California State Tax Return Amendment on Form 540

Understanding Form 540NR

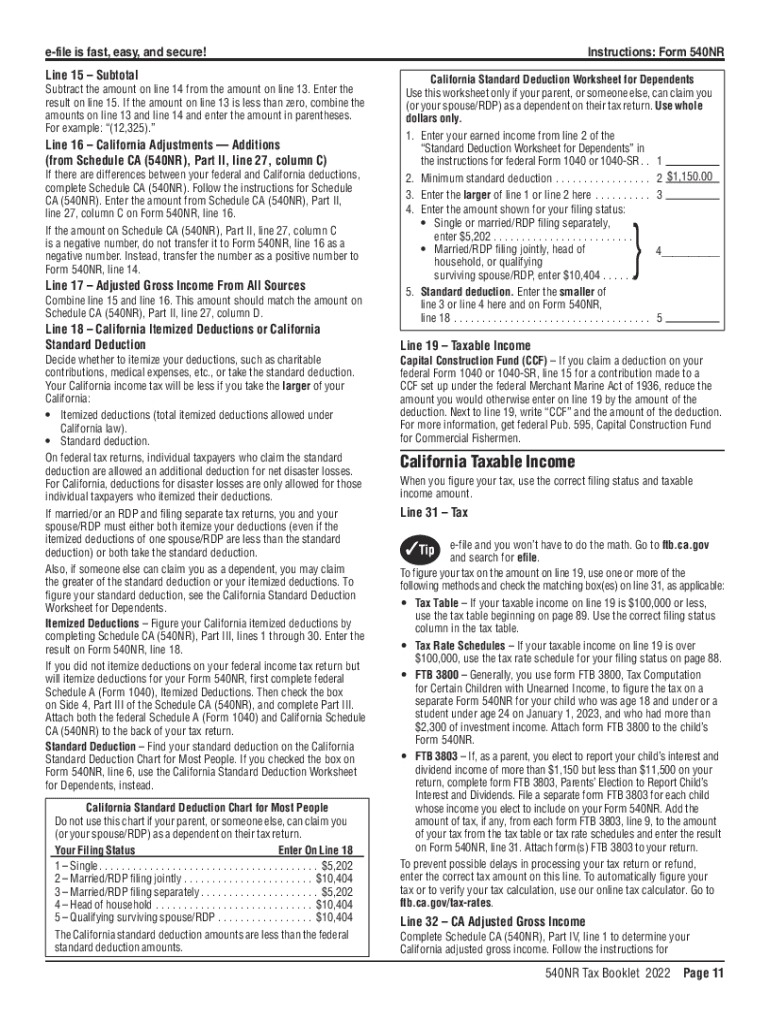

The California Form 540NR is a tax return specifically designed for non-residents and part-year residents of California. This form allows individuals to report their income earned within the state while excluding income earned outside California. It is essential for ensuring compliance with state tax regulations and accurately calculating any tax owed or refund due. Understanding the purpose of this form is crucial for anyone who has earned income in California but does not reside there full-time.

Steps to Complete Form 540NR

Filling out Form 540NR involves several key steps:

- Gather Required Documents: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine Filing Status: Identify whether you will file as single, married filing jointly, or married filing separately.

- Report Income: Enter all income earned in California on the appropriate lines of the form.

- Claim Deductions: Utilize any applicable deductions and credits to reduce your taxable income.

- Calculate Tax: Follow the instructions to compute the tax owed based on your income and deductions.

- Review and Sign: Ensure all information is accurate, sign the form, and date it before submission.

Required Documents for Form 540NR

To successfully complete Form 540NR, you will need to gather several important documents:

- W-2 Forms: These forms report your wages and taxes withheld from your employer.

- 1099 Forms: If you are self-employed or received other types of income, these forms will be necessary.

- Income Statements: Any additional documentation that reflects income earned in California.

- Previous Tax Returns: Having prior year returns can help in understanding your tax situation.

Filing Deadlines for Form 540NR

It is important to be aware of the filing deadlines associated with Form 540NR to avoid penalties:

- Standard Deadline: Typically, the deadline for filing is April 15 of the following year.

- Extensions: If you need more time, you can file for an extension, but any taxes owed must still be paid by the original deadline.

Form Submission Methods for 540NR

There are several ways to submit Form 540NR:

- Online Submission: You can file electronically through approved e-filing software.

- Mail: Print and mail the completed form to the address specified in the instructions.

- In-Person: Some individuals may choose to file in person at designated tax offices.

Key Elements of Form 540NR

Understanding the key elements of Form 540NR is essential for accurate filing:

- Personal Information: This includes your name, address, and Social Security number.

- Income Section: Clearly delineates income earned in California versus outside the state.

- Deductions and Credits: Identifies available deductions and credits to reduce taxable income.

- Signature Section: Requires your signature and date to validate the submission.

Quick guide on how to complete california state tax return amendment on form 540

Complete California State Tax Return Amendment On Form 540 effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage California State Tax Return Amendment On Form 540 on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

How to modify and eSign California State Tax Return Amendment On Form 540 with ease

- Obtain California State Tax Return Amendment On Form 540 and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or mask sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign California State Tax Return Amendment On Form 540 to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california state tax return amendment on form 540

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california 540nr ca and who needs it?

The california 540nr ca is a state tax form specifically designed for non-residents of California. It is required for individuals who earn income in California but do not live in the state. Properly filing this form ensures compliance with California tax laws and helps avoid any penalties.

-

How can airSlate SignNow help with filing the california 540nr ca?

airSlate SignNow streamlines the process of preparing and submitting your california 540nr ca by providing an intuitive eSigning solution. With our platform, users can easily fill out and electronically sign the form, saving time and reducing the likelihood of errors. This helps ensure that your tax documents are submitted accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for california 540nr ca?

Yes, airSlate SignNow offers several pricing plans that cater to various business needs, including features for managing california 540nr ca documents. The basic plan is affordable, providing essential tools for eSigning and document management. For more advanced features, users can opt for premium plans that include additional integrations and support.

-

What key features does airSlate SignNow offer for california 540nr ca document management?

airSlate SignNow boasts features such as customizable templates, secure storage, and automated workflows to assist in managing your california 540nr ca documents. The platform provides seamless collaboration tools, enabling multiple stakeholders to review and sign documents easily. Additionally, eSignature capabilities expedite the tax filing process.

-

How does airSlate SignNow ensure the security of california 540nr ca documents?

The security of your california 540nr ca documents is a top priority for airSlate SignNow. We utilize advanced encryption protocols and secure servers to protect your data during transmission and storage. All eSignatures are legally binding, and our platform complies with industry standards to ensure confidentiality and integrity.

-

Can I integrate airSlate SignNow with other applications for managing california 540nr ca?

Yes, airSlate SignNow offers numerous integrations with popular business applications, making it easier to manage your california 540nr ca documents alongside other tools you use. This allows for seamless data sharing and improved workflows, enhancing your overall efficiency and productivity when preparing tax documents.

-

What benefits does using airSlate SignNow provide for completing the california 540nr ca?

Using airSlate SignNow for your california 540nr ca simplifies the eSigning process and enhances document accuracy. It allows for faster turnaround times, reducing the stress of tax filing. Additionally, our user-friendly interface makes it accessible for users of all experience levels.

Get more for California State Tax Return Amendment On Form 540

- Low contrast test recording form

- E bank application individual 26aug15 sagicorja com form

- D league lpt player releaseeligibility form doc

- Cbre bid submission form bofa pdf pro construction inc

- Special power of attorney for representation in the extraordinary general meeting of the shareholders of comvex s comvex form

- Www dcc educulinary artsapplyculinary arts application delgado community college form

- Shippers letter of instruction rhlig logistics form

- Adavit for purchase of motor vehicles form

Find out other California State Tax Return Amendment On Form 540

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement