1099 Information Request Form

What is the 1099 information request form?

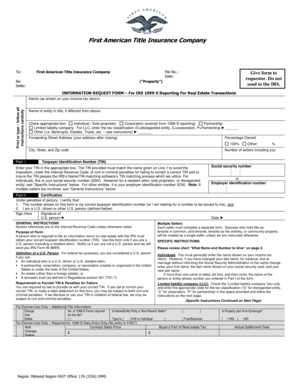

The 1099 information request form is a crucial document used primarily in the United States for tax purposes. It is designed to collect information from independent contractors, freelancers, and other non-employee service providers. This form helps businesses report payments made to individuals who are not on their payroll. The information gathered through this form is essential for accurate tax reporting and compliance with Internal Revenue Service (IRS) regulations.

How to use the 1099 information request form

Using the 1099 information request form involves several key steps. First, the business requesting the information must provide the form to the individual or entity from whom they need details. This includes requesting the recipient's name, address, and taxpayer identification number (TIN). Once the form is completed by the recipient, it should be returned to the business for record-keeping and reporting purposes. This process ensures that both parties comply with IRS requirements regarding income reporting.

Steps to complete the 1099 information request form

Completing the 1099 information request form can be straightforward if you follow these steps:

- Begin by entering the name and address of the business requesting the information.

- Provide the name and address of the individual or entity filling out the form.

- Include the taxpayer identification number (TIN), which can be a Social Security number or an Employer Identification Number.

- Verify that all information is accurate and complete before submitting the form.

Once filled out, the form should be signed and returned to the requesting business, ensuring that both parties retain a copy for their records.

Legal use of the 1099 information request form

The legal use of the 1099 information request form is governed by IRS guidelines. It is essential for businesses to use this form to collect accurate information from non-employees to ensure proper tax reporting. Failure to collect or report this information can lead to penalties and compliance issues. The form serves as a protective measure for both the business and the individual, ensuring that all income is reported accurately to the IRS.

Key elements of the 1099 information request form

Several key elements are essential for the 1099 information request form to be valid:

- Recipient's Name: The full legal name of the individual or business receiving payments.

- Address: The current mailing address of the recipient.

- Taxpayer Identification Number: This can be a Social Security number or Employer Identification Number.

- Signature: The recipient must sign the form to verify that the information provided is accurate.

Including these elements ensures that the form meets IRS requirements and can be used effectively for tax reporting.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1099 information request form. It is important for businesses to familiarize themselves with these guidelines to ensure compliance. The IRS requires that all payments made to non-employees exceeding a certain threshold be reported using the 1099 form. Additionally, businesses must ensure that they collect the necessary information from recipients in a timely manner to avoid penalties. Understanding these guidelines helps businesses maintain accurate records and fulfill their tax obligations.

Quick guide on how to complete 1099 information request form 100088392

Complete 1099 Information Request Form effortlessly on any device

Managing documents online has become increasingly popular with organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and electronically sign your documents quickly and without delay. Handle 1099 Information Request Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign 1099 Information Request Form effortlessly

- Find 1099 Information Request Form and then click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 1099 Information Request Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 information request form 100088392

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 information request form?

A 1099 information request form is a document used by businesses to request important tax information from contractors or freelancers. This form is crucial for ensuring accurate tax reporting and compliance with IRS regulations. Utilizing airSlate SignNow simplifies the process of sending and eSigning these forms.

-

How can airSlate SignNow help with the 1099 information request form?

airSlate SignNow provides a user-friendly platform for creating, sending, and managing your 1099 information request forms. With our digital signature feature, you can quickly gather the necessary information from contractors and ensure compliance. The solution is both efficient and secure, allowing for seamless transactions.

-

Is there a cost associated with using airSlate SignNow for 1099 information request forms?

Yes, airSlate SignNow offers various pricing plans to accommodate your business needs when handling 1099 information request forms. Each plan is cost-effective and designed to provide value, ensuring you get the features you need without overspending. You can choose a plan that best fits your organization’s requirements.

-

What features does airSlate SignNow offer for managing 1099 information request forms?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, secure storage, and tracking for your 1099 information request forms. These tools enhance your document management process, allowing you to focus on your business while we handle the paperwork. Our intuitive interface makes managing these forms incredibly easy.

-

Can I integrate airSlate SignNow with other tools when handling 1099 information request forms?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Workspace, Salesforce, and more. This compatibility ensures that your 1099 information request forms can seamlessly connect with your existing workflow, enhancing productivity and efficiency.

-

What benefits can I expect from using airSlate SignNow for 1099 information request forms?

Using airSlate SignNow for your 1099 information request forms streamlines the document signing process, saves time, and increases compliance accuracy. Our digital platform minimizes the risk of errors and enhances collaboration between parties. Additionally, you can access your documents from anywhere, making it easier to stay organized.

-

Are there any tutorials or support for using 1099 information request forms with airSlate SignNow?

Yes, airSlate SignNow provides a wealth of resources, including tutorials and customer support, to help you with 1099 information request forms. Our help center includes step-by-step guides and FAQs to assist you in navigating the platform. You can also signNow out to our support team for personalized assistance.

Get more for 1099 Information Request Form

- Registration membership application gssfonlinecom form

- Knee brace letter of medical form

- Aboutchet form

- Addendum to police report form

- Naming and writing covalent molecules notes answer key form

- Form it 112 c new york state resident credit for taxes paid to a

- Were working to keep medicine within your reach form

- Saas software license agreement template form

Find out other 1099 Information Request Form

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online