Withholding Tax Ghana PDF Form

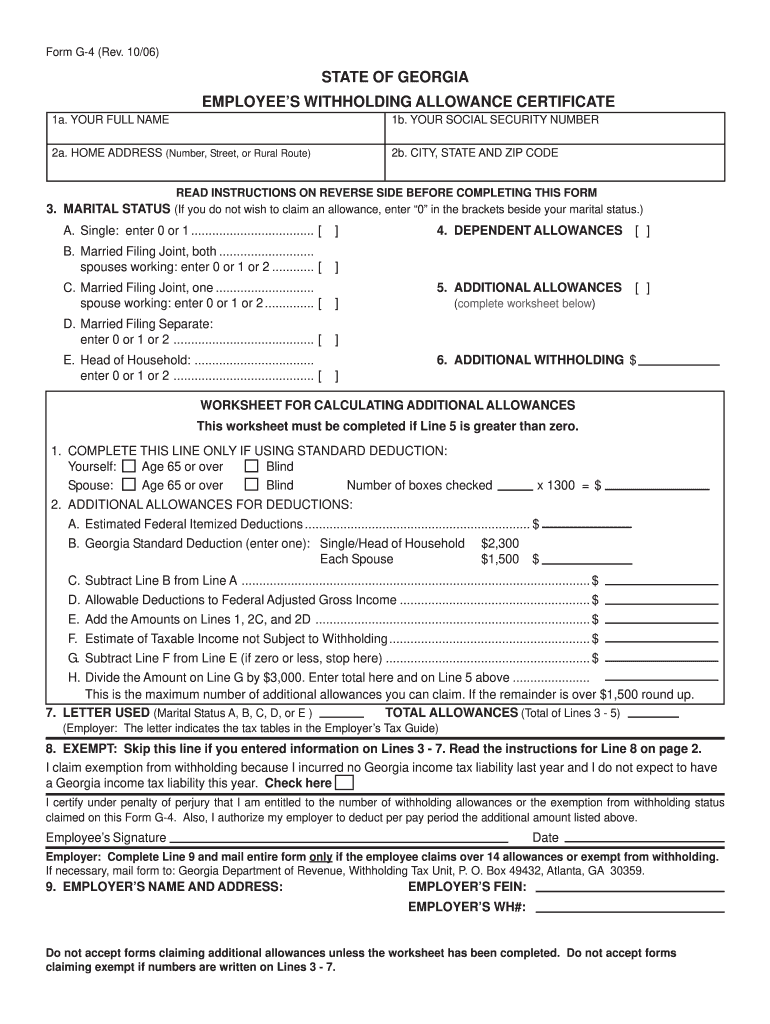

What is the Georgia State Withholding Tax Form?

The Georgia State Withholding Tax Form is a document used by employers to report and remit state income taxes withheld from employees' wages. This form is essential for ensuring compliance with state tax laws and for accurate payroll processing. Employers must complete this form to reflect the correct amount of state income tax withheld from each employee's paycheck, which is then submitted to the Georgia Department of Revenue.

Steps to Complete the Georgia State Withholding Tax Form

Completing the Georgia State Withholding Tax Form involves several key steps:

- Gather necessary information, including the employee's name, Social Security number, and total wages.

- Calculate the amount of state income tax to withhold based on the employee's earnings and the applicable withholding rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Georgia Department of Revenue by the specified deadline.

Legal Use of the Georgia State Withholding Tax Form

The Georgia State Withholding Tax Form is legally binding and must be filled out in accordance with state tax regulations. Employers are required to maintain accurate records of withheld taxes to ensure compliance with state laws. Failure to properly complete and submit this form can result in penalties and interest charges from the state.

Filing Deadlines for the Georgia State Withholding Tax Form

Employers must be aware of the filing deadlines for the Georgia State Withholding Tax Form to avoid penalties. Typically, the form is due on a monthly or quarterly basis, depending on the amount of tax withheld. It is crucial to check the Georgia Department of Revenue's guidelines for specific due dates and ensure timely submission.

Who Issues the Georgia State Withholding Tax Form?

The Georgia State Withholding Tax Form is issued by the Georgia Department of Revenue. This state agency oversees tax collection and compliance, providing the necessary forms and guidelines for employers. It is important for employers to refer to the Department's resources for the most current version of the form and any updates to withholding regulations.

Required Documents for Completing the Georgia State Withholding Tax Form

To complete the Georgia State Withholding Tax Form, employers need several key documents:

- Employee payroll records, including names and Social Security numbers.

- Wage and tax statements for each employee.

- Any relevant tax withholding agreements or forms completed by employees.

Quick guide on how to complete withholding tax ghana pdf

Complete Withholding Tax Ghana Pdf effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage Withholding Tax Ghana Pdf on any device with airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and eSign Withholding Tax Ghana Pdf with ease

- Obtain Withholding Tax Ghana Pdf and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize key sections of the documents or redact private information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the frustration of lost or incorrectly filed documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Withholding Tax Ghana Pdf to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding tax ghana pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Georgia state withholding tax form blank used for?

The Georgia state withholding tax form blank is designed for employers to report and remit state withholding taxes for their employees. It is essential for ensuring compliance with state tax laws and accurate payroll processing. By utilizing this form, employers can manage their tax obligations effectively and avoid potential penalties.

-

How can I obtain a Georgia state withholding tax form blank?

You can obtain the Georgia state withholding tax form blank directly from the Georgia Department of Revenue’s website. Additionally, airSlate SignNow allows you to create and manage this form digitally, making it easy to fill out and eSign. This streamlines your tax reporting process and ensures that your information is securely handled.

-

Is there a fee to use airSlate SignNow for the Georgia state withholding tax form blank?

AirSlate SignNow offers competitive pricing plans, allowing businesses to choose according to their needs. The platform typically provides a free trial, so you can explore its features for managing the Georgia state withholding tax form blank before committing to a paid plan. This ensures you only pay for features you will actually use.

-

Can I integrate airSlate SignNow with other tax software for the Georgia state withholding tax form blank?

Yes, airSlate SignNow offers integrations with various tax software solutions, enhancing your ability to manage the Georgia state withholding tax form blank. This allows for seamless data transfer and simplifies the workflow, ensuring that your tax forms are accurate and up-to-date. By connecting tools, you can enhance efficiency in your tax filing process.

-

What are the benefits of using airSlate SignNow for the Georgia state withholding tax form blank?

Utilizing airSlate SignNow for the Georgia state withholding tax form blank offers numerous benefits, including ease of use, cost-effectiveness, and improved document security. The platform allows for quick electronic signatures, which speeds up the approval process. Additionally, your documents are stored securely in the cloud, ensuring they are accessible whenever needed.

-

Can I edit the Georgia state withholding tax form blank after I've started filling it out?

Yes, airSlate SignNow allows you to edit the Georgia state withholding tax form blank even after you've started filling it out. You can make changes as necessary to ensure all information is accurate before finalizing the document. This flexibility helps reduce errors and enhances the reliability of your tax submissions.

-

Are there templates available for the Georgia state withholding tax form blank on airSlate SignNow?

AirSlate SignNow offers customizable templates for the Georgia state withholding tax form blank, making it easier for users to create consistent and compliant documents. These templates can be tailored to fit your business needs, saving you time and effort during tax season. With a template, you can quickly generate the required forms without starting from scratch.

Get more for Withholding Tax Ghana Pdf

Find out other Withholding Tax Ghana Pdf

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free