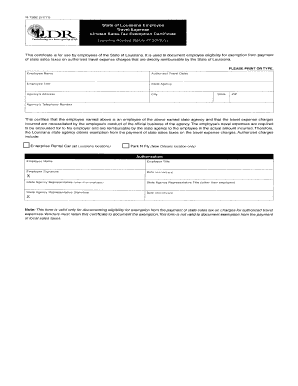

Louisiana Sales Tax Exemption Form PDF

What is the Louisiana Sales Tax Exemption Form PDF

The Louisiana Sales Tax Exemption Form PDF is a document used by individuals and businesses to claim exemption from sales tax on certain purchases. This form is essential for entities that qualify for tax-exempt status under Louisiana law, such as non-profit organizations, government agencies, and certain educational institutions. By completing this form, eligible entities can purchase goods and services without incurring sales tax, thus reducing their overall expenses.

How to use the Louisiana Sales Tax Exemption Form PDF

To use the Louisiana Sales Tax Exemption Form PDF, first ensure that you meet the eligibility criteria for tax exemption. Once confirmed, download the form from a reliable source. Fill out the required fields, including your name, address, and the reason for the exemption. After completing the form, present it to the vendor at the time of purchase. It is important to keep a copy for your records as it may be needed for future reference or audits.

Steps to complete the Louisiana Sales Tax Exemption Form PDF

Completing the Louisiana Sales Tax Exemption Form PDF involves several straightforward steps:

- Download the form from an official source.

- Enter your legal name and address in the designated fields.

- Specify the reason for the exemption, referencing the applicable law or regulation.

- Sign and date the form to validate it.

- Provide the completed form to the vendor when making a purchase.

Key elements of the Louisiana Sales Tax Exemption Form PDF

The Louisiana Sales Tax Exemption Form PDF contains several key elements that must be accurately filled out to ensure its validity. These include:

- Entity Information: Name and address of the tax-exempt entity.

- Exemption Reason: A clear statement of the reason for the exemption.

- Signature: The authorized representative must sign the form.

- Date: The date on which the form is completed.

Eligibility Criteria

Eligibility for using the Louisiana Sales Tax Exemption Form PDF typically includes various categories such as:

- Non-profit organizations recognized under IRS regulations.

- Government entities at the federal, state, or local level.

- Educational institutions that meet specific criteria.

It is crucial for applicants to verify their status before attempting to use the exemption form.

Form Submission Methods

The Louisiana Sales Tax Exemption Form PDF can be submitted in several ways, depending on the vendor's policies:

- In-Person: Present the completed form directly to the vendor at the time of purchase.

- Online: Some vendors may allow electronic submission of the form via email or their website.

- Mail: In certain cases, you may need to mail the form to the vendor for their records.

Quick guide on how to complete louisiana sales tax exemption form pdf

Complete Louisiana Sales Tax Exemption Form Pdf effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Louisiana Sales Tax Exemption Form Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign Louisiana Sales Tax Exemption Form Pdf with ease

- Locate Louisiana Sales Tax Exemption Form Pdf and then click Get Form to initiate the process.

- Employ the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Louisiana Sales Tax Exemption Form Pdf and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana sales tax exemption form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana sales tax exemption form PDF?

The Louisiana sales tax exemption form PDF is a document that allows qualifying purchases to be exempt from sales tax. This form is essential for businesses and organizations that meet specific criteria under Louisiana law. By using this form, eligible entities can save money on their purchases and manage their tax obligations effectively.

-

How can I obtain the Louisiana sales tax exemption form PDF?

You can easily obtain the Louisiana sales tax exemption form PDF from the official Louisiana Department of Revenue website or through airSlate SignNow. Simply visit our platform, access the document library, and download the form. Our platform simplifies the retrieval and filing process for your convenience.

-

Does airSlate SignNow support eSigning the Louisiana sales tax exemption form PDF?

Yes, airSlate SignNow offers seamless eSigning capabilities for the Louisiana sales tax exemption form PDF. This means you can fill out the form electronically and have it signed and submitted without any need for printing. The eSigning feature enhances efficiency and helps you save time in the document management process.

-

What are the benefits of using airSlate SignNow for the Louisiana sales tax exemption form PDF?

Using airSlate SignNow for the Louisiana sales tax exemption form PDF provides a host of benefits, including quick access, easy eSigning, and secure document storage. Our platform is user-friendly, allowing you to complete and manage your forms without hassle. Additionally, you can track document status and ensure all required signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for filing the Louisiana sales tax exemption form PDF?

Absolutely! airSlate SignNow offers a cost-effective solution for filing the Louisiana sales tax exemption form PDF. With subscription plans tailored for businesses of all sizes, you can choose the best fit for your needs without breaking the bank. This pricing model allows you to maximize value while minimizing costs associated with traditional document handling.

-

What integrations does airSlate SignNow offer for managing the Louisiana sales tax exemption form PDF?

airSlate SignNow provides numerous integrations with popular tools and platforms, enhancing your ability to manage the Louisiana sales tax exemption form PDF efficiently. You can sync with cloud storage services, CRMs, and project management tools to streamline workflows. These integrations ensure a smooth process from document creation to eSigning and storage.

-

Can I customize the Louisiana sales tax exemption form PDF in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Louisiana sales tax exemption form PDF according to their specific needs. You can add custom fields, logos, and other elements to tailor the document for your organization. This flexibility helps you create a professional and personalized experience for all your stakeholders.

Get more for Louisiana Sales Tax Exemption Form Pdf

- Tax code declarationir330july 2022use this form if

- Utilities account transfer formpdflaw of agencyfee

- Form i 212 application for permission to reapply for admission into

- Fillable online rsk application double agreements iceland form

- Fillable online l 0759 fax email print pdffiller form

- Dual barber shop and cosmetology salon license application form

- Documents submitted with you application will not be returned form

- Form 4 508

Find out other Louisiana Sales Tax Exemption Form Pdf

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document