement