Form 4789 1994

What is the Form 4789

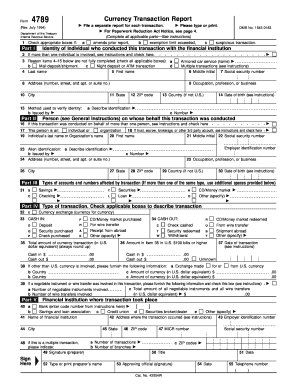

The Form 4789, also known as the currency transaction report, is a document required by the Financial Crimes Enforcement Network (FinCEN) for reporting certain transactions involving cash. This form is essential for financial institutions and businesses that engage in cash transactions exceeding ten thousand dollars in a single day. Its primary purpose is to help prevent money laundering and other financial crimes by ensuring transparency in large cash transactions.

How to use the Form 4789

Using the Form 4789 involves several key steps. First, businesses must determine if a cash transaction qualifies for reporting. If the transaction exceeds ten thousand dollars, the business must complete the form accurately, detailing the transaction's specifics, including the date, amount, and parties involved. After filling out the form, it must be submitted to FinCEN within 15 days of the transaction. This ensures compliance with federal regulations aimed at curbing illicit financial activities.

Steps to complete the Form 4789

Completing the Form 4789 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the transaction, including the date, amount, and involved parties.

- Access the Form 4789 online or obtain a physical copy from a financial institution.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to FinCEN within the required timeframe.

Legal use of the Form 4789

The legal use of the Form 4789 is governed by federal regulations aimed at maintaining the integrity of the financial system. Proper completion and timely submission of the form are crucial for compliance with the Bank Secrecy Act. Failure to file the form when required can lead to significant penalties, including fines and legal repercussions for the reporting entity.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how to handle cash transactions and the requirements for filing the Form 4789. These guidelines emphasize the importance of accurate reporting and maintaining records of cash transactions. Businesses are encouraged to consult IRS publications and resources to ensure they remain compliant with tax obligations related to cash transactions.

Penalties for Non-Compliance

Non-compliance with the requirements for the Form 4789 can result in serious consequences. Businesses that fail to file the report when necessary may face hefty fines. Additionally, repeated violations can lead to increased scrutiny from regulatory agencies, which may result in further legal action. It is essential for businesses to understand these penalties and take the necessary steps to comply with reporting requirements.

Quick guide on how to complete form 4789

Easily Prepare Form 4789 on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Form 4789 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-driven workflows today.

The Simplest Way to Modify and eSign Form 4789 Effortlessly

- Obtain Form 4789 and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form—via email, SMS, or invite link—or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 4789 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4789

Create this form in 5 minutes!

How to create an eSignature for the form 4789

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a currency transaction report and why is it important?

A currency transaction report (CTR) is a document that financial institutions are required to file for transactions involving more than $10,000 in cash. It is essential for compliance with financial regulations and helps in tracking potentially suspicious activity. Understanding CTRs is crucial for businesses to avoid penalties and maintain transparency.

-

How can airSlate SignNow assist with currency transaction reports?

airSlate SignNow provides a seamless way to send, eSign, and manage currency transaction reports electronically. With our user-friendly platform, you can ensure that all required signatures are collected efficiently, helping to speed up the compliance process. Our solution simplifies handling of such sensitive documents by ensuring they are processed securely.

-

Are there any costs associated with generating currency transaction reports using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that make it cost-effective for businesses of all sizes. While the costs may vary depending on the features you choose, our platform provides excellent value for the functionality, including support for currency transaction reports. You can start with a free trial to explore our offerings.

-

What features does airSlate SignNow offer for managing currency transaction reports?

Our platform includes features such as secure electronic signing, templates for efficient document preparation, and robust tracking options for currency transaction reports. Additionally, integration capabilities with other financial software help streamline the reporting process. This functionality makes airSlate SignNow ideal for businesses needing to handle CTRs efficiently.

-

Can I integrate airSlate SignNow with my existing financial systems for currency transaction reports?

Yes, airSlate SignNow allows easy integration with various financial and accounting software, making it convenient to manage currency transaction reports. These integrations ensure that your reporting processes align with your existing business workflows. This ultimately boosts efficiency and minimizes the risk of errors.

-

What security measures does airSlate SignNow have for handling currency transaction reports?

We prioritize the security of your documents, including currency transaction reports, by employing industry-leading encryption and compliance standards. Our platform ensures that all data is securely stored and transmitted, safeguarding sensitive information from unauthorized access. You can trust airSlate SignNow for secure eSignature solutions.

-

Is airSlate SignNow suitable for small businesses needing to file currency transaction reports?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, including small businesses. Our affordable plans cater to organizations looking to manage currency transaction reports efficiently without breaking the bank. The platform's ease of use makes it accessible even for those who are not tech-savvy.

Get more for Form 4789

- Application form all india open test for ntse stage 2 dlpd dlpd resonance ac

- Dmv massachusetts diabled application form

- Institutional verification worksheet form

- Application for book entry government securities form monetary masnetsvc2 mas gov

- Eylea4u enrollment form

- Cdtfa 447 statement pursuant to section 6247 of the california sales and use tax law 772015960 form

- Vehicle loaner agreement template form

- Vehicle maintenance agreement template form

Find out other Form 4789

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF