Self Employment Income Form

Understanding Self Employment Income

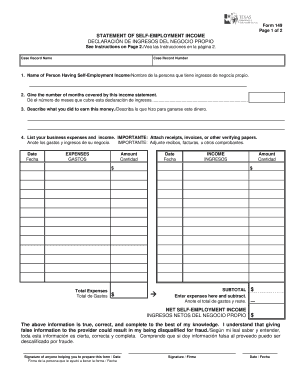

Self employment income refers to the earnings generated by individuals who work for themselves rather than for an employer. This income can come from various sources, such as freelance work, consulting, or running a small business. It is essential for self-employed individuals to accurately report their income to the IRS, as it affects tax obligations and eligibility for certain benefits.

Steps to Complete the Self Employment Income Form

Filling out the self employment income form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including profit and loss statements, invoices, and receipts. Next, complete the form by detailing your income and expenses. It is crucial to provide accurate figures, as discrepancies can lead to penalties. Finally, review the completed form for errors before submitting it to the appropriate tax authority.

Legal Use of the Self Employment Income Form

The self employment income form is legally binding when filled out correctly. To ensure its validity, it must be signed and dated by the individual reporting the income. Electronic signatures are acceptable under the ESIGN Act, provided that the signing process meets specific legal standards. This includes using a secure eSignature solution that complies with relevant regulations.

IRS Guidelines for Self Employment Income

The IRS provides clear guidelines on how to report self employment income. Self-employed individuals must file a Schedule C (Form 1040) to report income or loss from their business. Additionally, they are required to pay self-employment tax, which covers Social Security and Medicare taxes. It is vital to keep accurate records of all income and expenses to support claims made on the form.

Required Documents for Self Employment Income Reporting

When preparing to fill out the self employment income form, certain documents are essential. These include:

- Profit and loss statements

- Invoices issued to clients

- Receipts for business expenses

- Bank statements

- Any 1099 forms received from clients

Having these documents readily available will streamline the reporting process and help ensure accuracy.

Penalties for Non-Compliance with Self Employment Income Reporting

Failure to accurately report self employment income can result in significant penalties from the IRS. These may include fines, interest on unpaid taxes, and potential audits. It is crucial for self-employed individuals to stay informed about their reporting obligations to avoid these consequences. Regularly reviewing financial records and consulting with a tax professional can help mitigate risks associated with non-compliance.

Quick guide on how to complete self employment income 249325164

Complete Self Employment Income seamlessly on any device

Digital document management has become increasingly popular with organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without complications. Manage Self Employment Income on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to update and electronically sign Self Employment Income effortlessly

- Locate Self Employment Income and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or inaccuracies that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign Self Employment Income and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self employment income 249325164

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the des self employment form and how does it work?

The des self employment form is a document used to report income generated from self-employment to the relevant tax authorities. It provides a structured way for freelancers and independent contractors to declare their earnings and related expenses. Utilizing airSlate SignNow, you can easily fill out and eSign this form, streamlining your filing process.

-

How can I get access to the des self employment form through airSlate SignNow?

To access the des self employment form on airSlate SignNow, simply create an account and navigate to our templates section. You can easily search for the des self employment form and customize it as needed. SignNow's intuitive platform makes it simple to use and complete your forms electronically.

-

Is airSlate SignNow a cost-effective solution for managing the des self employment form?

Yes, airSlate SignNow offers competitive pricing plans that cater to individuals and small businesses, making it a cost-effective solution for managing the des self employment form. By shifting to an electronic platform, you save on printing and mailing costs. Plus, the efficiency of completing forms online contributes to overall cost savings.

-

What features does airSlate SignNow offer for the des self employment form?

airSlate SignNow includes numerous features for the des self employment form, such as template customization, electronic signatures, and easy sharing options. You can collaborate with your accountant or business partner directly through the platform. Additionally, secure storage and easy retrieval of your forms ensure you never lose important documents.

-

Can I integrate airSlate SignNow with other tools for managing my self-employment documents?

Absolutely! airSlate SignNow offers integrations with various tools like Google Drive, Dropbox, and CRM systems. This ensures that you can easily manage the des self employment form alongside your other business documents. These integrations enhance your workflow and improve document management efficiency.

-

How does using airSlate SignNow for the des self employment form benefit my business?

Using airSlate SignNow for the des self employment form can signNowly streamline your document workflow. It reduces the time spent on paperwork and minimizes errors in form completion. As a result, you can focus more on your business priorities while ensuring compliance with tax requirements.

-

What support is available for users of the des self employment form on airSlate SignNow?

AirSlate SignNow provides comprehensive customer support for users managing the des self employment form. You can access a wealth of resources, including tutorials, FAQs, and live chat assistance. This support ensures that you can effectively utilize the platform and resolve any issues promptly.

Get more for Self Employment Income

- Pratiyogita form

- Global stock plan services letter of authorization for stock form

- Intake application form

- End use statement for dual use items form

- Partnership declaration format

- Hardee county building department form

- A basketball camp for girls that will focus on the teaching of the fundamentals of basketball form

- Legacy high school jrotc raider team wordpress com form

Find out other Self Employment Income

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free