Underwriting Worksheet Form

What is the FHA Underwriting Checklist

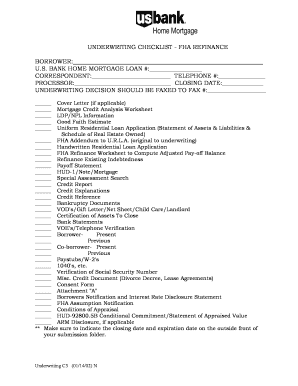

The FHA underwriting checklist is a comprehensive tool used by mortgage underwriters to evaluate loan applications for Federal Housing Administration (FHA) loans. This checklist ensures that all necessary documentation is collected and reviewed, facilitating a smooth underwriting process. It typically includes sections for borrower information, property details, credit history, income verification, and debt-to-income ratios. By adhering to this checklist, underwriters can ensure compliance with FHA guidelines and make informed lending decisions.

Key Elements of the FHA Underwriting Checklist

Understanding the key elements of the FHA underwriting checklist is crucial for both lenders and borrowers. Essential components include:

- Borrower Information: Personal details such as name, Social Security number, and employment history.

- Credit Report: A review of the borrower’s credit history and score to assess creditworthiness.

- Income Documentation: Verification of income through pay stubs, W-2 forms, and tax returns.

- Asset Verification: Documentation of savings, checking accounts, and other assets to ensure sufficient funds for down payment and closing costs.

- Property Appraisal: An evaluation of the property’s market value to ensure it meets FHA standards.

- Debt-to-Income Ratio: Calculation of the borrower’s monthly debts compared to their income to assess financial stability.

Steps to Complete the FHA Underwriting Checklist

Completing the FHA underwriting checklist involves several systematic steps to ensure all necessary information is accurately gathered and assessed. These steps include:

- Gather Documentation: Collect all required documents from the borrower, including identification, income statements, and asset information.

- Review Credit History: Obtain and analyze the borrower’s credit report to identify any potential issues that may affect loan approval.

- Assess Income and Employment: Verify the borrower’s employment status and income stability through the provided documentation.

- Evaluate Debt Obligations: Calculate the borrower’s debt-to-income ratio to ensure it falls within acceptable limits.

- Conduct Property Appraisal: Arrange for a professional appraisal of the property to confirm its value and condition.

- Compile Findings: Document all findings and ensure that the checklist is fully completed before submission for final approval.

Legal Use of the FHA Underwriting Checklist

The FHA underwriting checklist serves as a legally binding document that outlines the necessary criteria for loan approval under FHA guidelines. It is essential for lenders to ensure compliance with the checklist to avoid legal repercussions. Proper documentation and adherence to the checklist can protect lenders from potential claims of discrimination or negligence. Additionally, maintaining a thorough record of the underwriting process can provide evidence of due diligence in case of audits or disputes.

Required Documents for FHA Underwriting

To successfully complete the FHA underwriting checklist, specific documents are required from borrowers. These documents help verify the information provided and assess the borrower’s eligibility for an FHA loan. Commonly required documents include:

- Government-issued ID: A valid driver's license or passport for identity verification.

- Proof of Income: Recent pay stubs, W-2 forms, and tax returns from the last two years.

- Bank Statements: Recent statements from all financial accounts to verify assets.

- Credit Report: A full credit report detailing the borrower’s credit history.

- Property Information: Details about the property being purchased, including the purchase agreement and appraisal report.

How to Obtain the FHA Underwriting Checklist

The FHA underwriting checklist can typically be obtained through mortgage lenders or directly from the FHA’s official resources. Lenders often provide their customized versions of the checklist to align with their specific processes. Additionally, various online platforms and mortgage resources may offer downloadable versions of the checklist for convenience. It is crucial to ensure that the version used is up-to-date and compliant with current FHA regulations.

Quick guide on how to complete underwriting worksheet

Effortlessly Prepare Underwriting Worksheet on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without any holdups. Manage Underwriting Worksheet on any device using airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The Easiest Way to Alter and Electronically Sign Underwriting Worksheet Without Stress

- Access Underwriting Worksheet and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Underwriting Worksheet and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the underwriting worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FHA underwriting checklist and why is it important?

The FHA underwriting checklist is a crucial document that outlines the necessary steps and requirements for loan approval through the Federal Housing Administration. It helps ensure that all necessary information is collected upfront, facilitating a smoother underwriting process. By utilizing this checklist, lenders can signNowly reduce the chances of delays or denials during mortgage processing.

-

How can the airSlate SignNow platform assist in managing the FHA underwriting checklist?

airSlate SignNow provides an intuitive platform that allows users to easily create, share, and eSign the FHA underwriting checklist. This streamlines the document management process, ensuring that all parties have access to the latest version of the checklist in real-time. Additionally, the platform enhances collaboration, making it easier for lenders and borrowers to stay aligned throughout the underwriting process.

-

Are there any costs associated with using airSlate SignNow for the FHA underwriting checklist?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. The cost varies depending on the features included, such as the ability to manage the FHA underwriting checklist digitally. Overall, its cost-effective solution can save businesses money and time compared to traditional paper-based processes.

-

What features does airSlate SignNow offer for enhancing the FHA underwriting checklist process?

airSlate SignNow includes features like customizable templates, advanced eSigning capabilities, and secure cloud storage that enhance the FHA underwriting checklist process. These tools allow for quicker document turnaround times and improve the overall efficiency of the underwriting process. Additionally, the platform’s integration capabilities provide seamless access to other essential software tools.

-

Can I integrate airSlate SignNow with other tools for processing the FHA underwriting checklist?

Absolutely! airSlate SignNow offers integration options with various CRM and document management systems, allowing for a more streamlined workflow when dealing with the FHA underwriting checklist. This flexibility enables users to connect their favorite tools and optimize their processes, leading to enhanced productivity and better document handling.

-

How does airSlate SignNow ensure the security of the FHA underwriting checklist?

Security is a top priority for airSlate SignNow, especially regarding sensitive documents like the FHA underwriting checklist. The platform employs bank-level encryption protocols and offers secure access controls, ensuring that user data is protected at all times. This commitment to security allows customers to eSign and manage their documents confidently.

-

How can using an FHA underwriting checklist improve loan processing times?

Using an FHA underwriting checklist can signNowly speed up loan processing times by ensuring that all required documentation is gathered in one go. With airSlate SignNow, you can efficiently manage this checklist, reducing the back-and-forth communication typically associated with missing information. Consequently, this can lead to quicker approvals and satisfied clients.

Get more for Underwriting Worksheet

- Wetland inhabitant word search pdf water epa form

- Mary kay wish list form

- Form cc 1464 va

- Osteoporosis questionnaire pdf form

- Cs oa12 florida department of revenue form

- Quran class registration form pdf islamic institute of toronto

- Food vendor agreement template form

- Forbearance agreement template 787742365 form

Find out other Underwriting Worksheet

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now