PTAX 300 Application for Non Homestead St Clair County Form

What is the PTAX 300 Application For Non homestead St Clair County

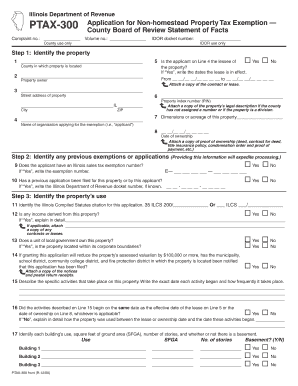

The PTAX 300 Application for Non Homestead in St Clair County is a form used to apply for a property tax exemption for non-homestead properties. This application allows property owners to seek relief from certain property taxes, specifically for properties that do not serve as the owner's primary residence. The form is essential for those looking to reduce their tax burden on investment properties, commercial real estate, or other non-residential properties within the county.

Steps to complete the PTAX 300 Application For Non homestead St Clair County

Completing the PTAX 300 Application involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary information about the property, including the property address, ownership details, and the specific reasons for seeking the exemption. Next, fill out the application form carefully, ensuring that all sections are completed and that the information provided is accurate. After completing the form, review it for any errors or omissions before submitting it to the appropriate county office. Finally, keep a copy of the submitted application for your records.

Eligibility Criteria

To qualify for the PTAX 300 Application for Non Homestead in St Clair County, property owners must meet certain eligibility criteria. Generally, the property must be classified as non-homestead, meaning it is not the owner's primary residence. Additionally, the applicant must provide evidence supporting the request for an exemption, such as proof of ownership and documentation detailing the property's use. It is important to review specific local regulations, as eligibility requirements may vary based on property type and use.

Required Documents

When submitting the PTAX 300 Application, applicants must include several supporting documents to validate their request. Commonly required documents include proof of property ownership, such as a deed or title, and any relevant financial statements that demonstrate the property's use and income generation. Additionally, applicants may need to provide a detailed description of the property and its intended use. Ensuring that all required documents are submitted with the application can help expedite the review process.

Form Submission Methods (Online / Mail / In-Person)

The PTAX 300 Application for Non Homestead in St Clair County can typically be submitted through various methods. Property owners may have the option to submit the form online, depending on the county's digital services. Alternatively, applicants can mail the completed form and supporting documents to the designated county office. For those who prefer a personal touch, in-person submissions are also accepted during regular business hours. It is advisable to check with the county office for the most current submission methods and any specific requirements.

Legal use of the PTAX 300 Application For Non homestead St Clair County

The legal use of the PTAX 300 Application is crucial for ensuring that property owners comply with local tax laws while seeking exemptions. This form serves as an official request to the county for a tax exemption, and its proper completion is essential for the application to be considered valid. Adhering to the guidelines set forth by the county and providing accurate information helps protect property owners from potential legal issues related to tax compliance. Understanding the legal implications of the application process is vital for successful submission.

Quick guide on how to complete ptax 300 application for non homestead st clair county

Effortlessly Prepare PTAX 300 Application For Non homestead St Clair County on Any Device

Digital document management has gained popularity among both organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the required form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hurdles. Manage PTAX 300 Application For Non homestead St Clair County on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-driven process today.

Steps to Modify and eSign PTAX 300 Application For Non homestead St Clair County Effortlessly

- Locate PTAX 300 Application For Non homestead St Clair County and click on Get Form to initiate the process.

- Utilize the tools we offer to submit your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal authenticity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues like lost or misplaced documents, tedious form navigation, and errors that necessitate printing new copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you choose. Edit and eSign PTAX 300 Application For Non homestead St Clair County to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 300 application for non homestead st clair county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 300 Application For Non homestead St Clair County?

The PTAX 300 Application For Non homestead St Clair County is a form used to apply for a property tax exemption for non-homestead properties in St Clair County. This application allows property owners to seek financial relief by determining their eligibility for a tax exemption on their non-homestead property.

-

How do I complete the PTAX 300 Application For Non homestead St Clair County?

Completing the PTAX 300 Application For Non homestead St Clair County involves filling out the required sections of the form with accurate information about your property and its intended use. You can access the application online and should ensure all details are correct before submission to avoid delays in processing.

-

What are the benefits of submitting the PTAX 300 Application For Non homestead St Clair County?

By submitting the PTAX 300 Application For Non homestead St Clair County, property owners can potentially reduce their property tax burden, leading to signNow savings. Additionally, it can help property owners understand their tax obligations and appeal any discrepancies they may encounter.

-

Is there a fee associated with the PTAX 300 Application For Non homestead St Clair County?

There are typically no fees associated with filing the PTAX 300 Application For Non homestead St Clair County. It is advised to check with the St Clair County tax assessor's office for any specific fees or changes that may apply.

-

How can airSlate SignNow assist with the PTAX 300 Application For Non homestead St Clair County?

airSlate SignNow provides an efficient platform for businesses to send and eSign the PTAX 300 Application For Non homestead St Clair County electronically. This service streamlines the application process, making it quicker and easier for property owners to submit their forms.

-

What features does airSlate SignNow offer for handling the PTAX 300 Application?

airSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning to facilitate the PTAX 300 Application For Non homestead St Clair County. These tools allow users to manage their documents effectively and ensure a smooth application process.

-

Can I integrate airSlate SignNow with other software for the PTAX 300 Application?

Yes, airSlate SignNow can be integrated with various software applications to enhance the management of the PTAX 300 Application For Non homestead St Clair County. These integrations help streamline workflows and maintain organized records of your property-related documents.

Get more for PTAX 300 Application For Non homestead St Clair County

- Death cum retirement gratuity form

- General procedures for commissing of air systems jkr form

- Consent form for areola repigmentation 2 pdf

- Residential rental property disclosureauthorization form

- Arizona form352credit for contributionsto qualify

- Arizona form 600 b claim for unclaimed property deceased owner

- Forms forms and publications library state of oregon

- Building permit loudonville ohio form

Find out other PTAX 300 Application For Non homestead St Clair County

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors