Mw507m Form

What is the Mw507m

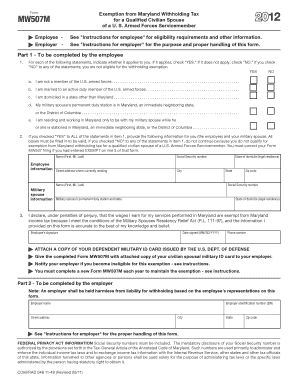

The Mw507m is a form used primarily for tax purposes in the United States. It serves as a withholding exemption certificate, allowing employees to claim exemptions from state income tax withholding. This form is essential for individuals who wish to reduce the amount of state tax withheld from their paychecks, particularly if they expect to owe no state tax or if their tax liability is lower than the amount being withheld. Understanding the Mw507m is crucial for employees to ensure they are not overpaying their state taxes throughout the year.

How to use the Mw507m

Utilizing the Mw507m involves several straightforward steps. First, individuals must obtain the form from their employer or the state tax authority. Once in possession of the form, it is important to fill it out accurately, providing necessary personal information such as name, address, and Social Security number. Additionally, the form requires details regarding the number of exemptions being claimed. After completing the Mw507m, it should be submitted to the employer’s payroll department to adjust the state tax withholding accordingly.

Steps to complete the Mw507m

Completing the Mw507m involves a few key steps:

- Obtain the Mw507m form from your employer or state tax authority.

- Fill in your personal information, including your full name, address, and Social Security number.

- Indicate the number of exemptions you are claiming based on your tax situation.

- Review the form for accuracy to ensure all information is correct.

- Submit the completed form to your employer’s payroll department.

Following these steps will help ensure that your state tax withholding is adjusted appropriately.

Legal use of the Mw507m

The Mw507m is legally binding when completed accurately and submitted to the appropriate party. It is important to understand that providing false information on this form can lead to penalties, including fines or increased tax liability. To ensure compliance with state tax laws, individuals should familiarize themselves with the legal requirements surrounding the Mw507m, including eligibility criteria and the specific exemptions applicable to their situation.

Filing Deadlines / Important Dates

Filing deadlines for the Mw507m typically align with the beginning of the tax year or when an employee starts a new job. It is advisable to submit the form as soon as employment begins or when there are changes in personal circumstances that affect tax withholding. Staying aware of these deadlines can help prevent over-withholding and ensure that individuals maintain proper cash flow throughout the year.

Who Issues the Form

The Mw507m is issued by the state tax authority in the United States. Each state has its own version of the form, tailored to its specific tax regulations and requirements. Employers are responsible for providing the Mw507m to their employees, ensuring that they have access to the necessary forms to manage their state tax withholdings effectively.

Quick guide on how to complete mw507m 1046371

Complete Mw507m effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic environmentally friendly alternative to conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Mw507m on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Mw507m with ease

- Obtain Mw507m and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Alter and eSign Mw507m and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw507m 1046371

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mw507m and how does it work?

The mw507m is a powerful tool offered by airSlate SignNow that enables users to send, sign, and manage documents electronically. It streamlines the eSigning process by providing an intuitive interface that allows for quick and easy document handling. With the mw507m, businesses can enhance their workflow efficiency and eliminate the hassle of paper-based transactions.

-

What are the pricing options for the mw507m?

airSlate SignNow offers competitive pricing for the mw507m, catering to various business sizes and needs. Customers can choose from monthly or annual subscription plans that provide access to essential features at cost-effective rates. To find the plan that suits you best, visit our pricing page and explore the mw507m options available.

-

What features does the mw507m provide?

The mw507m comes packed with features like document templates, real-time collaboration, and secure cloud storage. Additionally, users can enjoy unlimited document signing and advanced tracking capabilities, ensuring a seamless eSigning experience. These features not only enhance productivity but also provide oversight and control over your document processes.

-

How can the mw507m benefit my business?

Using the mw507m can signNowly improve your business's operational efficiency by reducing the time and costs associated with managing paper documents. It allows for faster agreement turnaround, improving customer satisfaction and facilitating smoother transactions. Furthermore, the mw507m helps maintain compliance and enhances security, ensuring your documents are safe.

-

Is the mw507m compatible with other software?

Yes, the mw507m integrates seamlessly with various applications such as CRM systems, cloud storage solutions, and accounting software. This interoperability ensures that you can include eSigning in your existing workflows without the need for major changes. By using the mw507m, you can enhance productivity across your teams and tools.

-

How do I get support for the mw507m?

airSlate SignNow provides comprehensive support for the mw507m through multiple channels, including live chat, email assistance, and an extensive knowledge base. Customers can easily access tutorials and FAQs to troubleshoot common issues. Our dedicated support team is available to help you maximize the benefits of the mw507m.

-

Can I try the mw507m before purchasing?

Absolutely! airSlate SignNow offers a free trial for the mw507m, allowing potential customers to explore its features and benefits before making a commitment. During the trial, you can test all the functionalities of the mw507m, enabling you to determine if it meets your business’s eSigning needs.

Get more for Mw507m

- Form sev fee

- Prha housing application form

- Wood county hospital financial assistance form

- Application for marriage license pagkuha na pahintulot form

- California state tax return amendment on form 540

- Duvcw membership app page23 duvcw form

- Illinois early childhood education form

- Completed example rta form 18a pdf reset form print

Find out other Mw507m

- Sign Vermont Permission Slip Fast

- Sign Arizona Work Order Safe

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now