Form Dte 105a

What is the Form Dte 105a

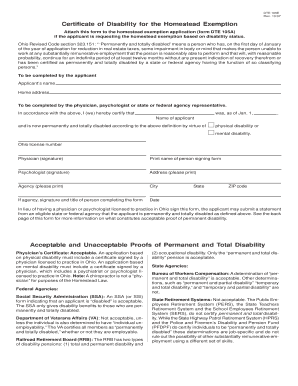

The Form Dte 105a is a specific document used in various legal and administrative contexts within the United States. It serves as a formal declaration or request, often required by governmental agencies or organizations. Understanding the purpose and requirements of this form is essential for compliance and successful submission. The form may be utilized in different scenarios, including tax filings, business registrations, or other official processes, depending on the jurisdiction and context in which it is applied.

Steps to Complete the Form Dte 105a

Completing the Form Dte 105a involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information and documentation required for the form. This may include personal identification details, financial information, or supporting documents relevant to the submission. Next, carefully fill out each section of the form, ensuring that all fields are completed accurately. It is crucial to review the form for any errors or omissions before finalizing it. Once completed, the form can be submitted according to the specified guidelines, whether online, by mail, or in person.

Legal Use of the Form Dte 105a

The legal use of the Form Dte 105a is governed by specific regulations and requirements that vary by state and context. To be considered legally binding, the form must be completed in accordance with applicable laws, including proper signatures and any necessary notarizations. Understanding the legal implications of the form is vital, as improper use or submission may lead to penalties or rejection. Compliance with relevant legal frameworks, such as eSignature laws, ensures that the form is recognized and enforceable in legal proceedings.

Key Elements of the Form Dte 105a

Key elements of the Form Dte 105a include essential information that must be accurately provided for the form to be valid. These elements typically consist of the applicant's name, address, and contact information, as well as any specific details pertinent to the request or declaration being made. Additionally, the form may require signatures from involved parties, dates of submission, and any relevant identification numbers. Ensuring that all key elements are correctly filled out is crucial for the successful processing of the form.

How to Obtain the Form Dte 105a

Obtaining the Form Dte 105a can be done through various channels, depending on the issuing authority. Typically, the form can be downloaded from official government websites or obtained directly from local offices or agencies that require its submission. It is important to ensure that the most current version of the form is used, as updates may occur. If assistance is needed, contacting the relevant agency can provide guidance on where and how to access the form.

Form Submission Methods

The Form Dte 105a can be submitted through multiple methods, allowing for flexibility based on the user's preferences and requirements. Common submission methods include online submission via designated portals, mailing the completed form to the appropriate agency, or delivering it in person to a local office. Each method may have specific guidelines regarding processing times and confirmation of receipt, so it is advisable to review these details before submitting the form.

Quick guide on how to complete form dte 105a

Effortlessly Prepare Form Dte 105a on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a great eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without hold-ups. Handle Form Dte 105a on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Form Dte 105a with Ease

- Locate Form Dte 105a and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that require new printed copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Form Dte 105a and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dte 105a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dte 105a form and how does airSlate SignNow facilitate its use?

The dte 105a form is a crucial document for various business operations, and airSlate SignNow simplifies its signing process. By providing an easy-to-use platform, SignNow allows users to send, sign, and store their dte 105a documents securely. This streamlines workflows and enhances efficiency in managing important paperwork.

-

What are the pricing options for using airSlate SignNow for dte 105a documents?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs, making it cost-effective for managing dte 105a forms. With various tiers, users can choose a plan that provides the features necessary for their workflow, ensuring they get the best value. You can explore the pricing page on our site for detailed information.

-

Can I integrate airSlate SignNow with other software to streamline dte 105a document management?

Yes, airSlate SignNow provides seamless integrations with many popular software applications, enhancing your ability to manage dte 105a documents efficiently. Whether you are using CRM systems or project management tools, integration ensures that your workflows remain smooth and productive. Check our integrations page for a full list of compatible solutions.

-

What are the main features of airSlate SignNow that support dte 105a document handling?

airSlate SignNow includes features such as customizable templates, in-app notifications, and real-time tracking that enhance the handling of dte 105a documents. These features streamline the signing process and improve collaboration among users. With airSlate SignNow, you can easily manage your dte 105a documents from start to finish.

-

How does airSlate SignNow ensure the security of my dte 105a documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the dte 105a. We employ advanced encryption protocols and secure cloud storage to protect your information. This ensures that your dte 105a documents remain confidential and safe throughout the signing process.

-

Is there a mobile app for airSlate SignNow that enables signing of dte 105a?

Yes, airSlate SignNow offers a mobile app that allows users to sign dte 105a documents on the go. The app provides the same user-friendly interface and features available on the desktop version, ensuring accessibility and convenience. This mobile functionality helps businesses maintain productivity regardless of location.

-

What benefits does using airSlate SignNow offer for managing dte 105a documents?

Using airSlate SignNow for dte 105a documents provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced collaboration. Our solution simplifies the signing process, allowing multiple stakeholders to sign documents effortlessly. By streamlining workflows, businesses can save time and resources.

Get more for Form Dte 105a

- Form b122a 2

- Ddp1 5298772 form

- Mp39 pt chart form

- A photographic atlas of developmental biology pdf form

- Cortisone injection shoulder airport security form

- Emergency contact information

- Prohibitions price caps and disclosures department of the treasury treasury form

- Exact and approximate area proportional circular venn and euler form

Find out other Form Dte 105a

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter