Bank Credit Reference Form

What is the Bank Credit Reference Form

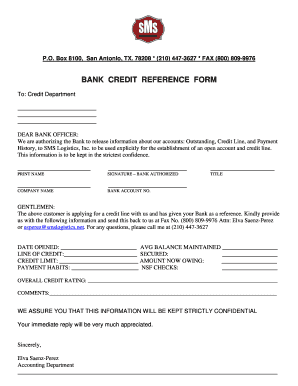

The bank credit reference form is a document used to request a credit reference from a financial institution. This form typically includes information about the individual or business seeking credit, such as their account history, payment behavior, and overall creditworthiness. It serves as a vital tool for lenders and landlords to assess the reliability of a borrower or tenant. By providing a formal request for this information, the bank credit reference form facilitates informed decision-making in financial transactions.

How to use the Bank Credit Reference Form

To effectively use the bank credit reference form, begin by obtaining the appropriate template from your financial institution or a trusted source. Fill out the required fields, which generally include your personal or business details, the purpose of the request, and any specific information the lender may need. Once completed, submit the form to your bank via the designated method, which may include online submission, mail, or in-person delivery. Ensure that you follow up with the bank to confirm receipt and processing of your request.

Steps to complete the Bank Credit Reference Form

Completing the bank credit reference form involves several straightforward steps:

- Gather necessary information, including your account details and identification.

- Access the bank credit reference template, either online or in print.

- Fill in your name, address, and contact information accurately.

- Specify the purpose of the credit reference request, such as applying for a loan or renting a property.

- Review the form for completeness and accuracy.

- Submit the form according to your bank's guidelines.

Legal use of the Bank Credit Reference Form

The bank credit reference form is legally recognized when it is filled out correctly and submitted in accordance with relevant regulations. It is important to ensure that the form complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which govern the use of electronic signatures and documents. By adhering to these legal frameworks, the completed form can be considered valid and binding in financial agreements.

Key elements of the Bank Credit Reference Form

Key elements of the bank credit reference form include:

- Applicant Information: Name, address, and contact details of the individual or business requesting the reference.

- Bank Information: Name and address of the bank providing the reference.

- Account Details: Type of account, account number, and duration of the banking relationship.

- Purpose of Request: Reason for seeking the credit reference, such as loan application or rental agreement.

- Signature: Signature of the applicant to authorize the bank to release the information.

Examples of using the Bank Credit Reference Form

Examples of situations where the bank credit reference form may be used include:

- Applying for a mortgage or personal loan, where lenders require proof of creditworthiness.

- Renting an apartment, where landlords may request a credit reference to assess potential tenants.

- Establishing business credit, where suppliers and vendors may ask for a credit reference to evaluate a company's financial stability.

Quick guide on how to complete bank credit reference form

Complete Bank Credit Reference Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle Bank Credit Reference Form on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-centered process today.

The easiest way to edit and eSign Bank Credit Reference Form with ease

- Obtain Bank Credit Reference Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you would prefer to send your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Bank Credit Reference Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank credit reference form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit reference template?

A credit reference template is a structured form that lenders use to gather financial information about individuals or businesses. It helps in assessing creditworthiness and provides a standardized way to request crucial data. Using our airSlate SignNow credit reference template, you can easily create and send documents with essential fields tailored for credit analysis.

-

How does the credit reference template benefit my business?

Our credit reference template streamlines the process of collecting financial references, which can save you time and effort. By utilizing this template, you ensure that all necessary information is captured in a clear and concise manner. This efficiency can enhance your customer onboarding experience and improve your credit assessment accuracy.

-

Is the credit reference template customizable?

Yes, the credit reference template is fully customizable. You can modify fields according to your specific needs or industry standards. This allows you to ask the right questions and gather the relevant information necessary for your credit evaluation processes.

-

What are the pricing options for using the credit reference template on airSlate SignNow?

AirSlate SignNow offers various pricing plans designed to suit different business sizes and needs. You can start with a free trial to see how the credit reference template integrates into your workflow. Our affordable subscription plans ensure that you get the most value while effectively managing your document workflow.

-

Can I integrate the credit reference template with other software?

Certainly! The credit reference template can be easily integrated with various CRM and accounting software. This ensures that the data collected can flow seamlessly into your existing systems, improving overall efficiency and data accuracy across your business operations.

-

How secure is the information captured using the credit reference template?

Security is a top priority at airSlate SignNow. The credit reference template incorporates advanced encryption methods for both data at rest and in transit. This means that the sensitive financial information collected through the template is safeguarded against unauthorized access.

-

What features are included in the credit reference template?

The credit reference template includes essential features such as customizable fields, eSignature capabilities, and tracking options. These features allow you to manage your documents efficiently while ensuring that you collect all necessary data for credit evaluations. You can also set reminders and automate follow-ups to streamline the process further.

Get more for Bank Credit Reference Form

Find out other Bank Credit Reference Form

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed