Gujarat Treasury Forms

What is the Gujarat Treasury Forms

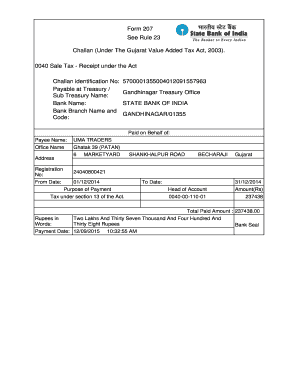

The Gujarat Treasury Forms are official documents used for various financial transactions within the state of Gujarat. These forms facilitate the payment of government dues, taxes, and other fees. They are essential for individuals and businesses engaging with state financial systems, ensuring that payments are processed correctly and efficiently. The forms include specific details such as the type of payment, the amount, and the purpose of the transaction, making them vital for both record-keeping and compliance with state regulations.

How to use the Gujarat Treasury Forms

Using the Gujarat Treasury Forms involves several straightforward steps. First, identify the specific form required for your transaction, such as the treasury challan form or GTR form 61. Next, fill out the form with accurate information, including personal or business details, payment amounts, and any relevant identification numbers. After completing the form, it can be submitted either online or in person at designated treasury offices. Ensuring that all information is correct is crucial, as errors can lead to delays or complications in processing payments.

Steps to complete the Gujarat Treasury Forms

Completing the Gujarat Treasury Forms requires careful attention to detail. Follow these steps for successful completion:

- Obtain the correct form from the official treasury website or local treasury office.

- Fill in your personal or business information accurately, including name, address, and contact details.

- Specify the payment type and amount clearly.

- Review the form for any errors or omissions before submission.

- Submit the completed form as per the guidelines, either online or in person.

Legal use of the Gujarat Treasury Forms

The Gujarat Treasury Forms hold legal significance in the context of financial transactions with the state government. When filled out correctly and submitted as required, these forms serve as official records of payments made. Compliance with the relevant laws and regulations is essential to ensure that the forms are recognized as valid by government authorities. This includes adhering to deadlines and providing accurate information, as inaccuracies may lead to penalties or disputes.

Who Issues the Form

The Gujarat Treasury Forms are issued by the state government of Gujarat, specifically through its treasury department. This department is responsible for managing state finances, including the collection of taxes and other revenues. By issuing these forms, the treasury department ensures that there is a standardized process for financial transactions, promoting transparency and accountability in government dealings.

Form Submission Methods

There are multiple methods for submitting the Gujarat Treasury Forms. Users can choose to submit forms online through the official treasury portal, which often provides a faster processing time. Alternatively, forms can be submitted in person at designated treasury offices across Gujarat. It is also possible to send completed forms via mail, although this may result in longer processing times. Each method has its own guidelines, so it's important to follow the specific instructions provided for the chosen submission method.

Quick guide on how to complete gujarat treasury forms

Finish Gujarat Treasury Forms effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Handle Gujarat Treasury Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Gujarat Treasury Forms smoothly

- Locate Gujarat Treasury Forms and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Gujarat Treasury Forms and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gujarat treasury forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Gujarat treasury forms and how can airSlate SignNow help?

Gujarat treasury forms are essential documents used for the payment and receipt of government funds in Gujarat. airSlate SignNow simplifies the process of managing these forms by allowing users to electronically sign and send them securely, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for handling Gujarat treasury forms?

Pricing for airSlate SignNow varies based on your business needs. We offer various plans that provide cost-effective solutions for managing Gujarat treasury forms, with flexible subscription options that suit businesses of all sizes.

-

What features does airSlate SignNow offer for Gujarat treasury forms?

airSlate SignNow offers features such as an intuitive document editor, customizable templates for Gujarat treasury forms, and advanced security measures, ensuring your forms are both easy to fill and safe. These features make document management streamlined and efficient.

-

Can I integrate airSlate SignNow with other software for managing Gujarat treasury forms?

Yes, airSlate SignNow provides integrations with various software applications, making it easy to handle Gujarat treasury forms within your existing workflows. This flexibility enhances your overall productivity by connecting with tools you already use.

-

How does electronic signing of Gujarat treasury forms benefit my business?

Electronic signing of Gujarat treasury forms saves time and reduces paper usage, allowing for faster processing and approval. This eco-friendly option enhances your business's efficiency while maintaining legal compliance.

-

Is airSlate SignNow secure for handling sensitive Gujarat treasury forms?

Absolutely. airSlate SignNow employs advanced encryption and security protocols to ensure that all Gujarat treasury forms are handled securely. Your sensitive data is protected, giving you peace of mind as you utilize our eSigning solutions.

-

How can I get support while using airSlate SignNow for Gujarat treasury forms?

We provide comprehensive customer support for users managing Gujarat treasury forms through airSlate SignNow. Our team is available via chat, email, and phone to assist you with any queries or technical challenges you might encounter.

Get more for Gujarat Treasury Forms

Find out other Gujarat Treasury Forms

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free