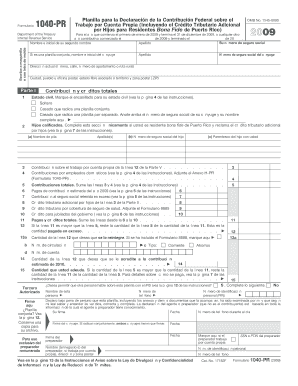

1040 Pr Form

What is the 1040 PR Form

The 1040 PR form is a tax document used by residents of Puerto Rico to report their income and calculate their tax obligations. Unlike the standard federal 1040 form, the 1040 PR is specifically designed to accommodate the unique tax laws applicable to Puerto Rico. This form allows taxpayers to claim various deductions and credits that are available only to residents of the island, making it essential for accurate tax reporting.

How to use the 1040 PR Form

Using the 1040 PR form involves several steps to ensure accurate completion. Taxpayers must gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Once the necessary information is collected, individuals can fill out the form by providing personal details, income information, and applicable deductions. After completing the form, it should be reviewed for accuracy before submission.

Steps to complete the 1040 PR Form

Completing the 1040 PR form requires careful attention to detail. Follow these steps:

- Gather all income statements, including W-2s and 1099s.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest.

- Claim deductions and credits applicable to your situation.

- Review the completed form for accuracy.

- Sign and date the form before submission.

Legal use of the 1040 PR Form

The 1040 PR form is legally binding when filled out correctly and submitted to the appropriate tax authorities. To ensure compliance with tax laws, it is crucial to provide accurate information and adhere to all filing requirements. Submitting a completed 1040 PR form signifies that the taxpayer has fulfilled their legal obligation to report income and pay taxes as required by law.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 1040 PR form. Typically, the deadline for submitting the form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The 1040 PR form can be submitted through various methods. Taxpayers have the option to file online using approved e-filing software, which often provides a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete 1040 pr form

Complete 1040 Pr Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 1040 Pr Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign 1040 Pr Form without hassle

- Obtain 1040 Pr Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1040 Pr Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 pr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 PR form and who needs it?

The 1040 PR form is a tax return document specifically designed for Puerto Rican residents to report their income to the Internal Revenue Service. Anyone earning income in Puerto Rico must fill out this form, including individuals and businesses. By using airSlate SignNow, you can easily eSign and send your 1040 PR form securely.

-

How can airSlate SignNow help me with my 1040 PR form?

airSlate SignNow provides a simple platform for eSigning and managing your 1040 PR form electronically. With its user-friendly interface, you can upload your document, collect signatures, and store your tax forms safely. This streamlines the entire process, ensuring your 1040 PR form is ready for submission.

-

What are the pricing options for using airSlate SignNow for the 1040 PR form?

airSlate SignNow offers various pricing plans that cater to both individuals and businesses. You can choose a plan based on your needs, which includes features suitable for managing documents like the 1040 PR form. Compare the plans on our website to find the best fit for your budget and requirements.

-

Is airSlate SignNow secure for sending my 1040 PR form?

Yes, airSlate SignNow uses state-of-the-art security measures to protect your documents, including the 1040 PR form. Your data is encrypted and stored securely, ensuring confidentiality and compliance with data protection regulations. You can send and eSign your forms with peace of mind.

-

Can I integrate airSlate SignNow with other applications for easier access to my 1040 PR form?

Absolutely! airSlate SignNow offers integration options with popular applications like Google Drive, Salesforce, and more. These integrations allow you to access, organize, and send your 1040 PR form along with your other documents seamlessly. This enhances your workflow efficiency.

-

What features does airSlate SignNow offer for managing my 1040 PR form?

airSlate SignNow includes features like template creation, easy document sharing, and tracking capabilities specifically beneficial for handling the 1040 PR form. You can create reusable templates for your tax documents, ensuring consistency. Additionally, you can easily track the status of your form.

-

How do I get started with eSigning my 1040 PR form using airSlate SignNow?

Getting started with airSlate SignNow is simple! Sign up for an account, upload your 1040 PR form, and use the intuitive tools to add signatures and other required fields. Follow the prompts to complete the eSigning process efficiently.

Get more for 1040 Pr Form

Find out other 1040 Pr Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors