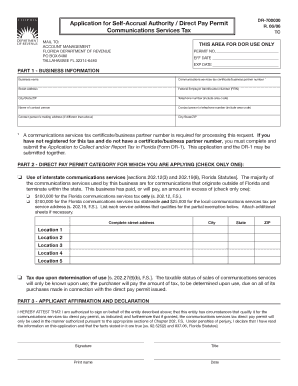

Fl Dept of Revenue Form

What is the Florida Department of Revenue?

The Florida Department of Revenue (FL Dept of Revenue) is the state agency responsible for administering Florida's tax laws, including the collection of state taxes. This department plays a crucial role in ensuring compliance with tax regulations and providing resources for taxpayers. It oversees various tax types, including sales tax, corporate income tax, and property tax, among others. The FL Dept of Revenue also offers guidance on tax obligations, helping individuals and businesses understand their responsibilities under Florida law.

Steps to Complete the Florida State Tax Form

Completing the Florida state tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant deductions. Next, download the appropriate Florida state tax form from the FL Dept of Revenue website. Fill out the form carefully, ensuring all information is accurate and complete. Once completed, review the form for any errors before submitting it. Finally, choose your submission method: online, by mail, or in person, depending on your preference and the form's requirements.

Legal Use of the Florida State Tax Form

The Florida state tax form is legally binding when completed and submitted according to the guidelines set by the FL Dept of Revenue. To ensure its validity, the form must be signed and dated by the taxpayer. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. This legal framework allows for the use of digital signatures, making it easier for taxpayers to file their forms securely and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Florida state tax form are crucial for compliance. Typically, individual income tax returns are due on April 15 each year, although this date may vary if it falls on a weekend or holiday. Businesses may have different deadlines based on their tax structure. It is essential to stay informed about any changes to these dates, as late submissions can result in penalties and interest charges. Taxpayers should mark their calendars and plan accordingly to ensure timely filing.

Required Documents

To complete the Florida state tax form, certain documents are required. Taxpayers should have their W-2 forms, 1099 forms, and any other income statements ready. Additionally, documentation for deductions, such as mortgage interest statements, property tax receipts, and medical expenses, should be collected. Having these documents organized will streamline the filing process and help ensure that all income and deductions are accurately reported on the form.

Form Submission Methods

There are several methods for submitting the Florida state tax form. Taxpayers can file online through the FL Dept of Revenue's electronic filing system, which is often the fastest and most efficient option. Alternatively, forms can be mailed to the appropriate address listed on the form or delivered in person at designated locations. Each submission method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Florida state tax form can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for severe infractions. It is essential for taxpayers to understand their obligations and file their forms on time to avoid these consequences. Being proactive in tax management can help mitigate risks associated with non-compliance.

Quick guide on how to complete fl dept of revenue

Complete Fl Dept Of Revenue effortlessly on any device

Electronic document management has become increasingly favored by companies and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documentation, as you can access the needed form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Fl Dept Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to alter and eSign Fl Dept Of Revenue with ease

- Locate Fl Dept Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fl Dept Of Revenue and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fl dept of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of airSlate SignNow in relation to Florida state tax documents?

airSlate SignNow simplifies the process of sending and eSigning Florida state tax documents. Our platform ensures that you can manage your tax documents securely and efficiently. With features designed for compliance, SignNow helps you meet Florida state tax requirements effortlessly.

-

How does airSlate SignNow integrate with accounting software for Florida state tax purposes?

airSlate SignNow integrates seamlessly with various accounting software, allowing you to streamline your Florida state tax filing process. This integration makes it easier to manage your documents, ensuring all necessary forms are signed and submitted on time. By connecting your accounting tools, you enhance accuracy and reduce the risk of errors.

-

Is airSlate SignNow a cost-effective solution for managing Florida state tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling Florida state tax documents. Our pricing plans cater to different business needs without compromising on essential features. With our platform, you can save both time and money while staying compliant with Florida state tax regulations.

-

What are the key features of airSlate SignNow that benefit Florida state tax filing?

airSlate SignNow offers key features including document templates, eSigning capabilities, and automated reminders, all essential for efficient Florida state tax filing. These features streamline the process, ensuring that all documents are eSigned and submitted promptly. Additionally, our platform provides secure storage for your tax documents, keeping them safe and accessible.

-

Can airSlate SignNow help with deadlines for Florida state tax submissions?

Absolutely! airSlate SignNow includes automated reminders to help you keep track of deadlines for Florida state tax submissions. This feature ensures that you never miss an important date, which is crucial for staying compliant with Florida's tax laws. With timely notifications, you can manage your tax responsibilities confidently.

-

How secure is my information when using airSlate SignNow for Florida state tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Florida state tax documents and personal information. You can trust that your data is safe while using our platform, allowing you to focus on what matters most—efficiently managing your tax needs.

-

Is support available for newcomers using airSlate SignNow for Florida state tax?

Yes, airSlate SignNow provides comprehensive support for newcomers, specifically those handling Florida state tax. Our user-friendly interface is backed by a dedicated support team offering guidance and troubleshooting assistance. Whether you have questions about features or need help with tax documents, we are here to help.

Get more for Fl Dept Of Revenue

- Lld form 390517433

- Ntse claim bill form download

- Assessing vertebrate biodiversity in a kelp forest ecosystem form

- Cerfa demande dautorisation de travail pour une tranger prsent en frace renouvellement des cerfa form

- Demande de renouvellement simplifi de passeport pour adulte demande de renouvellement simplifi de passeport pour adulte pour form

- Unaccompanied personal effects form turkish unaccompanied personal effects form

- Protected b when completednr302 declaration of eli form

- Massmutual transitions form

Find out other Fl Dept Of Revenue

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form