Form Iv Annual Return

What is the Form IV Annual Return

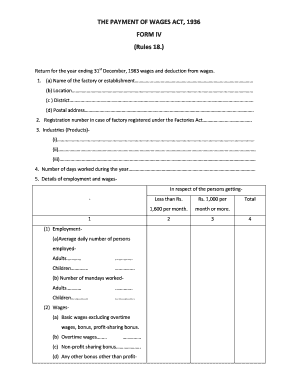

The Form IV Annual Return is a crucial document under the Payment of Wages Act, designed to ensure compliance with wage payment regulations in the United States. This form serves as a formal declaration of wage payments made by employers to their employees over a specified period. It includes essential details such as the total wages paid, deductions, and the number of employees covered. By submitting this form, employers demonstrate adherence to legal requirements, promoting transparency and accountability in wage practices.

How to use the Form IV Annual Return

Using the Form IV Annual Return involves several steps to ensure accurate completion and submission. Employers should first gather all necessary information, including employee details, wage records, and any applicable deductions. Next, the form must be filled out accurately, ensuring that all figures align with payroll records. Once completed, the form can be submitted electronically or via traditional mail, depending on state regulations. It is essential to retain a copy for record-keeping and future reference.

Steps to complete the Form IV Annual Return

Completing the Form IV Annual Return requires careful attention to detail. Follow these steps for accurate submission:

- Collect all relevant wage and employee information.

- Fill in the form, ensuring all sections are completed accurately.

- Double-check calculations for total wages and deductions.

- Sign the form, if required, to validate the submission.

- Submit the form by the designated deadline, either online or by mail.

Legal use of the Form IV Annual Return

The legal use of the Form IV Annual Return is governed by the Payment of Wages Act, which outlines the requirements for wage payments and employee rights. To ensure the form's legal validity, it must be completed in compliance with federal and state regulations. This includes accurate reporting of wages, timely submission, and adherence to privacy laws regarding employee information. Failure to comply can result in penalties or legal repercussions for employers.

Key elements of the Form IV Annual Return

Key elements of the Form IV Annual Return include:

- Employer Information: Name, address, and identification number.

- Employee Details: Names, positions, and wage information.

- Total Wages Paid: The sum of all wages disbursed during the reporting period.

- Deductions: Any applicable deductions from wages, such as taxes or benefits.

- Signature: Required to validate the form, confirming accuracy and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form IV Annual Return vary by state but generally align with the end of the fiscal year. Employers should be aware of specific dates to avoid penalties. It is advisable to check state regulations for precise deadlines and ensure timely submission. Keeping a calendar of important dates can help in maintaining compliance and avoiding late fees.

Quick guide on how to complete form iv annual return

Complete Form Iv Annual Return effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form Iv Annual Return on any platform using airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to adjust and eSign Form Iv Annual Return with ease

- Locate Form Iv Annual Return and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form Iv Annual Return and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form iv annual return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an iv form in the context of airSlate SignNow?

An iv form is a digital template used within airSlate SignNow to streamline the process of signing and managing documents electronically. This feature allows users to create, send, and eSign essential forms efficiently, ensuring that all necessary information is captured accurately.

-

How does airSlate SignNow enhance the iv form signing process?

airSlate SignNow offers a user-friendly interface that simplifies the iv form signing process. The platform allows users to sign documents from anywhere, on any device, ensuring that agreements are finalized promptly without the hassle of printing, scanning, or mailing.

-

What are the pricing options for using airSlate SignNow with iv forms?

airSlate SignNow provides competitive pricing plans that accommodate businesses of all sizes. The subscription includes access to essential features for managing iv forms, making it a cost-effective solution for companies looking to improve their document workflow.

-

Can I integrate airSlate SignNow with other applications to manage iv forms?

Yes, airSlate SignNow offers seamless integrations with a variety of applications such as Google Workspace, Salesforce, and Microsoft Office. This connectivity enables users to manage iv forms alongside their existing tools, enhancing productivity and streamlining workflows.

-

What benefits do businesses gain by using iv forms with airSlate SignNow?

By using iv forms with airSlate SignNow, businesses experience improved efficiency and reduced turnaround times for document signing. The digital nature of these forms eliminates manual errors, enhances compliance, and ensures that all parties can sign in a secure environment.

-

Are there any templates available for iv forms in airSlate SignNow?

AirSlate SignNow provides a variety of pre-built templates for iv forms, making it easier for users to create documents quickly. These customizable templates can be tailored to fit specific business needs, saving time and ensuring consistency.

-

Is it possible to track iv form status in airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of iv forms in real-time. This feature enables businesses to monitor when documents are sent, viewed, and signed, providing valuable insights into the signing process and improving overall efficiency.

Get more for Form Iv Annual Return

- Cepa community trust grant application final draft2docx form

- Industrial hvac ampamp generator rentals in fl tx ampamp laportable air form

- This examination must be certified by a form

- Insulation certificate 76111625 form

- Nj business report form

- Mdyear form

- Nj lottery claim status form

- Child and family information form 2019 2020doc

Find out other Form Iv Annual Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors