Illinois Withholding Allowance Worksheet Example Form

What is the Illinois Withholding Allowance Worksheet Example

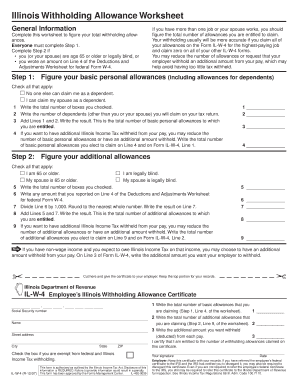

The Illinois Withholding Allowance Worksheet is a crucial document used by employees to determine the amount of state income tax to withhold from their paychecks. This worksheet helps individuals calculate their allowances based on personal circumstances, such as marital status and number of dependents. By accurately completing this form, employees can ensure that the correct amount of tax is withheld, reducing the likelihood of owing additional taxes at the end of the year.

How to use the Illinois Withholding Allowance Worksheet Example

Using the Illinois Withholding Allowance Worksheet involves several steps. First, employees need to gather personal information, including their filing status and the number of dependents. Next, they should follow the instructions provided on the worksheet to calculate their allowances. The worksheet typically includes sections for entering personal details, calculating the number of allowances, and determining any additional withholding amounts. After completing the worksheet, employees should submit it to their employer for processing.

Steps to complete the Illinois Withholding Allowance Worksheet Example

Completing the Illinois Withholding Allowance Worksheet requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Count the number of allowances you are eligible for based on your dependents and other factors.

- Calculate any additional withholding if necessary, particularly if you expect to owe taxes at the end of the year.

- Review the completed worksheet for accuracy before submitting it to your employer.

Legal use of the Illinois Withholding Allowance Worksheet Example

The Illinois Withholding Allowance Worksheet is legally recognized as a valid form for determining state tax withholding. To ensure its legal standing, the form must be completed accurately and submitted promptly. Employers are required to honor the information provided on the worksheet, which means that employees should take care to fill it out truthfully. Compliance with state regulations is essential to avoid potential penalties or issues with tax filings.

Key elements of the Illinois Withholding Allowance Worksheet Example

Several key elements are essential for the Illinois Withholding Allowance Worksheet to function effectively:

- Personal Information: Accurate details about the employee, including name and Social Security number.

- Filing Status: The employee's tax filing status, which affects the number of allowances.

- Allowances Calculation: A clear method for calculating the number of allowances based on dependents and other factors.

- Additional Withholding: An option for employees to specify any extra amounts to be withheld from their paychecks.

Examples of using the Illinois Withholding Allowance Worksheet Example

Examples can illustrate how the Illinois Withholding Allowance Worksheet functions in real-life scenarios. For instance, an employee who is married with two children may calculate their allowances differently than a single employee with no dependents. By reviewing various examples, individuals can better understand how to fill out the worksheet according to their unique situations. These examples can also highlight common mistakes to avoid during the completion process.

Quick guide on how to complete illinois withholding allowance worksheet example

Complete Illinois Withholding Allowance Worksheet Example seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without holdups. Handle Illinois Withholding Allowance Worksheet Example on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-oriented procedure today.

The easiest way to alter and eSign Illinois Withholding Allowance Worksheet Example effortlessly

- Find Illinois Withholding Allowance Worksheet Example and click Get Form to commence.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Illinois Withholding Allowance Worksheet Example and ensure excellent communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois withholding allowance worksheet example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Illinois W4 form?

The Illinois W4 form is a state tax form required for employees in Illinois to withhold the correct amount of state income tax from their paychecks. This form is crucial for ensuring that the correct deductions are made based on your personal circumstances, such as marital status and the number of dependents.

-

How can I complete my Illinois W4 using airSlate SignNow?

With airSlate SignNow, you can easily complete your Illinois W4 form online. Simply upload the document, fill in the required fields, and sign electronically, making the process quick and efficient.

-

Is airSlate SignNow a cost-effective solution for managing my Illinois W4?

Yes, airSlate SignNow offers a cost-effective solution for managing your Illinois W4 forms. With various pricing plans available, you can choose one that fits your budget while enjoying the benefits of online document management and e-signing.

-

What features does airSlate SignNow provide for Illinois W4 forms?

airSlate SignNow offers features like document templates, electronic signatures, and secure cloud storage for your Illinois W4 forms. These tools streamline the process, allowing you to fill out and sign documents seamlessly.

-

How does airSlate SignNow ensure the security of my Illinois W4 documents?

airSlate SignNow prioritizes the security of your Illinois W4 documents by implementing advanced encryption protocols and compliance with industry standards. You can trust that your personal information is protected during the signing and storage process.

-

Can airSlate SignNow integrate with other software for handling Illinois W4 forms?

Absolutely! airSlate SignNow integrates with various software applications to enhance your workflow involving Illinois W4 forms. Whether it's accounting software or HR platforms, integrations are designed to help you manage your documents more effectively.

-

What are the benefits of using airSlate SignNow for my Illinois W4?

Using airSlate SignNow for your Illinois W4 forms offers numerous benefits, including time savings, reduced paperwork, and improved accuracy in tax withholding. The user-friendly interface also makes the process straightforward and hassle-free.

Get more for Illinois Withholding Allowance Worksheet Example

Find out other Illinois Withholding Allowance Worksheet Example

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF