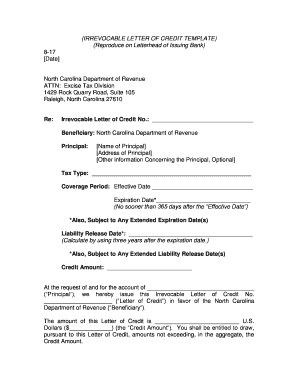

Irrevocable Letter of Credit Form

What is the irrevocable letter of credit?

An irrevocable letter of credit is a financial document issued by a bank that guarantees payment to a seller on behalf of a buyer, provided that the seller meets the specified terms and conditions. Unlike a revocable letter of credit, which can be altered or canceled by the buyer without consent from the seller, an irrevocable letter of credit cannot be changed or canceled without the agreement of all parties involved. This type of letter is commonly used in international trade to ensure that sellers receive payment, thereby reducing the risk of non-payment for goods or services delivered.

Key elements of the irrevocable letter of credit

Understanding the key elements of an irrevocable letter of credit is essential for both buyers and sellers. These elements typically include:

- Beneficiary: The party entitled to receive payment, usually the seller.

- Applicant: The buyer who requests the letter of credit from the bank.

- Issuing bank: The bank that issues the letter of credit on behalf of the buyer.

- Amount: The total monetary value that the bank guarantees to pay the beneficiary.

- Expiration date: The date until which the letter of credit is valid.

- Terms and conditions: Specific requirements that must be met for the payment to be released.

Steps to complete the irrevocable letter of credit

Completing an irrevocable letter of credit involves several important steps to ensure that all parties are protected and that the transaction proceeds smoothly:

- Step one: The buyer applies for the letter of credit through their bank, providing necessary details about the transaction.

- Step two: The bank reviews the application and issues the letter of credit, sending it to the seller's bank.

- Step three: The seller reviews the letter of credit to ensure that the terms align with the sales agreement.

- Step four: Upon shipment of goods or completion of services, the seller submits required documents to the bank.

- Step five: The bank verifies the documents against the letter of credit and processes the payment if all conditions are met.

How to use the irrevocable letter of credit

Using an irrevocable letter of credit effectively requires understanding its role in transactions. It acts as a safety net for sellers, assuring them that they will receive payment as long as they fulfill the agreed-upon terms. Buyers benefit by ensuring that payment is only made when the seller meets the specified conditions, reducing the risk of fraud. To utilize this financial tool, both parties should communicate openly about the terms and ensure that all documentation is accurate and submitted on time.

Legal use of the irrevocable letter of credit

The legal use of an irrevocable letter of credit is governed by various laws and regulations, including the Uniform Commercial Code (UCC) in the United States. This legal framework establishes the rights and obligations of all parties involved. It is crucial for both buyers and sellers to understand these legalities to avoid disputes. Proper execution of the letter of credit, adherence to its terms, and compliance with applicable laws ensure that the document is enforceable in a court of law.

Examples of using the irrevocable letter of credit

There are numerous scenarios where an irrevocable letter of credit is beneficial. For instance, an exporter selling goods to an overseas buyer may request an irrevocable letter of credit to ensure payment upon shipment. Another example is a construction company that requires materials from a supplier; an irrevocable letter of credit can guarantee payment once the materials are delivered. These examples illustrate how this financial instrument can facilitate trust and security in commercial transactions.

Quick guide on how to complete irrevocable letter of credit 431119090

Handle Irrevocable Letter Of Credit effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Irrevocable Letter Of Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Irrevocable Letter Of Credit with ease

- Find Irrevocable Letter Of Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Irrevocable Letter Of Credit and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable letter of credit 431119090

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an irrevocable letter of credit sample?

An irrevocable letter of credit sample is a template that outlines the terms and conditions of a financial guarantee made by a bank on behalf of a buyer. It ensures payment to the seller upon meeting specific conditions, thus providing security in transactions. This sample can help businesses understand the structure and essential clauses included in such documents.

-

How can I create an irrevocable letter of credit using airSlate SignNow?

Creating an irrevocable letter of credit using airSlate SignNow is simple and user-friendly. You can start by using our customizable templates, including an irrevocable letter of credit sample, to tailor it to your specific needs. Once you fill in the necessary details, you can send it for eSignature quickly and securely.

-

What features does airSlate SignNow offer for managing letters of credit?

airSlate SignNow offers a range of features for managing letters of credit, including customizable templates, secure eSigning, and automated workflows. With these tools, you can efficiently create, send, and track documents like the irrevocable letter of credit sample. Additionally, our platform ensures compliance and reduces the risk of errors in your documentation.

-

Are there pricing options available for using airSlate SignNow for letters of credit?

Yes, airSlate SignNow offers flexible pricing plans to accommodate various business needs, making it cost-effective for managing documents like the irrevocable letter of credit sample. You can choose a plan that fits your budget and requirements while enjoying features that enhance your document workflows. Be sure to check our website for the latest pricing information.

-

What are the benefits of using an irrevocable letter of credit?

Using an irrevocable letter of credit provides several benefits, including financial security for both buyers and sellers. It eliminates payment risks and establishes trust in international trade transactions. By utilizing an irrevocable letter of credit sample, businesses can understand how to structure these agreements effectively.

-

Is it possible to integrate airSlate SignNow with other software for handling letters of credit?

Yes, airSlate SignNow supports integrations with various software solutions to streamline your document management processes, including letters of credit. This connectivity allows you to work seamlessly with your existing tools and enhances workflow efficiency. You can easily integrate using our APIs or third-party applications.

-

How does airSlate SignNow ensure the security of my irrevocable letter of credit documents?

airSlate SignNow prioritizes the security of your documents, including irrevocable letter of credit samples, through advanced encryption and secure storage solutions. Our platform complies with industry standards, ensuring that your sensitive information is protected. You can also track document activity and control access to maintain confidentiality.

Get more for Irrevocable Letter Of Credit

- Oncotype requisition form

- 4 h agility score sheet basic elementary novice advanced dog form

- Ssm template form

- Georgia military pension fund retirement application form

- Sales and use tax nc form

- Virginia quilting bedding work order form

- Request for staff exclusion list check form providers must request

- Application for exemption from water and nyc form

Find out other Irrevocable Letter Of Credit

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity