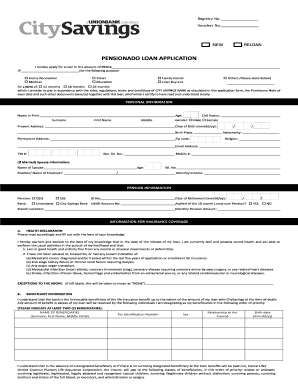

Union Bank Gsis Pension Loan Form

What is the Union Bank GSIS Pension Loan

The Union Bank GSIS Pension Loan is a financial product designed specifically for pensioners who are members of the Government Service Insurance System (GSIS) in the Philippines. This loan allows retirees to access funds against their pension benefits, providing them with financial support during their retirement years. The loan amount is typically based on the pensioner's monthly pension, offering a way to meet unexpected expenses or to improve their quality of life.

Eligibility Criteria

To qualify for the Union Bank GSIS Pension Loan, applicants must meet specific criteria. Generally, eligible individuals include retired government employees who are receiving a pension from the GSIS. Key requirements may include:

- Must be a member of the GSIS with an active pension.

- Must be at least 60 years old at the time of application.

- Must have no outstanding loans or obligations with the GSIS.

Meeting these criteria is essential for a smooth application process and timely approval.

Steps to Complete the Union Bank GSIS Pension Loan

Completing the Union Bank GSIS Pension Loan application involves several steps to ensure that all necessary information is accurately provided. The process typically includes:

- Gather required documents, such as proof of identity and pension statements.

- Fill out the pension loan application form, ensuring all information is complete.

- Submit the application either online or in person at a Union Bank branch.

- Wait for the approval process, which may take a few days.

- Receive the loan amount upon approval, which can be credited directly to the pensioner's bank account.

Required Documents

When applying for the Union Bank GSIS Pension Loan, several documents are necessary to facilitate the application process. Commonly required documents include:

- Valid government-issued identification (e.g., passport, driver's license).

- Latest pension statement from GSIS.

- Completed pension loan application form.

- Proof of any other income or financial obligations, if applicable.

Having these documents ready can help streamline the application process and reduce delays.

How to Obtain the Union Bank GSIS Pension Loan

Obtaining the Union Bank GSIS Pension Loan involves a straightforward process. Applicants can start by visiting the Union Bank website to access the pension loan application form. Alternatively, they can visit a local branch for assistance. The application can be submitted online or in person, depending on the applicant's preference. Once submitted, the bank will review the application and notify the applicant of the approval status.

Legal Use of the Union Bank GSIS Pension Loan

The Union Bank GSIS Pension Loan must be used in compliance with applicable laws and regulations. It is essential for borrowers to understand the terms of the loan agreement, including interest rates and repayment schedules. Proper use of the loan funds is also crucial, as it is intended to support the financial needs of pensioners. Failure to adhere to the loan agreement may result in penalties or legal actions.

Quick guide on how to complete union bank gsis pension loan

Easily Prepare Union Bank Gsis Pension Loan on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without any holdups. Handle Union Bank Gsis Pension Loan on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign Union Bank Gsis Pension Loan Effortlessly

- Locate Union Bank Gsis Pension Loan and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Edit and eSign Union Bank Gsis Pension Loan to ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the union bank gsis pension loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the union bank gsis pension loan?

The union bank gsis pension loan is a financial product designed for government retirees to access funds against their GSIS pension. This loan is tailored specifically for individuals receiving pension benefits, providing them with an affordable and accessible way to secure needed finances.

-

How can I apply for the union bank gsis pension loan?

To apply for the union bank gsis pension loan, you will need to visit the union bank website or your nearest branch. The application process typically requires you to submit your GSIS pension details along with necessary identification documents for verification.

-

What are the benefits of the union bank gsis pension loan?

The union bank gsis pension loan offers several benefits, including competitive interest rates and flexible repayment terms. Additionally, this loan allows pensioners to have quick access to funds, which can be crucial for meeting urgent financial needs.

-

Are there any fees associated with the union bank gsis pension loan?

Yes, there may be fees associated with the union bank gsis pension loan, including processing fees or insurance costs. It is advisable to review the loan agreement carefully to understand all possible charges before proceeding with your application.

-

Can I use the union bank gsis pension loan for multiple purposes?

Absolutely! The union bank gsis pension loan can be used for various purposes such as home renovations, medical expenses, or even personal projects. This flexibility allows pensioners to make the most of their loan benefits according to their specific needs.

-

What documents are required for the union bank gsis pension loan application?

When applying for the union bank gsis pension loan, you will typically need to provide your GSIS pension certificate, valid identification, proof of residency, and any other financial documents the bank may request. Ensuring that all documentation is in order can expedite your loan approval process.

-

How long does it take to get approved for the union bank gsis pension loan?

Approval for the union bank gsis pension loan can vary, but many applicants receive a decision within a few business days. Factors such as completeness of your application and verification of your documents can influence the overall approval timeline.

Get more for Union Bank Gsis Pension Loan

- Informal outline

- Mo social services request for backdate mo 886 4405 form

- Fairfax motions day praecipe form

- Pdf form example foersom

- Financial statement supplement forms u s department forms sc egov usda

- Personal financing i application form v6x

- Air force verbal counseling mfr example form

- Certificate of dependency and concurrent employment form

Find out other Union Bank Gsis Pension Loan

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now