City of Grand Rapids Mi Quarterly Tax Form Gr941

What is the City Of Grand Rapids Mi Quarterly Tax Form Gr941

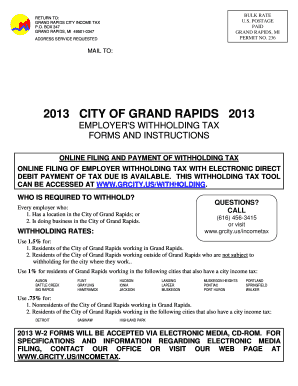

The City of Grand Rapids MI Quarterly Tax Form GR941 is a vital document used by businesses operating within the city to report and remit their quarterly business income taxes. This form is specifically designed for entities subject to the city's income tax regulations, ensuring compliance with local tax laws. The GR941 form captures essential financial information, including gross receipts and taxable income, which are necessary for calculating the tax owed to the city.

How to use the City Of Grand Rapids Mi Quarterly Tax Form Gr941

Using the City of Grand Rapids MI Quarterly Tax Form GR941 involves a straightforward process that requires accurate financial data. Businesses should begin by gathering their financial records for the quarter, including income statements and receipts. Once the necessary information is compiled, it can be entered into the form. After completing the form, businesses must ensure that all calculations are correct and that the form is signed appropriately before submission.

Steps to complete the City Of Grand Rapids Mi Quarterly Tax Form Gr941

Completing the City of Grand Rapids MI Quarterly Tax Form GR941 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial documents, including income statements and receipts.

- Fill in your business information, including name, address, and tax identification number.

- Report your gross receipts and any deductions applicable to your business.

- Calculate the total tax owed based on the provided tax rates.

- Review the form for accuracy and ensure all required signatures are included.

Legal use of the City Of Grand Rapids Mi Quarterly Tax Form Gr941

The legal use of the City of Grand Rapids MI Quarterly Tax Form GR941 is governed by local tax laws and regulations. To be considered legally binding, the form must be completed accurately and submitted by the designated deadlines. Businesses must also ensure compliance with eSignature laws if submitting electronically. Utilizing a reliable eSigning platform can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the City of Grand Rapids MI Quarterly Tax Form GR941 is crucial for compliance. Typically, the form must be submitted on a quarterly basis, with specific due dates established by the city. Businesses should mark their calendars for these dates to avoid penalties and ensure timely filing. It is advisable to check the city’s official resources for the most current deadlines.

Form Submission Methods (Online / Mail / In-Person)

The City of Grand Rapids MI Quarterly Tax Form GR941 can be submitted through various methods to accommodate different business needs. Options include:

- Online Submission: Many businesses prefer the convenience of submitting the form electronically through a secure platform.

- Mail Submission: The form can be printed and mailed to the appropriate city tax office.

- In-Person Submission: Businesses may also choose to deliver the form directly to the city office for immediate processing.

Quick guide on how to complete city of grand rapids mi quarterly tax form gr941

Complete City Of Grand Rapids Mi Quarterly Tax Form Gr941 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmental alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents promptly and without delays. Manage City Of Grand Rapids Mi Quarterly Tax Form Gr941 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The most efficient method to modify and eSign City Of Grand Rapids Mi Quarterly Tax Form Gr941 with ease

- Locate City Of Grand Rapids Mi Quarterly Tax Form Gr941 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that task.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your needs in document management with just a few clicks from any device you prefer. Modify and eSign City Of Grand Rapids Mi Quarterly Tax Form Gr941 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of grand rapids mi quarterly tax form gr941

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Grand Rapids MI quarterly tax form GR941?

The city of Grand Rapids MI quarterly tax form GR941 is a crucial document used by businesses to report their quarterly tax obligations. This form ensures that you are compliant with local tax regulations and helps maintain your business’s good standing. Utilizing tools like airSlate SignNow can simplify the process of completing and submitting this form.

-

How can airSlate SignNow help with the city of Grand Rapids MI quarterly tax form GR941?

airSlate SignNow provides an easy-to-use platform that allows businesses to fill out and eSign the city of Grand Rapids MI quarterly tax form GR941 efficiently. With its user-friendly interface, you can manage the entire tax form process digitally, saving time and reducing errors. This ensures your submissions are accurate and timely.

-

What features does airSlate SignNow offer for managing the city of Grand Rapids MI quarterly tax form GR941?

AirSlate SignNow offers features such as customizable templates, electronic signatures, and automated reminders to help manage the city of Grand Rapids MI quarterly tax form GR941. These tools facilitate a streamlined workflow, allowing businesses to focus on core activities rather than paperwork. Moreover, secure storage options ensure that your documents are protected.

-

Is airSlate SignNow cost-effective for small businesses handling the city of Grand Rapids MI quarterly tax form GR941?

Yes, airSlate SignNow offers competitive pricing plans that cater specifically to small businesses, making it a cost-effective solution for handling the city of Grand Rapids MI quarterly tax form GR941. With flexible subscription options, businesses can choose a plan that fits their needs without compromising on features. The savings from reduced errors and time spent on forms can signNowly benefit small enterprises.

-

Can airSlate SignNow integrate with other software for filing the city of Grand Rapids MI quarterly tax form GR941?

Absolutely! AirSlate SignNow offers robust integrations with various accounting and financial software systems, making it easier to file the city of Grand Rapids MI quarterly tax form GR941. This integration helps centralize your data, streamline your workflow, and minimize manual entry. You can enhance your productivity and accuracy signNowly.

-

What are the benefits of using airSlate SignNow for the city of Grand Rapids MI quarterly tax form GR941?

Using airSlate SignNow for the city of Grand Rapids MI quarterly tax form GR941 brings numerous benefits, including time savings, increased accuracy, and enhanced compliance. The platform's digital capabilities eliminate paper processes, help track progress, and ensure timely submission. Additionally, its user-friendly design minimizes the learning curve for your team.

-

How secure is airSlate SignNow for submitting the city of Grand Rapids MI quarterly tax form GR941?

AirSlate SignNow prioritizes security, employing advanced encryption methods to protect your sensitive information when submitting the city of Grand Rapids MI quarterly tax form GR941. Compliance with industry standards ensures that your data remains confidential and secure during the entire process. You can have peace of mind knowing that your documents are handled safely.

Get more for City Of Grand Rapids Mi Quarterly Tax Form Gr941

- Ark word family form

- Vgli beneficiary form

- Readychex loststolen check affidavit form

- Pythagorean theorem word problems matching worksheet answer key 94795170 form

- 185573 grapevine hurst v11 preferred imaging form

- Practice 6 1 ratios and unit rates sasd form

- Peer review checklist youth development omtk oms bgca form

- Notice to terminate tenancy agreement template form

Find out other City Of Grand Rapids Mi Quarterly Tax Form Gr941

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter