Form 2106

What is the Form 2106

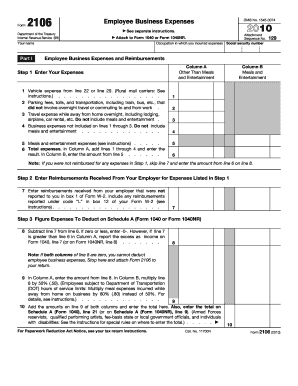

The Form 2106, also known as the Employee Business Expenses form, is a tax document used by employees to report unreimbursed business expenses. This form is essential for individuals who incur expenses while performing their job duties, which are not reimbursed by their employer. Common expenses reported on this form include travel, meals, and supplies necessary for work. The information provided on Form 2106 is used to calculate deductions that can lower taxable income, ultimately impacting the amount of tax owed or refund received.

How to use the Form 2106

Using Form 2106 involves documenting and categorizing business expenses accurately. Employees should gather all relevant receipts and records before filling out the form. The form requires detailed information about the nature of the expenses, the dates incurred, and the total amounts. After completing the form, it should be attached to the employee's tax return, allowing for the deduction of eligible expenses. It is important to ensure that all entries are accurate and supported by documentation to avoid issues with the IRS.

Steps to complete the Form 2106

Completing Form 2106 involves several key steps:

- Gather all necessary documentation, including receipts for business-related expenses.

- Fill out the personal information section, including your name, Social Security number, and employer details.

- Document your business expenses in the appropriate sections, categorizing them as travel, meals, or other expenses.

- Calculate the total amount of unreimbursed expenses and enter it on the form.

- Review the completed form for accuracy and ensure all required information is included.

- Attach the completed Form 2106 to your tax return when filing.

Legal use of the Form 2106

The legal use of Form 2106 is governed by IRS regulations that outline which expenses are deductible. To be legally valid, the expenses must be ordinary and necessary for the job. This means they should be common in the industry and helpful for the employee's work. Additionally, it is essential to maintain accurate records and receipts to substantiate the claims made on the form. Non-compliance with IRS guidelines can lead to penalties or disallowance of the claimed deductions.

IRS Guidelines

The IRS provides specific guidelines for using Form 2106, including what qualifies as deductible expenses and how to report them. Employees should refer to the IRS instructions for Form 2106 to ensure compliance with current tax laws. Key points include understanding the difference between reimbursed and unreimbursed expenses, as well as the importance of itemizing deductions correctly. Staying informed about any changes to tax laws or IRS guidelines is crucial for accurate reporting.

Filing Deadlines / Important Dates

Form 2106 must be filed along with your annual tax return, typically due on April fifteenth. If you require an extension, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is advisable to keep track of any changes to tax deadlines, especially if you are filing for the previous tax year or if there are updates due to special circumstances, such as natural disasters or legislative changes.

Required Documents

When completing Form 2106, it is essential to have several documents on hand to ensure accuracy and compliance. Required documents include:

- Receipts for all unreimbursed business expenses.

- Records of travel itineraries, mileage logs, and other relevant travel documentation.

- Any correspondence from your employer regarding business expenses.

- Previous tax returns, if applicable, for reference.

Quick guide on how to complete form 2106

Complete Form 2106 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Form 2106 on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to update and electronically sign Form 2106 with ease

- Locate Form 2106 and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 2106 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2106

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2106 and how can it benefit my business?

Form 2106 is used to report business-related expenses for employees and self-employed individuals. By utilizing airSlate SignNow, you can streamline the submission and eSigning process of Form 2106, making it simpler and more efficient for your business. This not only saves time but also helps in maintaining accurate records.

-

How does airSlate SignNow support the completion of Form 2106?

AirSlate SignNow allows users to easily fill out and eSign Form 2106 online. The platform features intuitive templates and a user-friendly interface, ensuring you can complete Form 2106 without hassle. This functionality lowers the burden of paperwork and expedites the reimbursement process.

-

What are the pricing options for using airSlate SignNow for Form 2106?

AirSlate SignNow offers various pricing plans tailored to different business needs, starting with a free trial for users to explore its features, including eSigning Form 2106. These plans are cost-effective, making it accessible for businesses of all sizes. Choose the plan that best suits your requirements and budget.

-

Can I integrate airSlate SignNow with other applications when processing Form 2106?

Yes, airSlate SignNow supports multiple integrations with popular applications, allowing you to enhance your workflow when managing Form 2106. By connecting with tools you already use, such as cloud storage or CRMs, you can streamline your document management process and improve efficiency.

-

Is airSlate SignNow compliant with legal standards when using Form 2106?

Absolutely, airSlate SignNow adheres to legal standards and regulations for electronic signatures, ensuring that Form 2106 submissions are legally binding. Your documents are secure and compliant, giving you peace of mind while handling sensitive information. This compliance is crucial for maintaining trust with your clients and employees.

-

How secure is airSlate SignNow when handling Form 2106?

AirSlate SignNow prioritizes security, implementing advanced encryption and security measures to protect your documents, including Form 2106. Your data remains confidential and safe from unauthorized access, which is vital in ensuring the integrity of sensitive business information.

-

What features does airSlate SignNow offer for managing Form 2106?

AirSlate SignNow offers key features such as template creation, bulk sending, and mobile access to help you manage Form 2106 efficiently. With these features, you can customize your forms, send them to multiple recipients, and sign on-the-go, enhancing productivity and convenience.

Get more for Form 2106

Find out other Form 2106

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online