Pennsylvania Income Tax Return PA 40 FormsPublications

What is the Pennsylvania Income Tax Return PA 40 FormsPublications

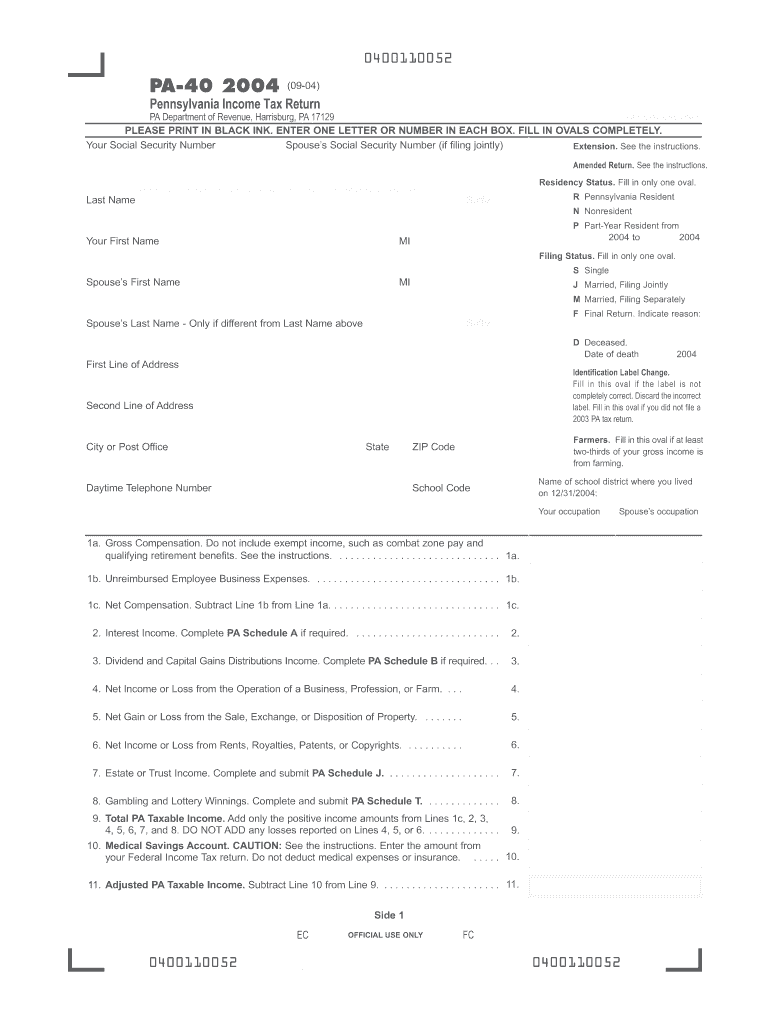

The Pennsylvania Income Tax Return PA 40 is a crucial document for residents and part-year residents of Pennsylvania who need to report their income and calculate their state tax liability. This form is used to declare various sources of income, including wages, salaries, and other earnings. It is essential for ensuring compliance with state tax laws and for determining any tax refunds or payments owed. The form is accompanied by specific publications that provide guidance on how to accurately complete and submit it, ensuring taxpayers understand their obligations and rights under Pennsylvania tax law.

Steps to complete the Pennsylvania Income Tax Return PA 40 FormsPublications

Completing the Pennsylvania Income Tax Return PA 40 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Obtain the PA 40 form and its accompanying instructions from the Pennsylvania Department of Revenue.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in amounts reported.

- Calculate your taxable income and determine any deductions or credits applicable to your situation.

- Review the completed form for errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Pennsylvania Income Tax Return PA 40 FormsPublications

The Pennsylvania Income Tax Return PA 40 is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must adhere to the guidelines outlined in the accompanying publications. This includes providing accurate information and signatures where required. The form's legal standing is reinforced by compliance with state laws governing tax submissions, which mandate proper documentation and adherence to deadlines. Failure to comply can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely submission of the Pennsylvania Income Tax Return PA 40 is critical to avoid penalties. The typical deadline for filing is April 15 of each year, aligning with federal tax deadlines. However, taxpayers should be aware of any changes or extensions that may apply, especially in light of special circumstances such as natural disasters or state declarations. It is advisable to check the Pennsylvania Department of Revenue’s official communications for the most current information regarding deadlines and any relevant updates.

Required Documents

To successfully complete the Pennsylvania Income Tax Return PA 40, taxpayers must gather several important documents, including:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions or credits, such as receipts for charitable contributions or education expenses.

- Previous year’s tax return for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Pennsylvania Income Tax Return PA 40. The form can be filed online through the Pennsylvania Department of Revenue's e-filing system, which is often the quickest method. Alternatively, taxpayers can print the completed form and mail it to the appropriate address provided in the instructions. In-person submissions may also be possible at designated state offices, although this option is less common. Each method has its own processing times and requirements, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete pennsylvania income tax return pa 40 formspublications

Complete Pennsylvania Income Tax Return PA 40 FormsPublications effortlessly on any device

Digital document administration has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Manage Pennsylvania Income Tax Return PA 40 FormsPublications on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Pennsylvania Income Tax Return PA 40 FormsPublications with ease

- Acquire Pennsylvania Income Tax Return PA 40 FormsPublications and then click Get Form to begin.

- Use the tools we offer to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious search for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Adjust and eSign Pennsylvania Income Tax Return PA 40 FormsPublications and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania income tax return pa 40 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Pennsylvania Income Tax Return PA 40 FormsPublications?

Pennsylvania Income Tax Return PA 40 FormsPublications are official documents required for filing state income taxes in Pennsylvania. They provide detailed information on income, deductions, and credits that allow residents to accurately report their earnings to the state. Understanding these forms is crucial for proper tax compliance.

-

How can airSlate SignNow assist with Pennsylvania Income Tax Return PA 40 FormsPublications?

airSlate SignNow simplifies the signing and submission process for Pennsylvania Income Tax Return PA 40 FormsPublications. With our platform, users can easily eSign documents online and streamline their tax filing experience. This reduces the hassle involved in dealing with paper forms and enhances accuracy.

-

Are there any costs associated with using airSlate SignNow for Pennsylvania Income Tax Return PA 40 FormsPublications?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Users can choose from subscription models that best fit their requirements, ensuring cost-effective solutions while managing Pennsylvania Income Tax Return PA 40 FormsPublications efficiently.

-

What features does airSlate SignNow provide for Pennsylvania Income Tax Return PA 40 FormsPublications?

airSlate SignNow includes features such as secure eSigning, document templates, and integration with various tax software. These functionalities make it easier to manage Pennsylvania Income Tax Return PA 40 FormsPublications, enabling users to collect signatures and share essential documents effortlessly.

-

How can I ensure the security of my Pennsylvania Income Tax Return PA 40 FormsPublications with airSlate SignNow?

airSlate SignNow prioritizes security through encryption and compliance with industry standards. Your Pennsylvania Income Tax Return PA 40 FormsPublications are protected during transmission and storage, ensuring your sensitive information remains confidential and secure throughout the process.

-

Can I integrate airSlate SignNow with other software for handling Pennsylvania Income Tax Return PA 40 FormsPublications?

Absolutely! airSlate SignNow offers integration options with a variety of popular business applications, enhancing your workflow for managing Pennsylvania Income Tax Return PA 40 FormsPublications. This allows users to import and export documents seamlessly, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Pennsylvania Income Tax Return PA 40 FormsPublications?

Using airSlate SignNow presents numerous benefits, including time savings, reduced paper usage, and enhanced accuracy. By eSigning Pennsylvania Income Tax Return PA 40 FormsPublications digitally, users can speed up the filing process and avoid common mistakes associated with manual handling.

Get more for Pennsylvania Income Tax Return PA 40 FormsPublications

- Assurity cancer wellness mark iii brokerage form

- Subcontractor disclosure form new jersey

- Application for utility service cmu canton form

- Fillable and printable ub o4 form

- Scottsdale homeowner application form

- Austin ampamp peter maccallum cancer centre drug and form

- Atm balancing sheet form cashcard com au

- Pharmacy to vet clinic compounding prescription form

Find out other Pennsylvania Income Tax Return PA 40 FormsPublications

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template