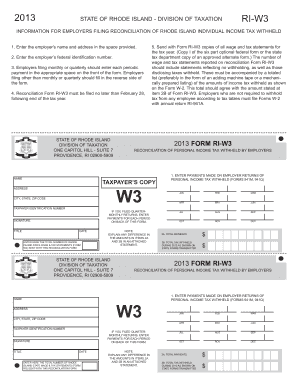

Ri W3 Form

What makes the ri w3 form legally valid?

As the society ditches in-office work, the execution of documents increasingly occurs electronically. The ri w3 form isn’t an exception. Handling it utilizing digital means differs from doing this in the physical world.

An eDocument can be considered legally binding given that particular requirements are fulfilled. They are especially vital when it comes to stipulations and signatures related to them. Entering your initials or full name alone will not guarantee that the institution requesting the sample or a court would consider it accomplished. You need a trustworthy tool, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your ri w3 form when filling out it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make document execution legitimate and safe. It also provides a lot of opportunities for smooth completion security wise. Let's rapidly run through them so that you can stay assured that your ri w3 form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy standards in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties identities through additional means, like a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data securely to the servers.

Filling out the ri w3 form with airSlate SignNow will give greater confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete ri w3

Complete Ri W3 effortlessly on any device

Online document management has become popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the right form and secure it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ri W3 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to modify and eSign Ri W3 with ease

- Locate Ri W3 and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign Ri W3 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri w3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 'ri w3' feature in airSlate SignNow?

The 'ri w3' feature in airSlate SignNow streamlines the document signing process, making it faster and more efficient. By utilizing this feature, users can easily send, sign, and manage documents without the hassle of printing or faxing. It's designed to enhance user productivity and ensure a seamless experience.

-

How does airSlate SignNow's pricing compare for users interested in 'ri w3' integrations?

AirSlate SignNow offers competitive pricing plans that cater to various business sizes, particularly for those leveraging the 'ri w3' integrations. Users can choose from monthly or annual subscriptions that provide access to all essential features, including unlimited signing and document storage, ensuring they receive value for their investment.

-

What are the key benefits of using airSlate SignNow with 'ri w3' capabilities?

Utilizing airSlate SignNow with 'ri w3' capabilities brings numerous benefits including enhanced security, ease of use, and comprehensive document management. Businesses can expect improved turnaround times for document processing, which leads to increased efficiency and better customer satisfaction rates. The user-friendly interface also aids in quick adoption by team members.

-

Can I integrate airSlate SignNow's 'ri w3' features with my existing tools?

Yes, airSlate SignNow's 'ri w3' features can seamlessly integrate with various existing tools such as CRMs, project management software, and other productivity applications. This ensures that your document workflow remains uninterrupted and synchronized with your business operations, leading to greater efficiency.

-

Is there a mobile application for airSlate SignNow that supports 'ri w3' features?

Absolutely! The airSlate SignNow mobile application incorporates 'ri w3' features, allowing users to send and sign documents on-the-go. The app is designed to facilitate quick access and performance of essential tasks from any mobile device, ensuring that you remain productive wherever you are.

-

What types of documents can I sign using airSlate SignNow's 'ri w3' feature?

With airSlate SignNow's 'ri w3' feature, users can sign a variety of document types, including contracts, agreements, and forms. This functionality supports multiple file formats such as PDF and Word, catering to diverse business needs and ensuring flexibility in document handling and processing.

-

How does airSlate SignNow ensure security for documents signed through 'ri w3'?

AirSlate SignNow implements robust security measures for documents signed through 'ri w3,' including encryption, multi-factor authentication, and secure cloud storage. These features help protect sensitive information, ensuring that documents remain confidential and compliant with regulatory standards.

Get more for Ri W3

- Wset level 1 exam questions pdf form

- Heating curve worksheet form

- La quinta employee login form

- Npdcl application form

- Excavator operator evaluation form

- American express bank statement template form

- Chapter 7 cell structure and function vocabulary review answers pdf form

- Qualified dividends worksheet form

Find out other Ri W3

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later