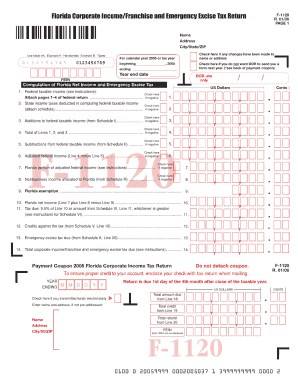

F 1120 Form

What is the F-1120S?

The F-1120S is a tax form specifically designed for S corporations in the United States. This form is used to report income, deductions, gains, losses, and other important tax information. Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their individual tax returns. This structure allows for potential tax benefits, making the F-1120S an essential document for S corporations aiming to comply with federal tax regulations.

Steps to Complete the F-1120S

Completing the F-1120S involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the income and deduction sections, as these will directly impact the tax liability. After filling out the form, review it for any errors before submitting it to the IRS. It is also advisable to keep copies of the completed form and any supporting documents for your records.

Legal Use of the F-1120S

The F-1120S must be used in accordance with IRS regulations to ensure its legal validity. E-signatures can be utilized for electronic submissions, provided they meet the requirements set forth by the ESIGN Act and UETA. It is crucial to ensure that all signatures are authentic and that the form is filled out completely. Non-compliance with these regulations can lead to penalties or delays in processing. Using a reliable e-signature platform can facilitate compliance and enhance the security of the submission process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the F-1120S is essential for S corporations. Typically, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request an extension, but it is important to note that this does not extend the time to pay any taxes owed.

Form Submission Methods

The F-1120S can be submitted through various methods, including online, by mail, or in person. Electronic filing is encouraged as it is faster and more efficient. Many tax software programs support the electronic submission of the F-1120S, which can simplify the process. For those who prefer to file by mail, ensure that the form is sent to the correct IRS address based on the corporation's location. In-person submissions are less common but may be an option for specific circumstances.

Required Documents

To complete the F-1120S, several documents are typically required. These include financial statements, records of income, and documentation of expenses. Additionally, any supporting schedules that detail specific deductions or credits should be included. It is important to have accurate and complete records to support the information reported on the form, as this can facilitate smoother processing and reduce the likelihood of audits.

Key Elements of the F-1120S

The F-1120S includes several key elements that must be accurately reported. These elements typically consist of the corporation's income, deductions, and credits. Specific sections may require information about the shareholders, including their share of income and any distributions received. Understanding these components is crucial for ensuring that the form is completed correctly and that all relevant tax obligations are met.

Quick guide on how to complete f 1120 148492

Complete F 1120 effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage F 1120 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign F 1120 effortlessly

- Locate F 1120 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign F 1120 and ensure effective communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f 1120 148492

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f1120s form and how does it relate to airSlate SignNow?

The f1120s form is a tax return form used by S Corporations in the United States. airSlate SignNow simplifies the process of eSigning and sending this form, allowing businesses to handle their documentation efficiently. By using airSlate SignNow, you can ensure that your f1120s form is securely signed and submitted on time.

-

How does airSlate SignNow improve the efficiency of handling f1120s forms?

airSlate SignNow streamlines the process of managing f1120s forms by providing a platform for electronic signatures, document sharing, and collaboration. This efficiency reduces turnaround time signNowly, enabling quicker submission and compliance with tax regulations. With airSlate SignNow, you can focus more on your business and less on paperwork.

-

What are the pricing plans for using airSlate SignNow for f1120s document management?

airSlate SignNow offers several pricing plans to accommodate different business needs, starting from a basic plan suitable for freelancers to comprehensive solutions for large enterprises. Each plan provides access to essential features required for managing f1120s documents. Check our pricing page to find the plan that best suits your requirements.

-

What features does airSlate SignNow offer for f1120s documentation?

airSlate SignNow includes a range of powerful features specifically designed for handling f1120s forms, including custom workflows, bulk sending of documents, and real-time tracking of document statuses. These features ensure that you can manage your f1120s forms efficiently. Additionally, you can leverage templates to standardize your documents.

-

Can airSlate SignNow integrate with other tools I use for managing f1120s?

Yes, airSlate SignNow supports integrations with various software tools commonly used in business operations, such as CRMs, cloud storage, and accounting software. This compatibility makes it easier to manage f1120s forms alongside your existing workflow. You can find our integration options highlighted on our website for more details.

-

How does airSlate SignNow ensure the security of my f1120s forms?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols and compliance with industry standards to protect your f1120s forms. You can be assured that your sensitive tax documents are safe and secure during the signing process.

-

What benefits can I expect from using airSlate SignNow for my f1120s forms?

Using airSlate SignNow for your f1120s forms offers numerous benefits, such as increased efficiency, reduced paper usage, and improved organization. The digital signature feature eliminates the need for physical signatures, making the process faster and more convenient. Moreover, it helps ensure compliance and minimizes the risk of errors in your documentation.

Get more for F 1120

- Cannabis template card 2x3 5in final form

- Gadolworksearch form

- Pdfsam split and merge pdf files and open source form

- Form 1040x rev november amended u s individual income tax return

- Speedishuttle application form

- Garage sale permit pasadena tx form

- Std awareness month dear colleague 3 28 cdc form

- Screening tests to detect chlamydia trachomatis and neisseria cdc form

Find out other F 1120

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online