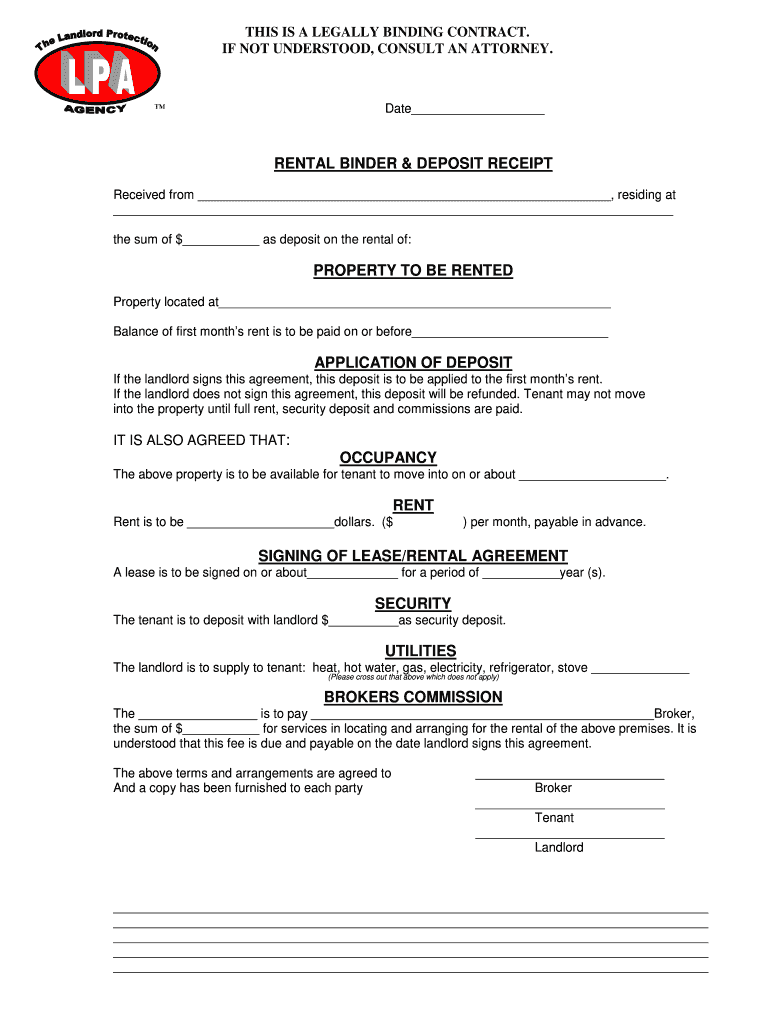

Binder Rental Form

What is a deposit receipt in real estate?

A deposit receipt in real estate serves as a formal document acknowledging the receipt of a deposit made by a tenant or buyer. This receipt is crucial in rental agreements or property transactions, as it provides proof of the deposit amount and the terms under which it was made. The deposit can be for a security deposit, first month’s rent, or earnest money in a purchase agreement. This document helps to protect both parties by clearly outlining the financial commitment involved.

Key elements of a deposit receipt

When creating a deposit receipt for real estate, several key elements should be included to ensure clarity and legal validity:

- Names of the parties: Include the names of the landlord or seller and the tenant or buyer.

- Property address: Clearly state the address of the property involved in the transaction.

- Deposit amount: Specify the exact amount of the deposit being acknowledged.

- Date of receipt: Indicate the date on which the deposit was received.

- Purpose of the deposit: Describe whether the deposit is for a security deposit, first month’s rent, or earnest money.

- Signatures: Both parties should sign the receipt to confirm their agreement to the terms outlined.

Steps to complete a deposit receipt

Completing a deposit receipt involves several straightforward steps:

- Gather necessary information: Collect the names of all parties, the property address, and the deposit amount.

- Choose a template: Use a reliable template that includes all required elements for a deposit receipt.

- Fill in the details: Input the gathered information into the template accurately.

- Review the document: Ensure all information is correct and that it meets any state-specific requirements.

- Sign the receipt: Both parties should sign the document to acknowledge their agreement.

- Provide copies: Give a copy of the signed receipt to each party for their records.

Legal use of a deposit receipt

A deposit receipt is legally binding when it includes all necessary elements and is signed by both parties. It serves as proof of the transaction and can be used in court if disputes arise regarding the deposit. It is important to ensure that the receipt complies with local laws and regulations, as these can vary by state. Understanding the legal implications of the deposit receipt can help safeguard the interests of both the tenant and the landlord or seller.

Examples of using a deposit receipt

Deposit receipts can be utilized in various scenarios within real estate transactions:

- Rental agreements: When a tenant pays a security deposit, a receipt provides proof of payment and terms.

- Home purchases: Buyers often provide earnest money to demonstrate their intent to purchase, which is documented through a receipt.

- Lease renewals: A deposit receipt can be issued when a tenant pays a renewal deposit for extending their lease.

State-specific rules for deposit receipts

Each state in the U.S. may have different regulations regarding deposit receipts, including requirements for the information included and how deposits must be handled. It is essential to familiarize yourself with your state’s laws to ensure compliance. Some states may require landlords to provide specific disclosures about how the deposit will be used or returned. Understanding these rules can help prevent legal issues and ensure a smooth transaction.

Quick guide on how to complete real estate deposit receipt formpdffillercom

The simplest method to obtain and endorse Binder Rental

At the level of your whole organization, ineffective workflows surrounding paper approvals can drain numerous working hours. Signing documents such as Binder Rental is an inherent aspect of operations in every sector, which is why the efficiency of each agreement's lifecycle signNowly impacts the overall productivity of the organization. With airSlate SignNow, endorsing your Binder Rental is as straightforward and rapid as possible. This platform provides you with the most recent version of almost any document. Even better, you can sign it instantly without installing external software on your computer or printing out physical copies.

Steps to obtain and endorse your Binder Rental

- Browse our collection by category or use the search bar to find the document you require.

- View the document preview by clicking Learn more to confirm it's the correct one.

- Select Get form to start editing immediately.

- Fill out your document and insert any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Binder Rental.

- Select the signature method that works best for you: Draw, generate initials, or upload a picture of your handwritten signature.

- Press Done to finalize editing and move on to sharing options as needed.

With airSlate SignNow, you have everything essential to manage your documents efficiently. You can locate, complete, modify, and even send your Binder Rental in a single tab without any difficulty. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do real estate agents track their expense receipts?

Realtors make up a signNow fraction of Expensify's userbase. Expensify imports expenses from your credit cards, scans receipts with your mobile phone, exports to your accounting package, and reimburses online. See Expense reports that don't suck! for more

-

How do I fill out a deposit slip?

You go to the bank of your choice, preferably where you have an account, and ask for a deposit slip. You then technically do a “fill in the blank” and then write the number of notes of relevant denomination note. Like thisCredit: http://mindpowerindia.com/sbi.phpNow go and deposit your Rs. 500 and Rs. 1000 notes, if you are in India :-)EDIT: As rightly pointed out by Lara Taylor sorry for being judgemental.

-

How can I fill out a savings deposit slip?

“How can I fill out a savings deposit slip?”Do you have some savings to deposit?Do you have a savings account?Do you know the savings account number?Do you have a way to obtain a savings deposit slip?Do you have a pen with which to fill out the savings deposit slip?Are you physically able to enter the appropriate information on the slip?When you’ve answered these questions, then someone can probably provide an appropriate answer to your question.

-

What clause on a 90 day $5M commercial real estate deal with 5% down allows me to back out AND get my entire deposit back?

From personal experience, having worked in the CRE field for a couple of years on various sides of the business.If you take away all the metrics (90 days, $5M, 5% down) you can distill the question to: 'how can I receive a full rebate on my purchase deposit?'The answer will vary depending on the unique circumstances related to you and the other party(ies) or intermediaries (brokers). This is highly due to the PSA - Purchase and Sale Agreement that you initially executed in order to satisfy the subsequent consideration of a legal contract. Typically in a Commercial Real Estate (CRE) PSA, there will be Letters of Intent (LOI) drafts sent back and forth to negotiate the finer aspects of the PSA construct - prior to execution of the PSA. Usually this is done from a legal representation standpoint of the two parties on either side of the intermediary or broker. Many more experienced purchasers or those that would qualify in a subjective stance as a professional investor/purchaser/institution etc will draft them without such representation or with very little final reviews after the material aspects of the draft have been hammered out. Deposits required to open escrow and establish consideration are highly variable depending on the deal and parties involved. 5% in many cases is a good benchmark that will commonly be set as the deposit (sometimes more or less arbitrary numbers will be used e.g. 25k deposit on $5M purchase price). That being said the construct of the PSA can vary greatly on different aspects of due diligence. Some will outline certain amounts of deposit be non-refundable regardless of outcome due to consideration of time spent in contract and not marketed with other parties. You will see this range again according to the details as outlined in your PSA (~1%-10% deposit in escrow). All of that considered there is an element agreed to in the purchase agreement under due diligence where specific contingencies must be met in order for a full deposit will be considered realizable and non-refundable. This like all of the above aspects can and is negotiated before execution (signing) of the PSA. For example: if your due diligence outlines contingencies as follows: -Buyer shall have 90 days to conduct due diligence on 'property as defined earlier in PSA', with one (or more) option(s) to extend by (x) days with additional non-refundable deposits of $x.-Due diligence satisfaction during 90 period is subjective upon the contingencies being satisfactory to purchaser:--Structurally sound, Pest inspection (depending on type of asset), flooding map, review of lease obligations and or contracts etc.To summarize there are many ways in which the contracts entered into a purchase agreement can allow for your or seller to back out of the deal, but they will be entirely outlined in the contract you have (assumption) already signed. If you have already signed a purchase agreement you are effectively engaged in a legal contract and are required to fulfill your obligations accordingly or face a lawsuit of specific performance (such as according to your contract you are not entitled to receive a rebate in any way, and you instruct escrow that you are not allowing them to release funds, selling party will sue to release the funds they are entitled to according to the contract you have engaged in).Still if you have entered into a contractual agreement which wouldn't entitle you to receive the funds, your best option will be one of two thing:-Prove you were defrauded either in representation or of facts presented.Representation: if your broker is engaged in dual agency (representing both parties ~30+/-% of the deals in CRE) and they have not informed you of the implications or possible implications of such then you could sue the brokerage house. (Very unlikely because in execution of a representation agreement if using an agent/broker these terms are often explicitly expressed)Defrauded: You can prove the facts presented you from any party submitting you facts were an absolute misrepresentation either due to fraud or neglect. This can be the case when facts are inconsistent with discovery made in due diligence. If seller and/or seller's agent represents current/proforma tax basis to be lower than actual you could make the argument for fraud (actual experience when underwriting an acquisition of $7M CRE where agent under express consent of seller represented tax basis to be roughly 40% lower than actual without any basis for such representation). Fraud is not as prevalent, proving knowledge it is harder (unless it involves fraudulent misrepresentation of facts where seller and/or seller's agent would have no excuse for incorrect representation). Long story short and to answer your question and hopefully others who may be in the same situation: If you have signed a purchase contract any rebate or release of funds from escrow will have been outlined in the contract already agreed upon; if you have yet to sign a contract, you can now have a better understanding of the framework and complications that can be involved in constructing a binding contract that is favorable in your terms and should be done with help of council. In my case, I elected not to proceed in acquiring said property in my example and backed out on a number of reasons. Legal action or threat thereof was not used as other contingencies were not satisfied. Please pm me if more information should be required or if elaboration/ consolidation should be necessary.*Disclaimer: I am not a lawyer, I do not warrant any comments to be correct or construed as fact and should not be used by any party other than illustrative purposes. Persons seeking advice should seek council/advisory experts in their field and jurisdiction with relevant background is such transactions. Additionally, this may not be re-posted for any publication other than on Quora.

-

How do I fill out a bank deposit slip?

You would have to show up in person at a branch location that belongs to your bank where your bank account is open. Most banks have a lines for the customers to get in line and wait for their turn to talk to the bank teller. Most banks will have a section in the middle of this section where they have a bunch of blank documents and a deposit slip is included there.There is specific information that you need to know in order to fill the bank deposit slip correctly and you don't have to spend time memorizing it or take documents of that information with you. All you have to do is just write it down in a piece of paper and then reap into pieces the paper when you are done. The information that you need to fill out the deposit slip is your account number. What is it that you are depositing a check or cash and what is the exact amount to be deposited. The deposit slip should include your name and your signature.In type of deposit slip, you would have to also check whether you are depositing the funds into your bank checkings account or into your bank savings account and your address. The signature section is a part that can only be signed in the presence of a bank teller. You would also have to write the date on which this deposit takes place.Some deposit slips differ in one or two things from the others but for the most part they all are very similar in many ways. In this deposit slip, you would not have to write the date or your address or whether it goes to a savings or checking accounts but all other information still applies.Note that in the two types of the deposits samples there is a section that says “subtotal” and another that says “less cash”. Those two sections are only applicable when you present a check to be cash but you also want part of that check to deposit into your account. For example, let us say that you present a check with the total funds of 1458 but you want to receive 800 in cash and the remaining balance is two be deposited. In that case, the subtotal would say “1458” and the “less cash” section would say “800” the the “total” section would say “658”. Those types of deposit slips are provided to you free of charge at the bank.The deposit slip shown above is another type of bank deposit slip which is more convenient and you have less possibilities of making entry errors because those types of deposit slips are already personalized and they already have your bank account, name and address printed on them. All you have to do is fill out the amount that you depositing into your bank account and whether it is a check or cash. However, the personalized deposit slips costs money.At the end of the successful deposit transaction, you should received from the bank teller a deposit receipt which summarizes the how much was deposited and your new bank account balance. Some advanced banks will even print a receipt with an image of the check that was deposited.

-

How do I fill out a money/rent receipt book for house cleaning services?

This is what I'm working with right now until I can get a better suited receipt book to use.

-

Could I leave out the earnest money deposit clause in a real estate standard purchase agreement?

Well technically, you could, but as a seller's agent I would advise any client of mine against giving your offer serious consideration. Earnest money has a function. It serves to show the seller just how serious you are about making the purchase. Which means, the more Earnest you offer, the more serious a seller should consider you. In addition, it is one of the negotiable terms in any offer, so if you do go to the trouble of cutting t out, you're only likely to see it re-inserted by the seller in the negotiating process. Do you have an objection to earnest money? It comes back and credits your side at the closing table. Or is your objection that you feel you may wish to rescind your offer at some point? That is tantamount to playing games with a seller...

-

What are the steps to fill out a deposit slip?

There are following steps to fillout a deposit slip:1.fill your branch name in which you have maintained your account.2. your name3.Your bank account no.4.Rupees with denominations and then in words5.your mobile no.6.your signature

-

What is the best way to invest in real estate?

From a distance, investing in real estate does seem very exciting. But it can prove to be a tough endeavor for those who’re starting a new.At the beginning, most investors feel that getting a real estate licence is enough and they can take everything on the go. But that approach is only confusing. It’s sort of like wanting to try out everything in a short span of time with no planning or strategy behind it.With that approach, mistakes are bound to happen. It’s okay, everybody makes mistakes but making one too many can leave you with little or no money, and you don’t want that do you?Are you a new investor? Here are 7 Mistakes Every Real Estate Investor Should Avoid.So if you want to start investing in real estate, where do you begin?The answer is very simple, stick to the basics. There are only two real estate fundamentals involved with starting in real estate. I’m not saying this is your formula for success because you’ll have to try out different strategies.Keeping it simple. Firstly, you have to identify your niche and secondly you have to plan a driving strategy to be successful in your niche.Identifying your nicheMaking a plan of actionThis blog will take you through all of the niches that you can look into when you’re beginning to invest in real estate and the different strategies that you can use.But, first let me paint a scenario for you!As children, all of us loved those every flavor candies, I sure did. When I got a hold of one of those boxes, I wanted to try all those different flavors and get a taste of everything. There were so many choices to pick from.Similarly, there are many choices while investing in real estate. You can choose a niche of your own liking and choose to apply a strategy to it. But unlike candies, you don’t have to try them all out to find out if you like them or not.You have to pick one and stick to it until you gain experience and get better at it. And that is what real estate investing is all about.Remember, choosing one niche helps you narrow down your focus and come up with a better action plan that will help to you make more money.Picking A Niche:When you’re investing in real estate, there are many niches that you can choose from. I have covered some of the basic and common types of property that you are likely to deal with in your line of business. Each of these categories can even be divided further but remember the point that I made earlier, these are just the basics, you can dig down further once you get a strong grip of the basics.Large Apartments:Small Apartments:Multi Family homesSingle Family homesCommercialRaw LandLarge Apartments:You might have seen big apartment complexes in your area as well. Yes, that is what I’m referring to when I say large apartments. This class of property usually is very high end and most people invest in this type through syndicates: a group of investors pooling in their resources. They are costly but they provide a steady inflow of cash after the investment with minimum personal involvement.Small ApartmentsThe difference between a large apartment building and a small apartment building is not very well defined. But usually buildings with 50 or lesser units is considered as small. Investment in such type of property can prove to be tricky because it’s a small investment for big expert investment funds while it’s too expensive for starting newbie. But once the finances are arranged, it can prove to be a worthy investment with great cash inflows.Multi Family Homes:Multi Family homes are usually 2-3 units and are a decent investment to make. Firstly, because you see lesser competition in this category and secondly, you’re able to enjoy the purchasing benefits of a single family home when you’re investing in this type of property. They prove to be a steady source of income and can even be used as a residence.Single Family HomesOne of the most common type of investment property that you’d see many investors dealing in is single family homes.Why is that so?Well, this type of property is usually easy to “buy n sell” and easy to rent out.And it’s relatively easier to arrange the finances for it. However, the cash inflow from this type of investment is not very big. The profits are small and marginal.Commercial:Investments in commercial real estate can vary between sizes and the intentions from the property. Some investors rent out their properties to small businesses for office use while some rent their property out to mega stores and supermarkets. Investment in this type of property is not recommended for those who’re not at a very strong financial position. Why? Because, although the cash flow is consistent when these properties are rented out but they might even remain empty for many months in a stretch.Raw Land:Well, it’s just a piece of land that can be used in many ways to generate profit . It can be worked on and sold for more value, it can be leased or rented out, and it can also be subdivided into smaller plots and then sold.Usually, a common strategy that is applied to raw land by many investors is “buy and hold” which means that they purchase the land and then hold for until it gets them substantial value. This value can increase over time due to a development nearby or a main freeway passing by.I have just outlined some of the very basic niches to start your real estate investment career. In the beginning, all you have to do is pick one niche and start working in the niche. This should be your stronghold; you should form connections, network, and know the in’s and out’s of that niche by heart. Sure, you can expand and test yourself in other niches as well when you’re experienced but when you’re starting in the investment business, sticking to your knitting is the best policy to adopt.Choosing a Driving StrategyNow that you have identified what niche you want to start with, it’s time to work on a driving strategyto get you going. I’ll try my best to keep this as simple as possible and take you through some of the basic strategies that you can adopt. It’s not set in stone to work with a single strategy and instead you can try out various strategies for your investment business.The Buy and Hold Strategy (long term investment)One of the most common forms of strategies involved with investing in real estate is the “Buy and Hold” strategy. The basic idea for this strategy is to buy a property and hold it for a substantial amount of time. During this time, the property can either be rented out or just held vacant until the time it’s value increases signNowly.Pros of the Buy and Hold StrategyDecreasing principle balanceIncreasing equityHowever, with this strategy, success is greatly depends upon an investor’s ability to identify good deals. It’s this basic understanding that makes all the difference. So as a starting investor, you should focus on learning how to identify deals, what bad decision you should avoid, and how to estimate expenses on a deal.If you’re able to do that, then my friend, you’ll surely be on your way to master the “buy and hold” strategy and will hopefully be on the road of making more money with your business.The Flipping Real Estate Strategy (short term investment)The second most popular strategy that is often used when investing in real estate is the house flippingstrategy. The basic idea is to purchase a house or a property at a lower price, making a small investment to make the property better and then selling it for a higher price. These type of investments are short term and are linked with your business objective.Rule of Thumb for flipping Houses: Buy the property for 70% of its original value (including investment)But for this strategy to succeed, speed is very important because it’s a short term investment. For you to be a successful house flipper, you can’t wait around and do it passively. You have to buy, make improvements, and sell the property as quickly as possible.The quick shotgun strategy helps you to avoid any monthly charges that might apply to your property, they may include, financing charges, property taxes or any other financial bills that might be due.Pro Tip: If your niche is to deal in single family houses, then this particular strategy is highly recommended for you.The WholeSaling StrategyUsually regarded as the easiest strategy for investing in real estate because an investor dealing wholesales does not actually have to own anything. A wholesaler’s job is to identify a good deal, get a contract for that deal, and then sell it to another investor or retail buyer.The fee of the contract may vary depending upon the size of the deal. However, being successful at wholesaling is not as easy as it sound. It may look easy but the key to being successful with this type of strategy is to continuously seek out newer and better deals and find new buyers for those contracts.Pro Tip: Staying persistent is the key to being successful in wholesaling.Starting in wholesaling is not a hard thing and someone with little financial resources (gotta have some money) can start to deal in wholesales. However, you have to manage your time and resources at the same time to be successful with it. A good amount of time needs to be spent prospecting for newer options while the same amount of time has to be spent in building a marketing funnel.If all of this information is going over your head and is too much to consume at the moment. There’s nothing to worry about. It’s only the beginning and investing in real estate is a learning curve from the beginning till the end. There are no shortcuts to being successful, so be patient. Take your time, step into the unknown waters, and learn to swim with the tide.I believe I have given you everything that you need in order to figure out what investment will work best for you. You can also plan to invest in rental properties. For which you might want to get yourself familiarized on How To Start Investing In Rental Properties.Hope my answer helped you a great deal :) Happy investing :)

Create this form in 5 minutes!

How to create an eSignature for the real estate deposit receipt formpdffillercom

How to generate an eSignature for the Real Estate Deposit Receipt Formpdffillercom online

How to generate an eSignature for your Real Estate Deposit Receipt Formpdffillercom in Chrome

How to make an eSignature for putting it on the Real Estate Deposit Receipt Formpdffillercom in Gmail

How to make an eSignature for the Real Estate Deposit Receipt Formpdffillercom from your smart phone

How to generate an eSignature for the Real Estate Deposit Receipt Formpdffillercom on iOS

How to create an electronic signature for the Real Estate Deposit Receipt Formpdffillercom on Android devices

People also ask

-

What is a deposit receipt in real estate?

A deposit receipt in real estate is a document acknowledging the receipt of a deposit from a buyer to secure a property. It typically outlines the terms of the deposit, including the amount and due date, ensuring that both parties are on the same page throughout the transaction process.

-

How does airSlate SignNow facilitate the creation of a deposit receipt for real estate transactions?

airSlate SignNow simplifies the creation of a deposit receipt for real estate transactions by providing customizable templates. Users can easily fill in the necessary details, ensuring accuracy and compliance, which ultimately speeds up the document workflow.

-

What are the benefits of using airSlate SignNow for deposit receipts in real estate?

Using airSlate SignNow for deposit receipts in real estate enhances operational efficiency by streamlining the e-signing process. It offers security features, like audit trails, to protect sensitive information, making it a reliable choice for real estate professionals.

-

Can I integrate airSlate SignNow with other real estate software?

Yes, airSlate SignNow offers integrations with popular real estate software platforms, allowing seamless data transfer. This harmonization enables users to manage deposit receipts in real estate while leveraging their existing tools for a more efficient workflow.

-

Is there a pricing plan for using airSlate SignNow for deposit receipts in real estate?

airSlate SignNow provides flexible pricing plans that cater to the needs of businesses in real estate. Each plan includes features suitable for drafting and signing deposit receipts, ensuring that users can find a solution that fits their budget.

-

How does e-signing improve the process of handling deposit receipts in real estate?

E-signing improves the handling of deposit receipts in real estate by allowing faster turnaround times. With airSlate SignNow, buyers and sellers can sign documents electronically from anywhere, reducing delays and improving the overall efficiency of transactions.

-

What features does airSlate SignNow offer for managing deposit receipts in real estate?

airSlate SignNow includes features like customizable templates, e-signature capabilities, and document tracking, all of which are crucial for managing deposit receipts in real estate. These features ensure that users can create, send, and finalize documents efficiently.

Get more for Binder Rental

- Ncbfaa poa fillable form

- Illinois withholding allowance worksheet example form

- Marshall swift calculator form

- Reading comprehension worksheets pdf form

- Table for converting inches to feet form

- Mvr consent form template

- Nj dept of banking and insurance complaint form

- Airport transfer booking form arts ac

Find out other Binder Rental

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document