Tax and Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49

Understanding the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940

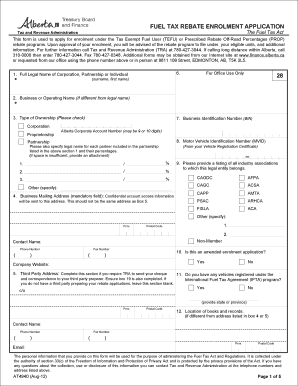

The Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 is a critical document for individuals and businesses seeking to claim a rebate on fuel taxes. This form is specifically designed to facilitate the enrolment process for receiving fuel tax rebates in Alberta. By submitting this form, applicants can ensure they are eligible for rebates that can significantly reduce their fuel expenses. Understanding the purpose and requirements of this form is essential for a successful application.

Steps to Complete the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940

Completing the AT4940 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and business information if applicable. Next, fill out each section of the form carefully, ensuring that all fields are completed as required. It is important to double-check for any errors or omissions that could delay processing. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of submission.

Eligibility Criteria for the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940

To qualify for the fuel tax rebate, applicants must meet specific eligibility criteria outlined by the Tax And Revenue Administration. Generally, eligible individuals include those who use fuel for specific purposes, such as farming or commercial activities. Additionally, businesses must provide proof of fuel usage and demonstrate that they have paid the applicable fuel taxes. Understanding these criteria is vital to ensure that your application is accepted and processed without issues.

Legal Use of the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940

The legal validity of the AT4940 form is upheld by compliance with various regulations governing eSignatures and document submissions. When filling out the form electronically, it is crucial to use a reliable eSigning platform that ensures the document meets legal standards. This includes maintaining the integrity of the information provided and securing the signatures required for submission. By adhering to these legal requirements, applicants can ensure their form is recognized and accepted by the relevant authorities.

Form Submission Methods for the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940

Applicants have multiple options for submitting the AT4940 form. The form can be completed and submitted online through a secure portal, which is often the fastest method. Alternatively, applicants may choose to print the form, fill it out manually, and send it via postal mail. In-person submissions may also be available at designated locations, depending on local regulations. Understanding these submission methods can help streamline the application process.

Required Documents for the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940

When completing the AT4940 form, applicants must provide several supporting documents to verify their eligibility for the fuel tax rebate. Commonly required documents include proof of identity, business registration details (if applicable), and records of fuel purchases. These documents help substantiate the claims made in the application and ensure that the rebate is processed efficiently. It is advisable to check the latest requirements to avoid any delays in the application process.

Quick guide on how to complete tax and revenue administration fuel tax rebate enrolment application form at4940 fuel tax rebate enrolment application form

Effortlessly Prepare Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49 on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without interruptions. Manage Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49 on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to alter and eSign Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49 effortlessly

- Obtain Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax and revenue administration fuel tax rebate enrolment application form at4940 fuel tax rebate enrolment application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940?

The Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 is a form used to apply for fuel tax rebates in Alberta. This application helps businesses recover fuel tax paid on eligible fuel used in their operations, providing financial relief and support. Completing this form accurately ensures compliance with Finance Alberta's regulations.

-

How can airSlate SignNow help with the completion of the AT4940 form?

AirSlate SignNow streamlines the process of completing the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940. With its user-friendly interface and eSignature capabilities, users can fill out, sign, and send the form electronically, saving time and reducing paperwork. This ensures that your submission to Finance Alberta is quick and efficient.

-

Are there any fees associated with using airSlate SignNow for the AT4940 form?

AirSlate SignNow offers a range of pricing plans designed to fit different business needs, including options for electronic signing of the AT4940 form. Costs are determined by the features selected, such as the number of users and volume of documents processed. This makes it a cost-effective solution to manage your Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940.

-

What are the benefits of using airSlate SignNow for my fuel tax rebate applications?

Using airSlate SignNow for the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 maximizes efficiency and accuracy. The platform enables quick document access, secure cloud storage, and seamless collaboration among team members. Additionally, eSigning eliminates delays, helping you to submit your application to Finance Alberta faster.

-

Is airSlate SignNow compliant with regulatory standards for Finance Alberta?

Yes, airSlate SignNow is compliant with regulatory standards, ensuring that your use of the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 meets all legal requirements. The platform employs advanced security features to protect sensitive data and supports compliance during the document signing process. Trust is paramount when dealing with Finance Alberta's applications.

-

Can I integrate airSlate SignNow with other tools for managing my rebate applications?

Absolutely! AirSlate SignNow offers integration capabilities with various business applications, enhancing your workflow for handling the AT4940 form. You can connect it with software like CRM systems or document management tools to streamline processes and maintain organized records for your Tax And Revenue Administration submissions.

-

What types of documents can I create beyond the AT4940 form with airSlate SignNow?

Aside from the Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940, airSlate SignNow allows you to create and manage a variety of documents. This includes contracts, agreements, and other forms requiring signatures. The platform's versatility makes it a comprehensive tool for all your document needs.

Get more for Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49

- Tvfc temperature log form

- Rhode island ucat form

- Wi sctf payment coupon form

- Youngstar self assessment tool for family child care wisconsin dcf wisconsin form

- Applied fine arts petition for academic credit bethel college form

- Translation agreement template form

- Translation service agreement template form

- Transmutation agreement template form

Find out other Tax And Revenue Administration Fuel Tax Rebate Enrolment Application Form AT4940 Fuel Tax Rebate Enrolment Application Form AT49

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free