PA Beaver County Property Tax Relief Application Homestead and 2022-2026

Understanding the Beaver County Homestead Exemption

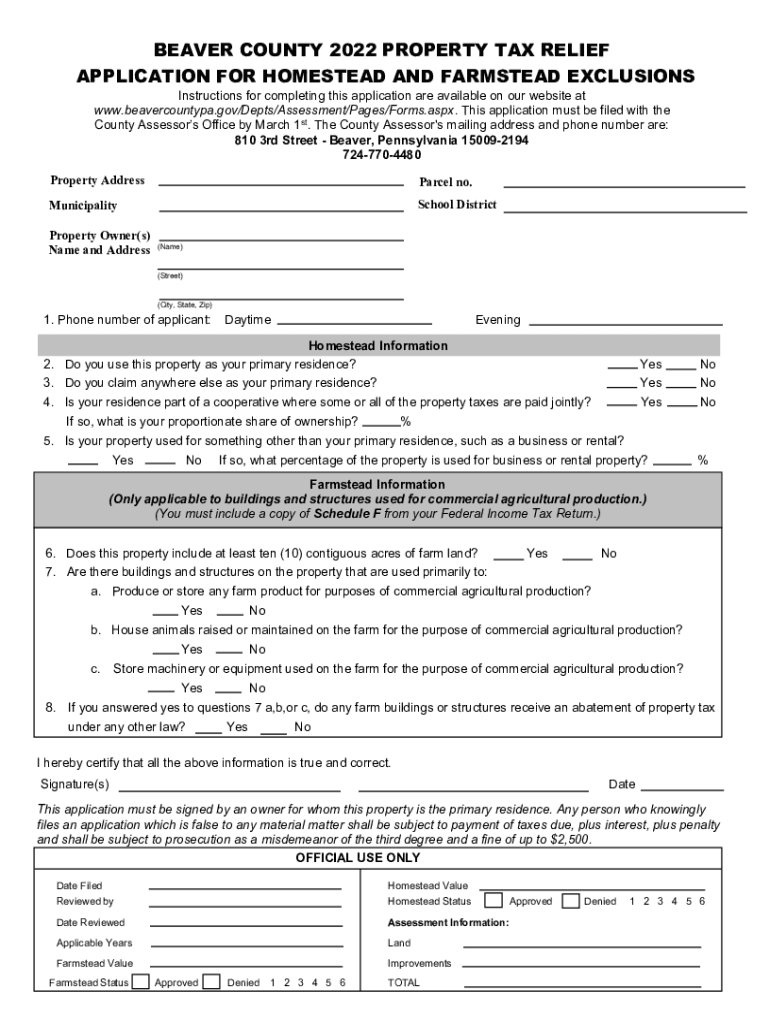

The Beaver County Homestead Exemption is a property tax relief program designed to assist homeowners by reducing their taxable property value. This exemption is particularly beneficial for those who meet specific eligibility criteria, allowing them to save on their annual property taxes. Homeowners must apply for this exemption to receive the benefits, which can significantly lower their financial burden.

Eligibility Criteria for the Beaver County Homestead Exemption

To qualify for the Beaver County Homestead Exemption, applicants must meet certain requirements. Generally, these criteria include:

- Ownership of the property as the primary residence.

- Meeting income limits set by local regulations.

- Being a resident of Beaver County.

It is essential for applicants to review the specific guidelines provided by the county to ensure they meet all necessary conditions before applying.

Steps to Complete the Beaver County Homestead Exemption Application

Filling out the Beaver County Homestead Exemption application involves several straightforward steps:

- Obtain the application form, which is usually available online or at local government offices.

- Fill out the required information, ensuring all details are accurate and complete.

- Gather any necessary documentation to support your application, such as proof of residency and income.

- Submit the completed application by the specified deadline, either online, by mail, or in person.

Following these steps carefully can help ensure a smooth application process.

Form Submission Methods for the Beaver County Homestead Exemption

Applicants have several options for submitting their Beaver County Homestead Exemption application. These methods include:

- Online Submission: Many counties offer an online portal for easy submission.

- Mail: Applications can be sent via postal service to the designated county office.

- In-Person: Applicants may also choose to deliver their forms directly to the county office.

Choosing the most convenient submission method can help streamline the process and ensure timely receipt of the application.

Important Filing Deadlines for the Beaver County Homestead Exemption

To successfully apply for the Beaver County Homestead Exemption, it is crucial to be aware of the filing deadlines. These dates can vary each year, so applicants should check the county's official resources for the most current information. Missing the deadline may result in the inability to receive the exemption for that tax year, impacting the homeowner's financial planning.

Legal Use of the Beaver County Homestead Exemption Application

The Beaver County Homestead Exemption application is a legally binding document. It is important for applicants to provide accurate information, as any discrepancies could lead to penalties or denial of the exemption. The application must be completed in accordance with local laws and regulations, ensuring that all submitted information is truthful and verifiable.

Quick guide on how to complete pa beaver county property tax relief application homestead and

Effortlessly Complete PA Beaver County Property Tax Relief Application Homestead And on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage PA Beaver County Property Tax Relief Application Homestead And on any device using airSlate SignNow’s Android or iOS applications and simplify any document-focused task today.

The Simplest Way to Modify and eSign PA Beaver County Property Tax Relief Application Homestead And with Ease

- Find PA Beaver County Property Tax Relief Application Homestead And and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign PA Beaver County Property Tax Relief Application Homestead And and guarantee outstanding communication throughout the entire form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa beaver county property tax relief application homestead and

Create this form in 5 minutes!

How to create an eSignature for the pa beaver county property tax relief application homestead and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the beaver county homestead exemption?

The Beaver County homestead exemption is a property tax relief program designed to assist homeowners by reducing their taxable property value. This exemption can provide substantial savings on property taxes, making homeownership more affordable. To qualify, homeowners must meet specific criteria set by Beaver County regulations.

-

How do I apply for the beaver county homestead exemption?

To apply for the Beaver County homestead exemption, you must submit an application to the local taxing authority. The process generally involves providing proof of residency and ownership of the property. It's essential to check the specific application deadlines to ensure you don't miss out on potential savings.

-

What are the eligibility requirements for the beaver county homestead exemption?

Eligibility for the Beaver County homestead exemption typically requires that you are the owner of the property and it serves as your primary residence. Additional criteria may include income limits or age requirements, especially for senior citizens. Be sure to consult Beaver County's official guidelines for the most accurate information.

-

What benefits can I expect from the beaver county homestead exemption?

The primary benefit of the Beaver County homestead exemption is the reduction in your property tax bill, which can provide signNow financial relief. This program not only helps you save money but also encourages stability and investment in local communities. By lowering your property taxes, it allows you to allocate funds towards other essential areas of your household budget.

-

Is the beaver county homestead exemption a one-time benefit?

No, the Beaver County homestead exemption is not a one-time benefit; it typically renews annually as long as you continue to meet the eligibility requirements. However, it’s important to keep your information updated with local authorities to ensure you receive the exemption every year. This ongoing benefit aids in providing consistent property tax savings.

-

How does the beaver county homestead exemption interact with other tax credits?

The Beaver County homestead exemption can often be combined with other tax credits and relief programs, enhancing your overall savings. However, specific rules may apply, so it’s essential to check how each program interacts with one another in Beaver County. Consulting a tax professional or local tax office can provide clarity on this matter.

-

Can I appeal a decision regarding my beaver county homestead exemption application?

Yes, if your application for the Beaver County homestead exemption is denied, you have the right to appeal the decision. The appeal process typically involves submitting a request to the local tax office for a review. Ensure to gather any necessary documentation to support your case during the appeal.

Get more for PA Beaver County Property Tax Relief Application Homestead And

- Vermont dol form 25

- Pre algebra week 3 day 4 form

- Dating form

- Sbirt screening form

- Form of application for an arms licence in form ii iii and iv

- Navy training jacket spot check form

- Change in reserve component category rcc change in reserve component category rcc form

- Certification of labor peace agreement imperial county planning form

Find out other PA Beaver County Property Tax Relief Application Homestead And

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer