Kansas K 4 Rev 1013 Form

What is the Kansas K-4 Rev 1013 Form

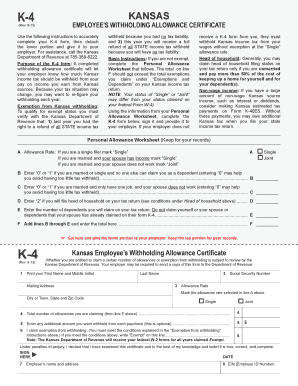

The Kansas K-4 Rev 1013 Form is a state tax form used by employees in Kansas to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted based on the individual's filing status, exemptions, and any additional withholding amounts they may wish to specify. It is crucial for both employees and employers to accurately complete this form to comply with state tax regulations.

How to use the Kansas K-4 Rev 1013 Form

To use the Kansas K-4 Rev 1013 Form, an employee must fill it out and submit it to their employer. The form requires personal information, including the employee's name, address, and Social Security number. Additionally, the employee must indicate their filing status and the number of exemptions they are claiming. Employers use this information to calculate the appropriate state tax withholding from the employee's wages.

Steps to complete the Kansas K-4 Rev 1013 Form

Completing the Kansas K-4 Rev 1013 Form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Indicate the number of exemptions you are claiming. This can affect the amount withheld from your paycheck.

- If desired, specify any additional amount you want withheld from your paycheck.

- Review the completed form for accuracy before submitting it to your employer.

Legal use of the Kansas K-4 Rev 1013 Form

The Kansas K-4 Rev 1013 Form is legally binding once completed and submitted to your employer. It is important to ensure that the information provided is accurate and up-to-date, as incorrect information can lead to improper tax withholding. Employers are required by law to maintain this form on file and use it for calculating state income tax withholdings. Compliance with state tax laws is essential to avoid penalties or issues with tax authorities.

Filing Deadlines / Important Dates

While the Kansas K-4 Rev 1013 Form does not have a specific filing deadline for employees, it is important to submit it as soon as employment begins or when there are changes in your tax situation. Employers must ensure that they have the most current version of the form on file to comply with withholding requirements. Additionally, employees should review their withholding status at least annually or whenever there are significant life changes, such as marriage or the birth of a child.

Form Submission Methods

The Kansas K-4 Rev 1013 Form can be submitted to your employer through various methods, depending on the employer's policies. Common submission methods include:

- In-person delivery to the human resources or payroll department.

- Email submission, if allowed by the employer.

- Mailing the form directly to the employer's payroll office.

It is advisable to confirm with your employer regarding their preferred submission method to ensure timely processing.

Quick guide on how to complete kansas k 4 rev 1013 form

Effortlessly Prepare Kansas K 4 Rev 1013 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly without any delays. Manage Kansas K 4 Rev 1013 Form from any device using the airSlate SignNow apps available for Android or iOS and enhance any document-related process today.

Edit and Electronically Sign Kansas K 4 Rev 1013 Form with Ease

- Obtain Kansas K 4 Rev 1013 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers explicitly for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Kansas K 4 Rev 1013 Form and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas k 4 rev 1013 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas K 4 Rev 1013 Form?

The Kansas K 4 Rev 1013 Form is a tax withholding form used by employees to provide their employers with information about their tax status. This form allows you to declare allowances for state income tax withholding, which can help in ensuring accurate deductions from your paycheck. Completing the Kansas K 4 Rev 1013 Form correctly is vital for your financial planning.

-

How can airSlate SignNow help in filling out the Kansas K 4 Rev 1013 Form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out the Kansas K 4 Rev 1013 Form electronically. You can customize the document to suit your needs and ensure all necessary fields are properly completed. This streamlines the process and reduces any potential errors that could occur when filling out the form by hand.

-

Is there a cost associated with using airSlate SignNow for the Kansas K 4 Rev 1013 Form?

airSlate SignNow provides a cost-effective solution for handling the Kansas K 4 Rev 1013 Form, with flexible pricing plans to fit various business needs. You can evaluate their free trial to explore features before committing, ensuring the service is within your budget. Overall, it offers signNow savings compared to traditional paper-based methods.

-

What features does airSlate SignNow offer for managing the Kansas K 4 Rev 1013 Form?

airSlate SignNow provides a range of features for managing the Kansas K 4 Rev 1013 Form, including templates, e-signatures, and secure storage. You can collaborate in real-time with team members, ensuring everyone has the necessary input for completing the form efficiently. Additionally, audit trails are available to keep track of document changes and actions.

-

Can I integrate airSlate SignNow with other applications while working with the Kansas K 4 Rev 1013 Form?

Yes, airSlate SignNow supports a variety of integrations with popular applications, making it easy to work with the Kansas K 4 Rev 1013 Form alongside your other business tools. This includes integration with CRM systems, cloud storage solutions, and more, enhancing your workflow and efficiency. The seamless connectivity helps keep all your documents organized and accessible.

-

What are the benefits of using airSlate SignNow for the Kansas K 4 Rev 1013 Form?

Using airSlate SignNow for the Kansas K 4 Rev 1013 Form streamlines your document management process, allowing for quick and hassle-free e-signing. It also improves accuracy, reduces processing time, and minimizes the need for paper documents, which is better for the environment. Overall, this solution enhances your productivity and saves you valuable time.

-

How secure is the information provided in the Kansas K 4 Rev 1013 Form through airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Kansas K 4 Rev 1013 Form. The platform employs advanced encryption and secure cloud storage to protect sensitive information. With compliance to legal standards and robust authentication options, you can trust that your data is safe while using this e-signature solution.

Get more for Kansas K 4 Rev 1013 Form

Find out other Kansas K 4 Rev 1013 Form

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF