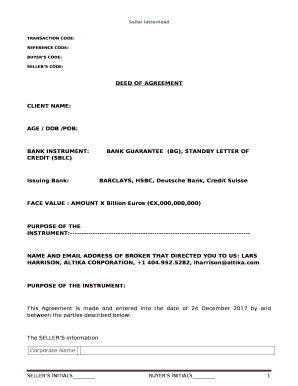

Deutsche Bank Sblc Form

What is the Deutsche Bank SBLC

The Deutsche Bank Standby Letter of Credit (SBLC) is a financial instrument issued by Deutsche Bank that serves as a guarantee for payment. It assures the beneficiary that should the applicant fail to fulfill their contractual obligations, Deutsche Bank will cover the payment up to the specified amount. This instrument is often used in international trade and financing transactions, providing security to sellers and ensuring that they receive payment even if the buyer defaults.

How to Obtain the Deutsche Bank SBLC

To obtain a Deutsche Bank SBLC, an applicant must initiate the process by contacting Deutsche Bank directly. The applicant typically needs to provide detailed information about the transaction, including the purpose of the SBLC, the amount required, and the terms of the agreement. Additionally, the bank will require financial documentation to assess the applicant's creditworthiness. Once the application is reviewed and approved, the bank will issue the SBLC, which can then be presented to the beneficiary.

Steps to Complete the Deutsche Bank SBLC

Completing a Deutsche Bank SBLC involves several key steps:

- Gather Required Information: Collect all necessary details about the transaction, including the beneficiary's information and the specific terms of the SBLC.

- Complete the Application Form: Fill out the Deutsche Bank SBLC application form accurately, ensuring all required fields are completed.

- Submit Supporting Documents: Provide any additional documentation requested by the bank, such as financial statements or contracts.

- Review Terms and Conditions: Carefully review the terms of the SBLC to ensure they align with your needs and expectations.

- Receive the SBLC: Once approved, the bank will issue the SBLC, which can be delivered electronically or in paper form.

Legal Use of the Deutsche Bank SBLC

The Deutsche Bank SBLC is legally binding and must comply with relevant regulations and standards. It is crucial for both parties involved—the applicant and the beneficiary—to understand the legal implications of the SBLC. The document must clearly outline the obligations and rights of each party, ensuring that it adheres to the Uniform Commercial Code (UCC) guidelines and any applicable international laws. Proper legal use helps prevent disputes and ensures enforceability in case of default.

Key Elements of the Deutsche Bank SBLC

Several key elements define the Deutsche Bank SBLC, including:

- Beneficiary: The party entitled to receive payment under the SBLC.

- Applicant: The individual or entity requesting the SBLC from Deutsche Bank.

- Amount: The maximum sum guaranteed by the SBLC.

- Expiration Date: The date by which the SBLC must be executed.

- Conditions for Payment: Specific terms that must be met for the beneficiary to claim payment.

Examples of Using the Deutsche Bank SBLC

The Deutsche Bank SBLC can be utilized in various scenarios, such as:

- International Trade: Importers may use an SBLC to guarantee payment to foreign suppliers.

- Construction Projects: Contractors may require an SBLC to ensure that funds are available for project completion.

- Loan Agreements: Borrowers can use an SBLC as collateral for securing loans from financial institutions.

Quick guide on how to complete deutsche bank sblc

Complete Deutsche Bank Sblc effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly and without complications. Handle Deutsche Bank Sblc on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Deutsche Bank Sblc with ease

- Obtain Deutsche Bank Sblc and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Deutsche Bank Sblc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deutsche bank sblc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of using a Deutsche Bank letterhead with airSlate SignNow?

Using a Deutsche Bank letterhead with airSlate SignNow enhances your business's credibility and professionalism. It signifies that your documents are authentic and can be trusted by recipients. This can help streamline the signing process, making it more efficient and reliable.

-

How does airSlate SignNow support the use of Deutsche Bank letterhead in documents?

airSlate SignNow allows you to easily upload and use a Deutsche Bank letterhead on your documents. You can customize your templates to include the letterhead, ensuring that every eSigned document maintains your brand's identity. This feature enhances your overall presentation and compliance.

-

Is there a cost associated with adding a Deutsche Bank letterhead in airSlate SignNow?

Adding a Deutsche Bank letterhead to your documents in airSlate SignNow is included in your subscription plan. The pricing is competitive and offers great value for the features provided. This ensures you can utilize your letterhead without incurring additional costs.

-

What are the main features of airSlate SignNow that complement a Deutsche Bank letterhead?

airSlate SignNow offers robust features such as customizable templates and secure eSignature solutions that pair well with a Deutsche Bank letterhead. You can automate workflows and track document statuses, which enhances the efficiency of using your letterhead for important communications.

-

Can I integrate my Deutsche Bank letterhead with other applications through airSlate SignNow?

Yes, airSlate SignNow allows integration with various applications, which can further enhance the use of your Deutsche Bank letterhead. You can connect it to CRM and document management systems seamlessly. This enables you to use your letterhead across multiple platforms, ensuring consistency.

-

How does airSlate SignNow ensure the security of documents using a Deutsche Bank letterhead?

Security is a top priority at airSlate SignNow. Documents that utilize a Deutsche Bank letterhead are encrypted and stored securely, protecting sensitive information. Additionally, features like identity verification and audit trails ensure that all signed documents meet compliance standards.

-

What benefits does using a Deutsche Bank letterhead provide for my business?

A Deutsche Bank letterhead is a symbol of professionalism, which can improve client trust and satisfaction. Using it within airSlate SignNow enhances your brand's image while ensuring that all documentation is handled seamlessly. This can lead to improved workflows and fewer delays in business processes.

Get more for Deutsche Bank Sblc

- Dd form 1222

- Cdc 10211w fire officer i form

- Nlpdp application form

- Authorization for clinical communication university of michigan form

- 1 bevill state community college health science di form

- Rio salado college maximum timeframe appeal form riosalado

- Petition for exemption of the health fee form pdf city college of ccsf

- Puente intake form moreno valley college

Find out other Deutsche Bank Sblc

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF