for Paperwork Reduction Act Notice, See Page 3 Fdic 1995-2026

IRS Guidelines

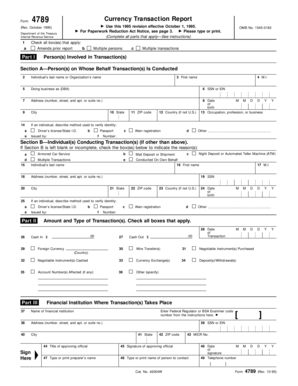

The currency transaction report form, commonly referred to as the CTR form or Form 4789, is mandated by the Financial Crimes Enforcement Network (FinCEN) under the Bank Secrecy Act. This form is essential for reporting cash transactions exceeding $10,000. Financial institutions must adhere to specific IRS guidelines when completing this form to ensure compliance with federal regulations. These guidelines outline the necessary information to be reported, including the identity of the individual or entity involved in the transaction, the amount of cash involved, and the nature of the transaction.

Steps to complete the currency transaction report form

Completing the currency transaction report form involves several key steps:

- Gather necessary information about the transaction, including the date, amount, and parties involved.

- Fill out the CTR form accurately, ensuring all required fields are completed. This includes details such as the name, address, and taxpayer identification number of the individual or entity.

- Review the form for any errors or omissions before submission.

- Submit the completed form to FinCEN within the required timeframe, which is typically 15 days after the transaction.

Filing Deadlines / Important Dates

Timely filing of the currency transaction report form is crucial to avoid penalties. The form must be submitted within 15 days of the transaction date. It is important to keep track of any specific deadlines that may apply, especially during peak transaction periods or when there are changes in reporting requirements. Failure to meet these deadlines can result in significant fines and legal repercussions.

Penalties for Non-Compliance

Non-compliance with the reporting requirements for the currency transaction report form can lead to severe penalties. Financial institutions may face fines ranging from $500 to $10,000 per violation, depending on the severity and frequency of the non-compliance. Additionally, individuals involved in the transactions may also face legal consequences, including potential criminal charges for willful violations of the Bank Secrecy Act.

Required Documents

When preparing to complete the currency transaction report form, certain documents are typically required. These may include:

- Identification documents for individuals involved in the transaction, such as a driver's license or passport.

- Business documentation if the transaction involves a corporate entity, including articles of incorporation or a business license.

- Records of the transaction itself, detailing the amount of cash exchanged and the purpose of the transaction.

Form Submission Methods

The currency transaction report form can be submitted through various methods, ensuring flexibility for financial institutions. The primary submission methods include:

- Online submission through the BSA E-Filing System, which allows for quick and secure filing.

- Mailing a paper version of the form to the appropriate FinCEN address.

- In-person submission at designated financial institutions, although this method is less common.

Quick guide on how to complete for paperwork reduction act notice see page 3 fdic

Complete For Paperwork Reduction Act Notice, See Page 3 Fdic effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage For Paperwork Reduction Act Notice, See Page 3 Fdic on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign For Paperwork Reduction Act Notice, See Page 3 Fdic with ease

- Obtain For Paperwork Reduction Act Notice, See Page 3 Fdic and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign For Paperwork Reduction Act Notice, See Page 3 Fdic and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for paperwork reduction act notice see page 3 fdic

Create this form in 5 minutes!

How to create an eSignature for the for paperwork reduction act notice see page 3 fdic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sccy 9 bank?

The sccy 9 bank is a reliable and user-friendly handgun that features a compact design for easy carrying. It's known for its accuracy and affordability, making it a popular choice among gun enthusiasts and first-time buyers alike. Its lightweight construction and effective safety features add to its appeal in the personal defense market.

-

How much does the sccy 9 bank cost?

Pricing for the sccy 9 bank typically ranges from $300 to $400, depending on the retailer and any additional features. This makes it a cost-effective option compared to other handguns in its class. Be sure to check local laws as prices may also vary based on state regulations.

-

What are the key features of the sccy 9 bank?

The sccy 9 bank boasts several impressive features, including a polymer frame, stainless steel slide, and a 10-round capacity magazine. These characteristics enhance its reliability and performance in various situations. Additionally, it includes a manual safety for added security while handling.

-

What are the benefits of owning an sccy 9 bank?

Owning an sccy 9 bank provides users with a dependable firearm for personal protection or sport shooting. Its lightweight design ensures comfort during extended wear, and the manageable recoil is especially suited for new shooters. Furthermore, its affordability means you don’t have to break the bank to own a high-quality handgun.

-

Is the sccy 9 bank easy to maintain?

Yes, the sccy 9 bank is designed for easy maintenance. Regular cleaning and lubrication are straightforward processes due to its simple construction. Maintaining your weapon not only ensures optimal performance but also extends its lifespan signNowly.

-

Are there any integrations available for the sccy 9 bank?

While the sccy 9 bank itself does not have digital integrations, it can be easily customized with various accessories such as sights, grips, and holsters. These enhancements can improve your shooting experience and tailor the firearm to your specific needs. Make sure to consider compatibility with each additional accessory.

-

Where can I purchase an sccy 9 bank?

You can purchase the sccy 9 bank at most gun retailers, both in-store and online. It's advisable to buy from licensed dealers to ensure compliance with local laws. Additionally, many manufacturers offer direct purchases through their websites, which may provide exclusive offers.

Get more for For Paperwork Reduction Act Notice, See Page 3 Fdic

- Diocese of birmingham in alabama form ch 1 parentalguardian

- Assumption of risk and release form 09 10 indd emerson college emerson

- Affidavit of vin form

- Pa affidavit 1609 pr pdf form

- Hud form 50058 pdf

- Ipaliwanag ang tungkulin o ginagampanang papel form

- Tanning release form 428609192

- Howard college housing application home of the howard form

Find out other For Paperwork Reduction Act Notice, See Page 3 Fdic

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer