Wood Badge Ticket Worksheet Form

What is the Wood Badge Ticket Worksheet

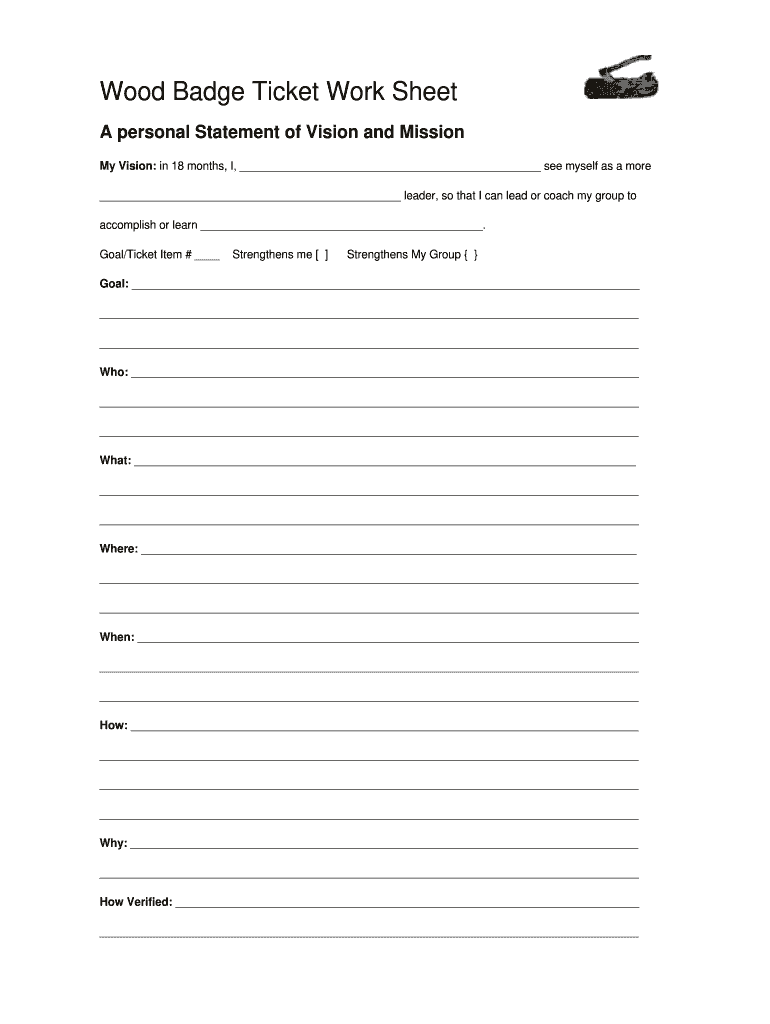

The Wood Badge Ticket Worksheet is a crucial document used in the Wood Badge training program, which is designed for adult leaders in the Boy Scouts of America. This form serves as a roadmap for participants to outline their personal leadership goals and the steps they will take to achieve them. It is a structured approach to ensure that leaders can apply the skills learned during training to real-world scenarios, enhancing their effectiveness in guiding youth and fellow leaders.

How to Use the Wood Badge Ticket Worksheet

To effectively use the Wood Badge Ticket Worksheet, participants should begin by identifying specific goals they wish to achieve. Each goal should be measurable and relevant to their role as a leader. The worksheet includes sections for outlining these goals, the action steps required to accomplish them, and a timeline for completion. Regularly reviewing and updating the worksheet helps maintain focus and accountability throughout the process.

Steps to Complete the Wood Badge Ticket Worksheet

Completing the Wood Badge Ticket Worksheet involves several key steps:

- Identify Goals: Reflect on your leadership aspirations and determine what you want to achieve.

- Outline Action Steps: For each goal, list the specific actions you will take to reach it.

- Set Timelines: Establish realistic deadlines for each action step to ensure progress.

- Review and Revise: Periodically assess your progress and make adjustments as necessary.

Legal Use of the Wood Badge Ticket Worksheet

The Wood Badge Ticket Worksheet is not a legally binding document; however, it is essential for ensuring that participants adhere to the principles of the Wood Badge program. By completing the worksheet, leaders commit to their goals and the ethical standards of the Boy Scouts of America. This commitment fosters accountability and encourages leaders to implement positive changes within their units.

Key Elements of the Wood Badge Ticket Worksheet

The Wood Badge Ticket Worksheet consists of several key elements that guide the participant's leadership journey:

- Goals: Clearly defined objectives that participants aim to achieve.

- Action Steps: Specific tasks that will lead to the accomplishment of each goal.

- Timelines: Deadlines for each action step to ensure timely progress.

- Accountability: A section for noting who will help support the participant in achieving their goals.

Examples of Using the Wood Badge Ticket Worksheet

Participants can use the Wood Badge Ticket Worksheet in various ways to enhance their leadership skills. For instance, a leader may set a goal to improve communication within their troop. The action steps could include organizing regular meetings, implementing feedback sessions, and training other leaders in effective communication strategies. By documenting these steps, the leader can track their progress and make necessary adjustments to achieve their objectives.

Quick guide on how to complete wood badge ticket item work sheet form

Uncover how to effortlessly navigate the Wood Badge Ticket Worksheet implementation with this simple guide

Digital submission and completion of forms is becoming more common and the preferred choice for many users. It provides several benefits over outdated printed documents, including convenience, time saving, enhanced precision, and security.

With tools like airSlate SignNow, you can locate, modify, authorize, enhance, and dispatch your Wood Badge Ticket Worksheet without being overwhelmed by repetitive printing and scanning. Follow this concise tutorial to begin and execute your paperwork.

Apply these instructions to acquire and complete Wood Badge Ticket Worksheet

- Begin by clicking the Get Form button to access your form in our editor.

- Follow the green indicator on the left that highlights necessary fields to ensure you don’t miss them.

- Utilize our advanced features to annotate, adjust, sign, secure, and enhance your document.

- Safeguard your file or transform it into an interactive form using the appropriate tab options.

- Review the form and inspect it for errors or inconsistencies.

- Select DONE to complete your editing.

- Rename your file or keep it as is.

- Select the storage option you prefer to retain your form, send it via USPS, or click the Download Now button to save your document.

If Wood Badge Ticket Worksheet isn’t what you needed, feel free to explore our vast collection of pre-existing templates that you can complete with minimal hassle. Test our platform today!

Create this form in 5 minutes or less

FAQs

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the wood badge ticket item work sheet form

How to make an eSignature for the Wood Badge Ticket Item Work Sheet Form in the online mode

How to create an electronic signature for the Wood Badge Ticket Item Work Sheet Form in Chrome

How to make an electronic signature for signing the Wood Badge Ticket Item Work Sheet Form in Gmail

How to make an electronic signature for the Wood Badge Ticket Item Work Sheet Form from your smartphone

How to create an eSignature for the Wood Badge Ticket Item Work Sheet Form on iOS devices

How to generate an eSignature for the Wood Badge Ticket Item Work Sheet Form on Android OS

People also ask

-

What is a ticket sheet form printable?

A ticket sheet form printable is a customizable template that businesses can use to create tickets for events, services, or products. With airSlate SignNow, you can easily personalize your ticket sheet form printable to meet your specific needs, ensuring a professional appearance.

-

How can I create a ticket sheet form printable using airSlate SignNow?

Creating a ticket sheet form printable with airSlate SignNow is straightforward. Simply choose from our extensive library of templates or start from scratch, then customize it to include your branding, ticket details, and other important information.

-

Is airSlate SignNow's ticket sheet form printable feature cost-effective?

Yes, airSlate SignNow offers a cost-effective solution for creating ticket sheet form printables. Our pricing plans are designed to be flexible and affordable, allowing businesses of all sizes to access high-quality document creation without breaking the bank.

-

What features does airSlate SignNow offer for ticket sheet form printable?

With airSlate SignNow, your ticket sheet form printable comes with features like eSignature capabilities, customizable templates, and secure cloud storage. Additionally, users can track the status of their tickets and receive notifications once they are signed.

-

Can I integrate the ticket sheet form printable with other tools?

Absolutely! airSlate SignNow supports seamless integrations with various applications and platforms, allowing you to easily connect your ticket sheet form printable to your favorite business tools, such as CRM systems and project management software.

-

What are the benefits of using a ticket sheet form printable in my business?

Using a ticket sheet form printable can streamline your ticketing process, enhance customer experience, and improve organization. By adopting airSlate SignNow, you also ensure that all your documentation is legally binding and securely stored.

-

Is it possible to share my ticket sheet form printable with others?

Yes, you can easily share your ticket sheet form printable with others via email or by generating a shareable link. This feature allows your team or clients to access and eSign the documents conveniently, increasing efficiency in your operations.

Get more for Wood Badge Ticket Worksheet

- Aro form 99

- Patient responsibility letter template form

- Virginia 529 intent to enroll form

- Mdcf form

- Boarding contract for horses form

- Ad 616 form

- Avidyne servicebulletin no 601 00006 096 form

- Unofficial consolidation form 45 106f12 risk acknowledgement form for family friend and business associate investors

Find out other Wood Badge Ticket Worksheet

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself