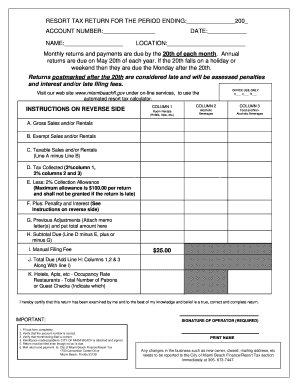

City of Miami Beach Resort Tax Form

What is the City Of Miami Beach Resort Tax

The City of Miami Beach Resort Tax is a local tax imposed on short-term rentals and hotel accommodations within the city. This tax is designed to generate revenue for the city, which can be used for various public services and infrastructure projects. The tax rate is typically a percentage of the total rental fee charged to guests, and it is applicable to all visitors staying in hotels, motels, and other lodging facilities for six months or less. Understanding this tax is essential for both property owners and guests to ensure compliance and proper financial planning.

How to use the City Of Miami Beach Resort Tax

Using the City of Miami Beach Resort Tax involves understanding how it applies to your rental or accommodation situation. Property owners must collect the tax from guests and remit it to the city. This process typically includes calculating the tax based on the rental fee, ensuring accurate record-keeping, and submitting the collected tax to the appropriate city department. For guests, it is important to be aware that this tax will be added to the total cost of their stay, impacting their overall budget.

Steps to complete the City Of Miami Beach Resort Tax

Completing the City of Miami Beach Resort Tax involves several key steps:

- Determine the applicable tax rate based on the type of accommodation.

- Calculate the total tax due by applying the rate to the rental fee.

- Collect the tax from guests at the time of payment.

- Maintain accurate records of all transactions and tax collected.

- Submit the collected tax to the City of Miami Beach by the designated deadlines.

Legal use of the City Of Miami Beach Resort Tax

The legal use of the City of Miami Beach Resort Tax is governed by local laws and regulations. Property owners must ensure they are compliant with these laws to avoid penalties. This includes properly registering their business, accurately collecting the tax, and timely remitting it to the city. Failure to comply can result in fines or legal action, emphasizing the importance of understanding the legal framework surrounding this tax.

Filing Deadlines / Important Dates

Filing deadlines for the City of Miami Beach Resort Tax are crucial for compliance. Typically, property owners must submit their collected taxes on a monthly basis. Important dates include the last day of each month for collecting taxes and the submission deadline, which is usually set for the 20th of the following month. Staying informed about these deadlines helps avoid late fees and ensures that all tax obligations are met.

Required Documents

To properly manage the City of Miami Beach Resort Tax, certain documents are required. Property owners should maintain records of all rental agreements, invoices, and receipts related to the collection of the tax. Additionally, any forms provided by the city for tax reporting must be completed accurately. Keeping organized documentation is essential for both compliance and financial management.

Quick guide on how to complete city of miami beach resort tax

Prepare city of miami beach resort tax effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage resort tax miami beach on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign miami beach resort tax effortlessly

- Obtain miami beach resort tax login and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign miami beach hotel local taxes breakdown and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to miami beach hotel local taxes breakdown

Create this form in 5 minutes!

How to create an eSignature for the city of miami beach resort tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask miami beach resort tax

-

What is the Miami Beach resort tax and how does it apply to my stay?

The Miami Beach resort tax is an additional fee applied to hotel and resort accommodations in the city. This tax typically ranges from 6% to 7% and is added on top of your room rate. Understanding this tax ensures you are aware of the total cost of your stay, helping you budget accordingly.

-

How is the Miami Beach resort tax collected during my booking?

The Miami Beach resort tax is usually collected at the time of booking or check-in by your hotel or resort. It is added to your final bill, so you should ensure that you review it before confirming your payment. Knowing how this tax is applied helps you understand your overall expenses.

-

Are there any exemptions to the Miami Beach resort tax?

Certain exemptions may apply to the Miami Beach resort tax, including exceptions for government employees traveling on official business or certain charities. It’s advisable to check with your resort to see if you qualify for any exemptions, as this can help reduce your overall costs during your stay.

-

How can I minimize the impact of the Miami Beach resort tax on my travel budget?

To minimize the impact of the Miami Beach resort tax on your travel budget, consider booking hotels that offer promotions or lower rates that already account for this tax. Additionally, exploring vacation rentals may provide alternatives that are exempt from the tax. Always calculate the total price, including taxes, to compare your options effectively.

-

What services can I access while staying at a resort with a Miami Beach resort tax?

While the Miami Beach resort tax may seem like an added expense, it often funds services and amenities for guests, such as beach maintenance, tourism promotion, and local events. Staying at resorts that collect this tax can enhance your vacation experience through improved facilities and local engagements.

-

Is the Miami Beach resort tax included in the price quoted online?

Most online booking platforms do not include the Miami Beach resort tax in the initial quote for hotel stays. Be sure to read the fine print and check your final total before completing your reservation. Understanding this upfront can prevent surprises in your overall travel expenses.

-

What are the consequences of not paying the Miami Beach resort tax?

Failing to pay the Miami Beach resort tax may result in additional charges at check-out or potential issues with your hotel reservation. Resorts are obligated to collect this tax, therefore not addressing it can lead to complications during your stay, including penalties or fines.

Get more for miami beach resort tax login

- Membership proposal form skal roma skalroma

- Ds 5525 2016 2019 form

- Forms department of land and natural resources hawaiigov dobor ehawaii

- Name your consultants name occupation date address phone h w c email do you use mk products form

- Signalofficesupply office supply line card form

- Credit card authorization form silkscreen suppliescom

- Hcbs rent subsidy application iowa finance authority iowafinanceauthority form

- Free texas small estate affidavit form pdf word eforms collincountytx

Find out other miami beach hotel local taxes breakdown

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy