Schedule Se for Form

What is the Schedule SE for Form

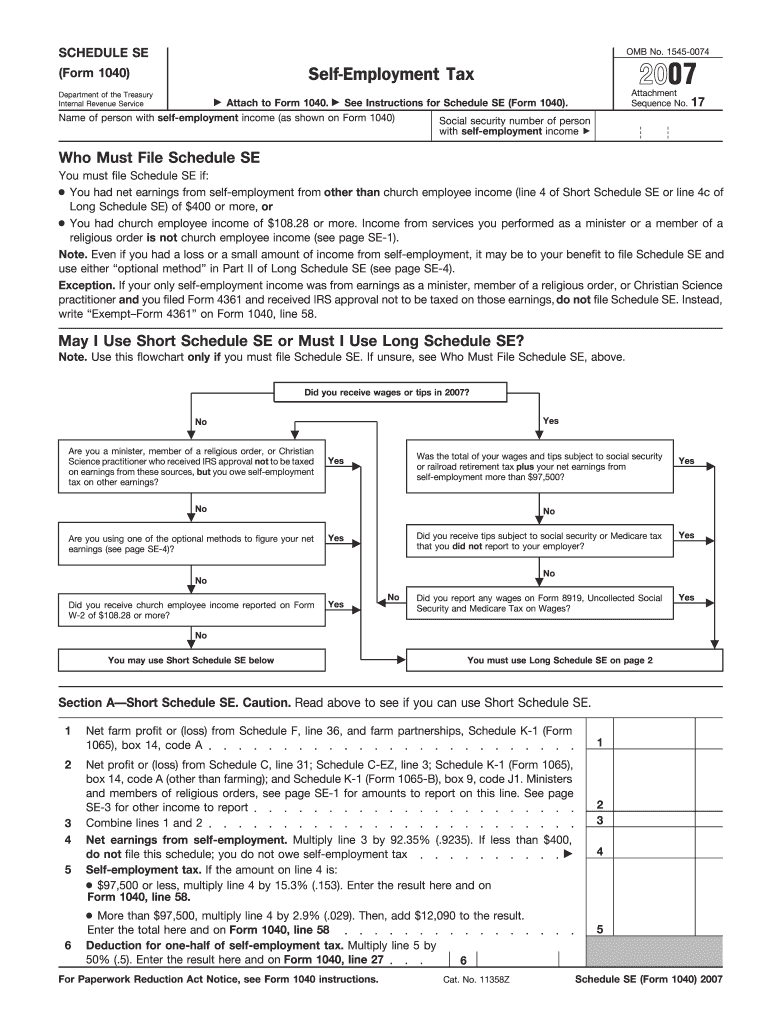

The Schedule SE for Form is a tax form used by self-employed individuals to calculate their self-employment tax. This form is essential for reporting income earned from self-employment, which is subject to Social Security and Medicare taxes. It is typically filed alongside Form 1040, the individual income tax return, to ensure that self-employed individuals contribute appropriately to these federal programs. Understanding the Schedule SE is crucial for anyone who earns income outside of traditional employment, including freelancers, independent contractors, and small business owners.

How to use the Schedule SE for Form

Using the Schedule SE for Form involves several steps. First, gather all relevant income information from your self-employment activities. This includes income from freelance work, business operations, or any other self-employed endeavors. Next, complete the form by calculating your net earnings from self-employment, which is typically derived from your business income minus allowable business expenses. Finally, transfer the calculated self-employment tax amount to your Form 1040. Accurate completion of this form ensures you meet your tax obligations and avoid penalties.

Steps to complete the Schedule SE for Form

Completing the Schedule SE for Form involves a systematic approach:

- Step 1: Gather all income documentation related to your self-employment activities.

- Step 2: Calculate your net earnings by subtracting your business expenses from your total income.

- Step 3: Fill out the form, starting with your net earnings and applying the appropriate tax rates.

- Step 4: Review your calculations to ensure accuracy.

- Step 5: Transfer the self-employment tax amount to your Form 1040.

Legal use of the Schedule SE for Form

The Schedule SE for Form is legally binding when accurately completed and submitted to the Internal Revenue Service (IRS). It must be filed by individuals who meet the self-employment income threshold, which is currently set at $400 or more in net earnings. Failure to file this form can result in penalties and interest on unpaid taxes. It is important to adhere to IRS guidelines and ensure that all information reported is truthful and complete to avoid legal repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule SE for Form. These guidelines include instructions on how to calculate your net earnings, the applicable tax rates, and the deadlines for submission. It is essential to follow these guidelines to ensure compliance with tax laws. The IRS also offers resources and publications that can assist in understanding the intricacies of self-employment taxes and the proper use of the Schedule SE.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE for Form align with the due date for Form 1040, which is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Individuals who require additional time to file may submit an extension request, which grants an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete schedule se for form

Complete Schedule Se For Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Schedule Se For Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Schedule Se For Form without any hassle

- Locate Schedule Se For Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign Schedule Se For Form and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule se for form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of 'Schedule Se For Form' in airSlate SignNow?

'Schedule Se For Form' allows users to define specific dates and times for when documents should be signed. This feature streamlines the signing process, ensuring that all stakeholders know their deadlines, resulting in faster turnaround times for important documents.

-

How does airSlate SignNow's pricing structure work for 'Schedule Se For Form'?

The pricing for using the 'Schedule Se For Form' feature is included in the overall subscription plans for airSlate SignNow. Each plan offers various tiers based on user needs, encompassing document signing, scheduling, and additional features tailored for different business sizes.

-

Can I customize the signing schedule with 'Schedule Se For Form'?

Yes, airSlate SignNow allows users to customize the signing schedule with 'Schedule Se For Form'. You can specify not only the date but also the time, so that signatories are alerted when it's time to review and sign the document.

-

What integrations does airSlate SignNow offer with 'Schedule Se For Form'?

airSlate SignNow offers seamless integrations with various platforms, allowing you to incorporate 'Schedule Se For Form' into your existing workflows. This includes integrations with CRM systems, project management tools, and cloud storage services, making document scheduling easier.

-

What are the main benefits of using 'Schedule Se For Form'?

The primary benefits of using 'Schedule Se For Form' include improved organization, time management, and accountability in your document processes. This feature helps reduce delays by ensuring everyone knows when their action is needed, which can enhance overall efficiency.

-

Is 'Schedule Se For Form' suitable for businesses of all sizes?

'Schedule Se For Form' is designed to cater to businesses of all sizes, from startups to enterprises. Whether you are managing a small team or a large organization, this feature can help streamline your document signing processes effectively.

-

How does 'Schedule Se For Form' improve document management?

By using 'Schedule Se For Form', businesses can enhance document management signNowly. It minimizes the risk of overlooked deadlines, promotes systematic tracking of signatures, and ensures all parties are aware of their responsibilities.

Get more for Schedule Se For Form

Find out other Schedule Se For Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free