Form 8853

What is the Form 8853

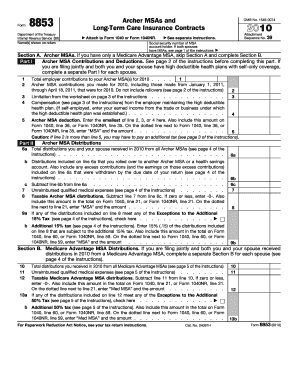

The Form 8853, also known as the "Report of Health Savings Accounts (HSAs) and Archer Medical Savings Accounts (MSAs)," is a tax form used in the United States. It is primarily designed for individuals who have health savings accounts or Archer MSAs. This form helps taxpayers report contributions, distributions, and other relevant information related to these accounts. Proper completion of Form 8853 is essential for ensuring compliance with IRS regulations and for accurately reporting health-related tax benefits.

How to use the Form 8853

Using Form 8853 involves several steps to ensure accurate reporting of health savings accounts and Archer MSAs. Taxpayers must first gather necessary information, including account balances, contributions, and distributions. After collecting this data, individuals fill out the form, providing details such as the type of account, amounts contributed, and any distributions made during the tax year. Once completed, Form 8853 should be submitted alongside your federal tax return to the IRS.

Steps to complete the Form 8853

Completing Form 8853 requires attention to detail. Follow these steps for accurate completion:

- Gather all relevant documents, including account statements and previous tax returns.

- Fill out your personal information at the top of the form, including your name and Social Security number.

- Report contributions made to your health savings account or Archer MSA in the appropriate sections.

- Detail any distributions taken from these accounts, ensuring to note the purpose of each distribution.

- Review your entries for accuracy before signing and dating the form.

Legal use of the Form 8853

The legal use of Form 8853 is governed by IRS regulations. To ensure that the form is legally valid, it must be completed accurately and submitted on time. The information reported must reflect actual contributions and distributions to avoid potential penalties. Additionally, electronic signatures are acceptable, provided they meet the requirements set forth by the IRS. Utilizing a reliable eSignature solution can help maintain compliance and ensure the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for Form 8853 align with the general tax return deadlines. Typically, taxpayers must submit their forms by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines, as failure to file on time can result in penalties or delays in processing your tax return.

Required Documents

To complete Form 8853 accurately, certain documents are required. These include:

- Account statements from your health savings account or Archer MSA.

- Previous tax returns, which may provide context for contributions and distributions.

- Documentation of any medical expenses paid from these accounts.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete form 8853

Complete Form 8853 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Form 8853 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The easiest way to alter and eSign Form 8853 without difficulty

- Locate Form 8853 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 8853 and ensure superior communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8853

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8853 and why is it important?

Form 8853 is used to report Health Savings Account (HSA) contributions and distributions for taxpayers. Understanding how to complete Form 8853 accurately is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

-

How does airSlate SignNow assist with Form 8853?

airSlate SignNow streamlines the process of preparing and signing Form 8853 by providing an easy-to-use platform. Users can fill out, eSign, and manage their Form 8853 documents securely and efficiently, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8853?

airSlate SignNow offers various pricing plans that cater to different needs, including options for small businesses and larger enterprises. Each plan provides access to features that facilitate handling Form 8853 and other essential documents cost-effectively.

-

Can I integrate airSlate SignNow with other applications when working with Form 8853?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. These integrations enable users to easily manage and share their Form 8853 alongside other important documents within their existing workflows.

-

What features does airSlate SignNow provide for filling out Form 8853?

airSlate SignNow provides a range of features for filling out Form 8853, including customizable templates, eSignature capabilities, and document sharing. These tools ensure that users can quickly and accurately complete the form while maintaining compliance.

-

Can I track the status of my Form 8853 using airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their Form 8853 in real-time. You can get notifications for document openings, completions, and signatures, ensuring that you are always up to date on your submission.

-

Is airSlate SignNow secure for handling sensitive documents like Form 8853?

Yes, airSlate SignNow prioritizes security and compliance, employing enterprise-grade encryption and complying with regulations. This ensures that your Form 8853 and other sensitive documents are handled securely.

Get more for Form 8853

Find out other Form 8853

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online