886 H Eic Form

What is the 886 H EIC

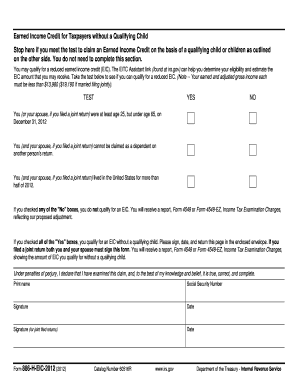

The 886 H EIC, or Form 886 H Earned Income Credit, is a tax form used by individuals in the United States to claim the Earned Income Tax Credit (EITC). This form is specifically designed for taxpayers who have qualifying children and meet certain income thresholds. The EITC is a vital tax benefit that helps low- to moderate-income working individuals and families by reducing their tax liability and potentially providing a refund. Understanding the purpose and requirements of Form 886 H EIC is essential for eligible taxpayers to ensure they receive the financial assistance they qualify for.

How to obtain the 886 H EIC

Obtaining Form 886 H EIC is a straightforward process. Taxpayers can access this form through the Internal Revenue Service (IRS) website, where it is available for download in PDF format. Additionally, the form can be obtained at local IRS offices or through tax preparation services. It is crucial to ensure that the version being used is the most current, as the IRS updates forms regularly to reflect changes in tax law. For the 2024 tax year, the latest version of Form 886 H EIC should be used to ensure compliance with current regulations.

Steps to complete the 886 H EIC

Completing Form 886 H EIC involves several key steps:

- Gather necessary documentation: Collect all relevant documents, including proof of income, Social Security numbers for all qualifying children, and any other supporting materials.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Provide information about qualifying children: List each child’s name, Social Security number, and relationship to you, ensuring that they meet the eligibility criteria.

- Calculate your earned income: Use the provided sections to accurately report your earned income and any adjustments that may apply.

- Review and verify: Double-check all entries for accuracy to avoid delays or issues with your tax return.

Legal use of the 886 H EIC

Form 886 H EIC is legally binding when completed accurately and submitted in accordance with IRS guidelines. Taxpayers must ensure they meet the eligibility criteria for the Earned Income Tax Credit, including income limits and qualifying child requirements. Falsely claiming the EITC can result in penalties, including fines and disqualification from claiming the credit in future tax years. Therefore, it is essential to provide truthful and complete information when filling out this form.

Eligibility Criteria

To qualify for the Earned Income Tax Credit using Form 886 H EIC, taxpayers must meet specific eligibility criteria:

- Income limits: The taxpayer's earned income must fall below the set thresholds, which vary based on filing status and the number of qualifying children.

- Qualifying children: The taxpayer must have one or more qualifying children who meet age and residency requirements.

- Filing status: Eligible taxpayers may file as single, head of household, or married filing jointly, but not as married filing separately.

- Citizenship: The taxpayer must be a U.S. citizen or a resident alien for the entire tax year.

Filing Deadlines / Important Dates

Filing deadlines for Form 886 H EIC align with the standard tax return deadlines. For the 2024 tax year, the deadline to file your federal tax return, including Form 886 H EIC, is typically April 15 of the following year. Taxpayers should be aware of any extensions that may apply and ensure that all forms are submitted on time to avoid penalties. It is advisable to check the IRS website for any updates regarding deadlines or changes to tax laws that may affect filing dates.

Quick guide on how to complete 886 h eic

Complete 886 H Eic effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 886 H Eic on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign 886 H Eic with ease

- Locate 886 H Eic and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Let go of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 886 H Eic and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 886 h eic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 886 h eic and why is it important?

The form 886 h eic is a crucial document used to claim the Earned Income Tax Credit (EITC). This form provides the IRS with information about your eligibility for the credit, which can signNowly reduce your tax liability. By using airSlate SignNow, you can easily manage and eSign your form 886 h eic to ensure timely submission and compliance.

-

How can airSlate SignNow help in filling out the form 886 h eic?

airSlate SignNow simplifies the process of filling out the form 886 h eic with its user-friendly interface. You can easily input your information, and the platform allows you to save and edit the document as needed. This ensures accuracy and efficiency when preparing your tax documents.

-

What features does airSlate SignNow offer for the form 886 h eic?

airSlate SignNow provides features such as customizable templates and secure document storage, which are essential when handling your form 886 h eic. The platform also includes options for team collaboration, making it easy for multiple users to review the document before submission. These features enhance productivity and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for using the form 886 h eic?

Yes, airSlate SignNow offers a cost-effective solution for managing your form 886 h eic. The pricing plans are designed to fit various budgets while providing comprehensive features that cater to both individuals and businesses. By choosing airSlate SignNow, you can save time and money in the document signing process.

-

Can I integrate airSlate SignNow with other applications while working on the form 886 h eic?

Absolutely! airSlate SignNow supports seamless integration with various applications that you may use for financial and tax management. This integration allows you to import data directly into the form 886 h eic, streamlining your workflow and making the process more efficient.

-

What are the benefits of electronically signing the form 886 h eic?

Electronic signing of the form 886 h eic provides numerous benefits, including increased security and faster processing times. By utilizing airSlate SignNow, you can ensure that your document is signed securely, reducing the risk of fraud and errors. Additionally, eSigning allows for quick submission, getting your tax credits processed faster.

-

How does airSlate SignNow ensure the security of my form 886 h eic?

airSlate SignNow prioritizes security with features such as encryption, secure data storage, and compliance with industry standards. When you sign and submit your form 886 h eic through our platform, you can trust that your sensitive information is protected against unauthorized access. Our commitment to security gives you peace of mind throughout the signing process.

Get more for 886 H Eic

- Dss form 2930 55174656

- Form l chg arizona department of insurance azinsurance

- Home insurance form aar insurance

- Form 941 employers quarterly federal tax return clover

- Neck disability index 100393420 form

- Report an illness or health incidentkdhe ks form

- Digital marketing service agreement template form

- Digital marketing service level agreement template form

Find out other 886 H Eic

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now