57 Form

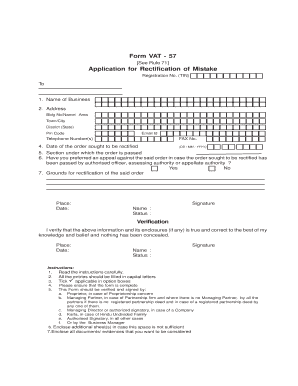

What is the 57 Form

The 57 form, often referred to as the VAT 57 form, is a document used in the United States for various purposes related to value-added tax (VAT) transactions. This form is essential for businesses that engage in activities subject to VAT, allowing them to report and manage their tax obligations effectively. Understanding the purpose of the 57 form is crucial for compliance and accurate financial reporting.

How to obtain the 57 Form

To obtain the VAT 57 form, businesses can typically access it through the official state tax authority's website or office. In many cases, the form is available for download in a PDF format, which can be printed and filled out manually. Alternatively, some states may offer an online submission process, allowing businesses to complete the form electronically. It is important to ensure that the correct version of the form is used, as different states may have variations.

Steps to complete the 57 Form

Completing the VAT 57 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including sales records and tax invoices. Next, enter the required information in the designated fields, ensuring that all figures are accurate and reflect the business's financial activities. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the 57 Form

The VAT 57 form holds legal significance in the context of tax compliance. When properly completed and submitted, it serves as a formal declaration of a business's VAT obligations. This form must adhere to specific legal requirements to be considered valid, including accurate reporting of financial data and timely submission to the relevant tax authority. Failure to comply with these legal standards can result in penalties or audits.

Key elements of the 57 Form

Several key elements must be included in the VAT 57 form for it to be complete and compliant. These elements typically include the business's name, address, and tax identification number, as well as detailed information regarding sales and purchases subject to VAT. Additionally, the form may require the submission of supporting documents to substantiate the reported figures, such as invoices or receipts.

Form Submission Methods

The VAT 57 form can be submitted through various methods, depending on state regulations. Common submission methods include online filing through the state tax authority's website, mailing a physical copy of the completed form, or delivering it in person to a local tax office. Each method has its own guidelines and deadlines, so it is essential for businesses to choose the most appropriate option for their needs.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the VAT 57 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by tax authorities. It is crucial for businesses to understand their obligations and ensure timely and accurate submission of the form to avoid these consequences. Regular training and updates on tax regulations can help mitigate the risk of non-compliance.

Quick guide on how to complete vat 57 form

Complete vat 57 form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle vat 57 on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign vat 57 form with ease

- Obtain 57 form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign vat 57 and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 57 form

Create this form in 5 minutes!

How to create an eSignature for the vat 57

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 57 form

-

What is VAT 57 and how does it relate to airSlate SignNow?

VAT 57 is a specific VAT exemption form that can be used for various business transactions. With airSlate SignNow, businesses can efficiently manage and eSign VAT 57 forms digitally, streamlining the process and ensuring compliance with tax regulations.

-

How does airSlate SignNow help in handling VAT 57 forms?

airSlate SignNow provides an intuitive platform for sending and signing VAT 57 forms electronically. This solution reduces paperwork and speeds up the process, making it easier for businesses to manage their VAT obligations.

-

What are the pricing plans for using airSlate SignNow for VAT 57 forms?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. The plans include features specifically designed for handling VAT 57 forms, ensuring you get the best value for your eSigning needs.

-

Does airSlate SignNow offer any features specifically for VAT 57 compliance?

Yes, airSlate SignNow includes features that help ensure compliance with VAT 57 regulations. This includes secure storage, audit trails, and customizable templates that can help you meet legal requirements efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software for VAT 57?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing you to manage your VAT 57 forms alongside your financial data. This integration enhances workflow efficiency and accuracy.

-

What benefits does airSlate SignNow provide for managing VAT 57 documentation?

Using airSlate SignNow for your VAT 57 documentation offers several benefits, including enhanced security, reduced processing time, and improved organization. You can track and manage your documents in real-time, which helps streamline your VAT processes.

-

Is there a mobile app available for signing VAT 57 forms on-the-go?

Yes, airSlate SignNow offers a mobile app that allows users to easily sign VAT 57 forms from anywhere. This flexibility ensures that you can manage your business documentation even when you’re not at your desk.

Get more for vat 57

- A 4a2 indd form

- January 5 to our clients kakimoto amp nagashima llp form

- Business registration packet oklahoma tax commission ok gov tax ok form

- Idaho income tax substitute form specifications tax idaho

- Study minnesota public radio minnesota publicradio form

- 177 tuesday september 13 notices table 10 summary of current economic parameter estimates gpo form

- Guidelines presenting jazz chamber music america chamber music form

- Pregnancy disability leave request form

Find out other vat 57 form

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe